Make the most of your stock purchase plan,

with your hourly partner.

I’m Kevin Estes, CFP®, CCFC, MBA - a financial planner who helps tech professionals and their families live great lives.

Request a free intro call.

-

Maximize Your Benefits

-

Minimize Lifetime Taxes

-

Only Pay For What You Need

Expand options.

Some employers offer a 15% discount.

A lookback could lower the purchase price further.

The maximum qualified plan contribution is:

15% of gross comp,

up to $25,000 a year.

Enhance benefits.

Automate saving: use payroll deductions.

Build wealth: leverage stock discounts.

Grow with your company: align your financial success.

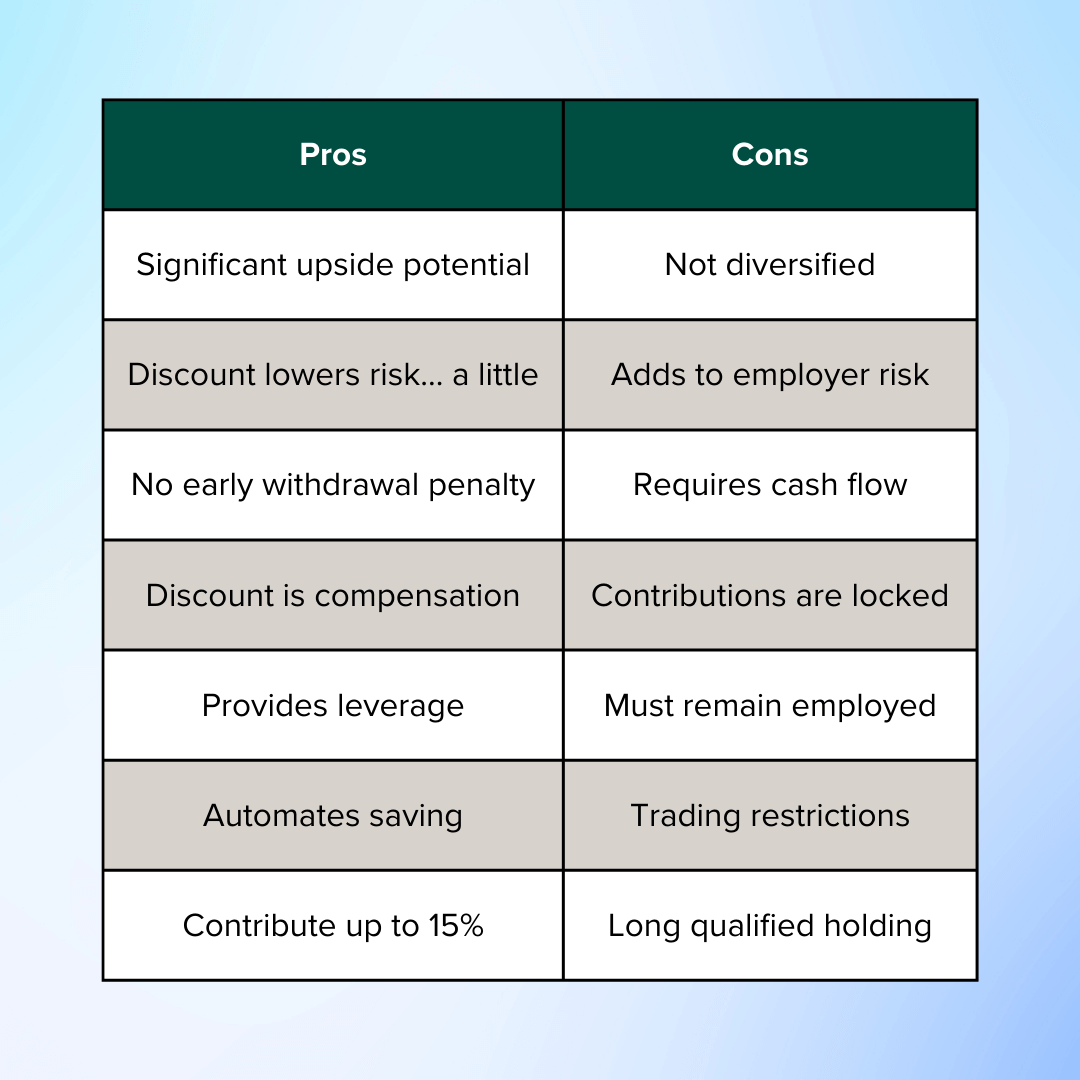

Is an ESPP right for you?

I can help you decide whether it aligns with your long-term goals.

If so, I’ll share creative - yet practical - ways to fund purchases.

Why Scaled Finance?

Professional guidance: navigate ESPP complexities with confidence.

Tailored strategies: maximize opportunities for your goals.

Tax optimization: leverage tax hacks to save more.

Trusted by employees at: