Know whether to unlock the Mega Backdoor,

with your hourly partner.

I’m Kevin Estes, CFP®, CCFC, MBA - a financial planner who helps tech professionals and their families live great lives.

Subscribe to download the white paper:

-

Maximize Your Benefits

-

Minimize Lifetime Taxes

-

Only Pay For What You Need

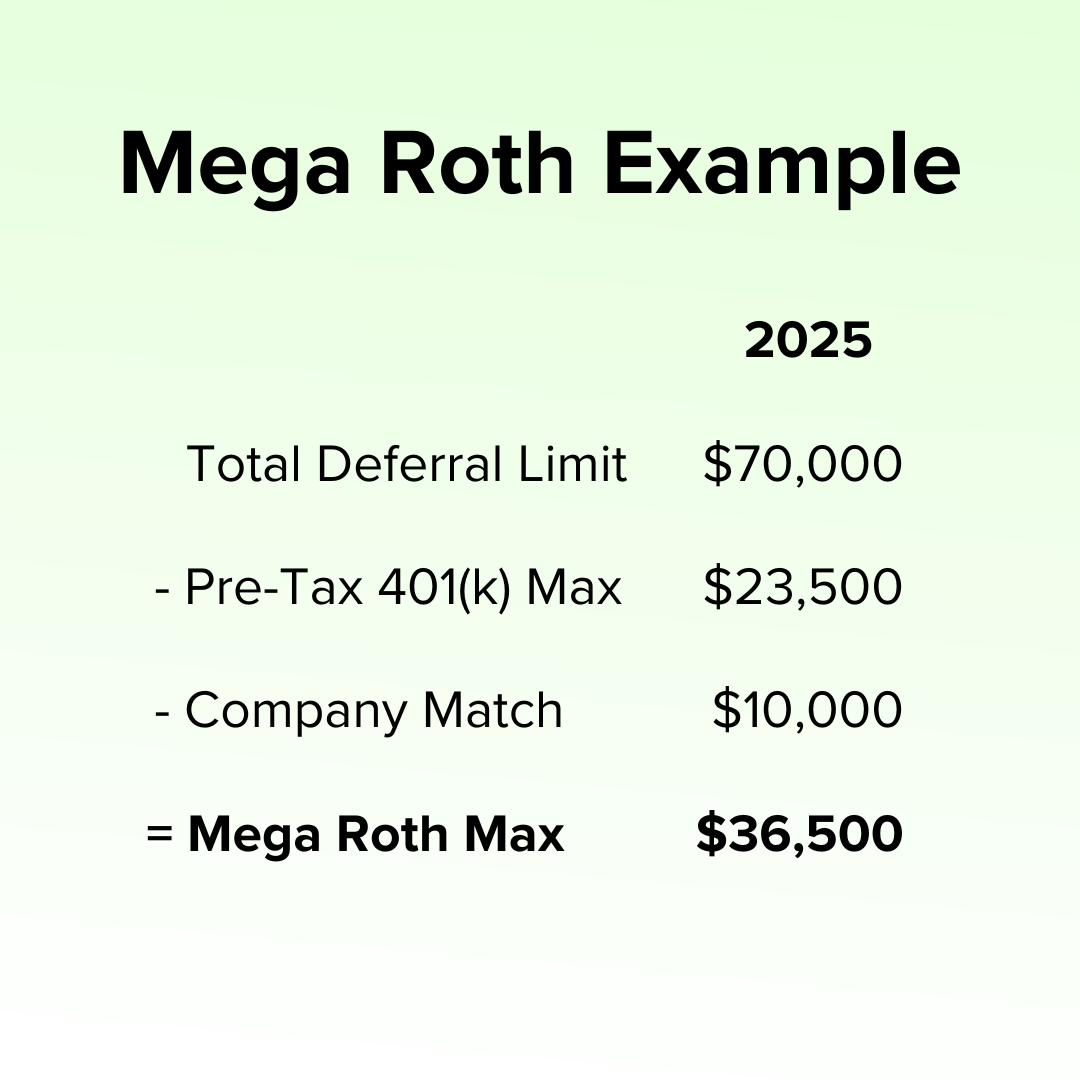

What’s a Mega Roth?

Employee 401(k) contributions are usually capped at $23,500 for 2025.

You might nearly triple that to $70,000 with:

pre-tax / Roth,

employer matching, and

after-tax 401(k) contributions.

The after-tax funds are then converted to Roth.

What’s the benefit?

Converting funds from after-tax to Roth can avoid tax on the growth.

This strategy is especially powerful for high earners looking to:

save more,

minimize lifetime taxes, and

maximize company benefits.

Maximize benefits.

With a deep understanding of the benefits, I help you:

determine if your 401(k) plan allows a Mega Roth,

calculate your ideal contribution, and

optimize the investments to help you achieve your goals.

Take action now.

Some companies are removing or restricting the Mega Roth option.

If your employer still allows it, now may be the time to lock in years of tax-free growth.

Trusted by employees at: