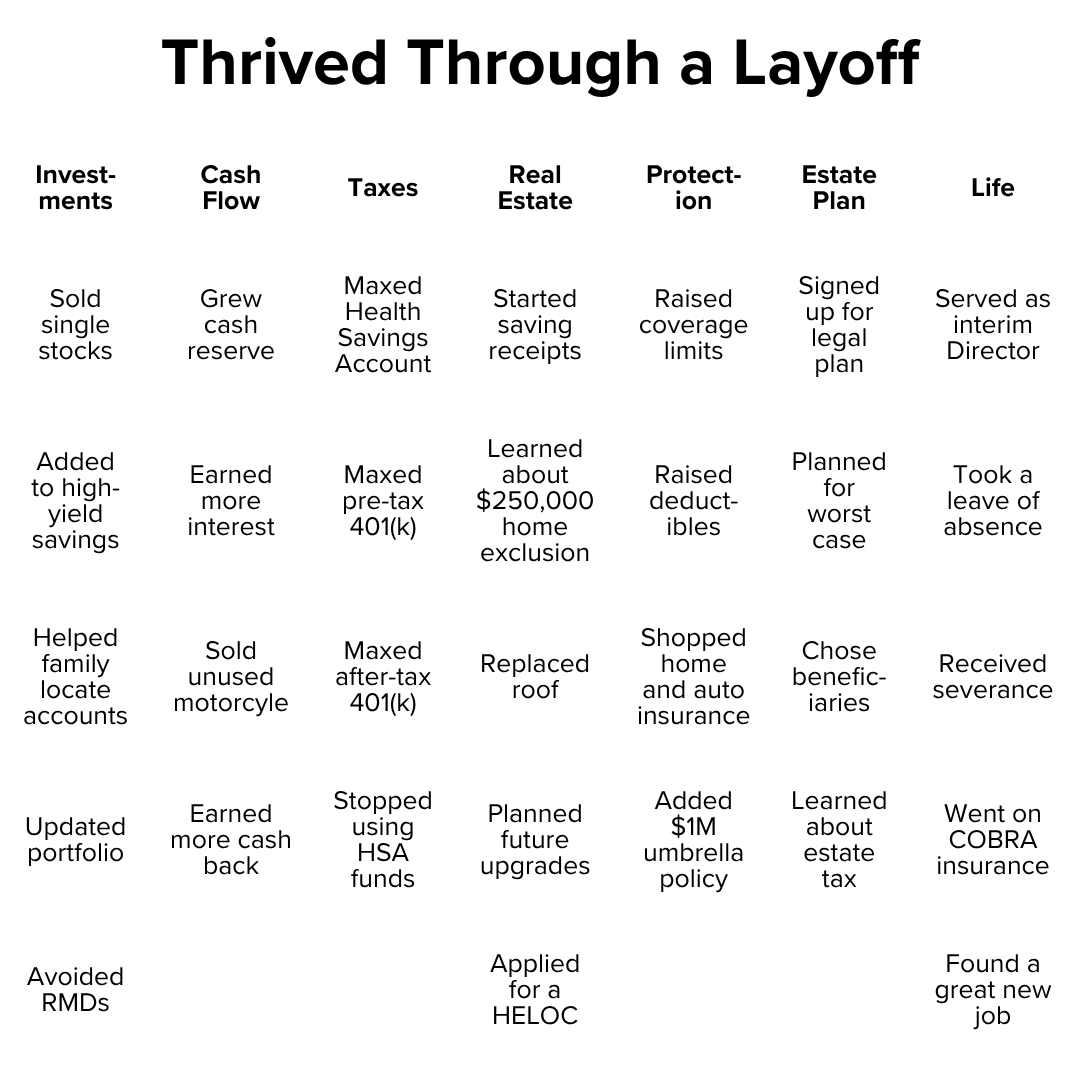

Case Study: Thrived Through a Layoff

Hello, I’m Kevin - a financial planner who helps tech professionals and their families live great lives.

Make yourself at home. We’ll get to how a client thrived through a layoff in a moment.

But first - here are some links you may want to save for later.

My Goal? Help People Reach Financial Independence!

Is It Worth Holding Employer Stock?

Now, let's get on to the case study!

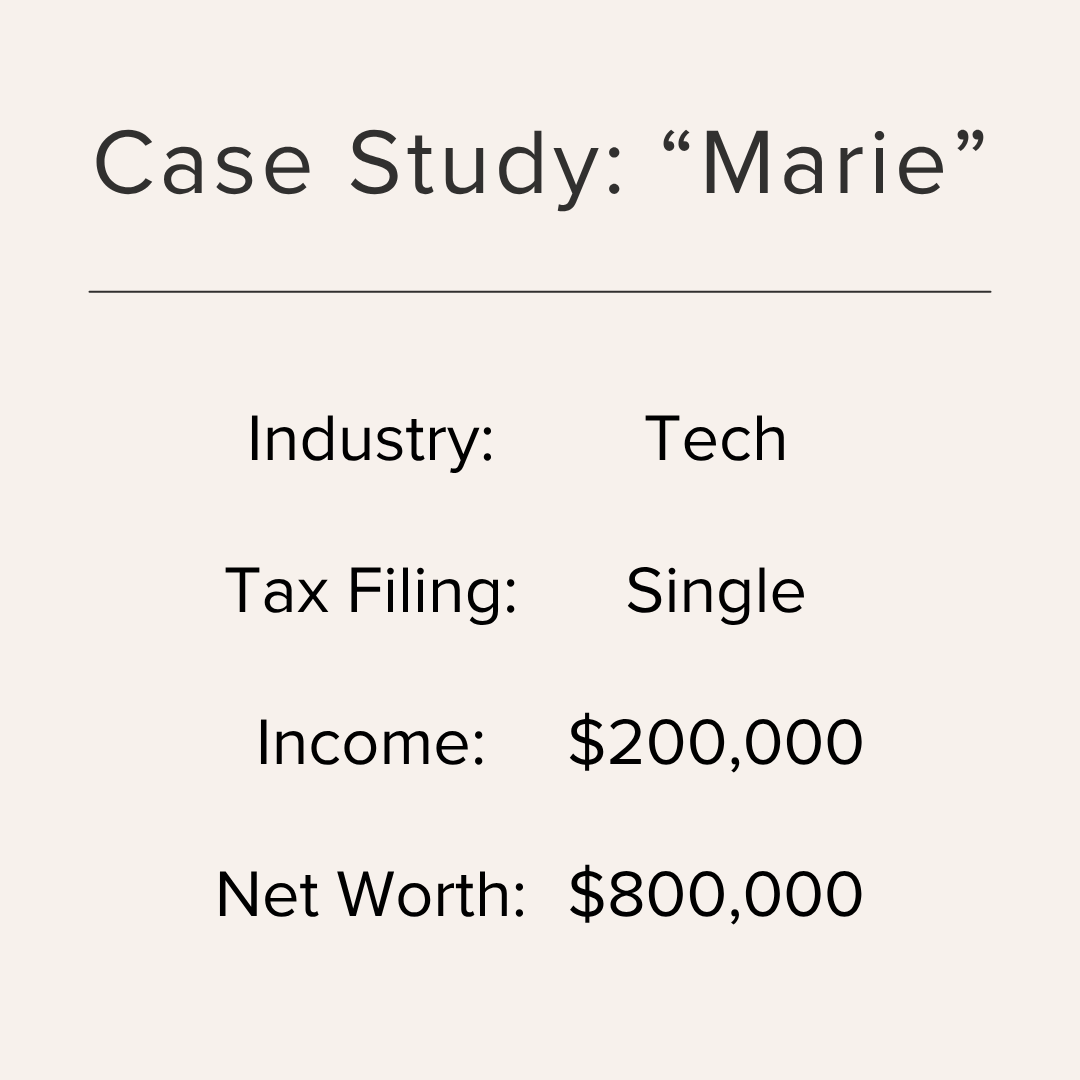

Situation

“Marie” is a lovely woman who works at a tech company and earns about $200,000 a year. She’s single and had a net worth of almost $800,000 when we started working together.

Steps

“Marie” has been wonderful to work with! She asks insightful questions and quickly implements nearly every recommendation.

She’s made great strides - despite being laid off!

Among other things, she’s improved her:

investments,

cash flow,

taxes,

real estate,

protection,

estate plan, and

life.

The following moves were right for her but may not be right for you! None of this is financial, tax, insurance, legal, or other advice.

1. Investments

“Marie” had been saving diligently.

Individual Stocks

As a tech professional, she was comfortable owning tech stocks - including shares from her previous employer.

We discussed how single stocks tend to have higher risk for similar expected returns. Also, her cash reserve was less than three to six months of living expenses.

She decided to sell some individual stocks and deposit the funds in her high-yield savings account.

Health Savings Account

We explored the potential long-term benefits of growing her HSA balance. She updated those investments to be more aggressive and hopefully take advantage of tax-free growth.

We also considered how using Health Savings Account funds to pay medical expenses now is a bit like taking money out of a Roth account.

Instead, she started paying her healthcare expenses out of pocket. She’s saving the receipts in case she needs to access funds tax-free.

Roth IRA

“Marie” moved her Roth IRA account:

from a custodian with fewer options and higher fees

to one with more options and lower fees.

She wanted to contribute more to her Roth IRA. However, she earned too much to do so directly!

Instead, she started contributing to an after-tax 401(k) account.

Inheritance

Her grandfather mentioned she’d likely receive an inheritance from him.

Of course, she didn’t want to hear it. She loved her Pop Pop and wanted him to live many happy years!

We discussed how there may be no rush to spend or invest those funds if he were to pass.

Estate and Inheritance Tax

She was a bit worried about inheritance taxes. Fortunately, neither an estate nor an inheritance tax was likely in this situation.

His estate was smaller than both the federal and his state’s exemption.

Step-Up in Basis

Unfortunately, her grandfather passed. She inherited some funds.

The investments received a step-up in basis. That is, they were generally treated as if she purchased the shares when she inherited them.

She could sell the investments without paying taxes based on her grandfather’s low purchase price.

IRA

She also inherited a small traditional (pre-tax) IRA account.

Since her grandfather had started Required Minimum Distributions (RMDs), she had to continue taking them. The balance was small enough that she chose to withdraw all funds in the first year to avoid dealing with the ongoing hassle.

Rebalanced

We created an Investment Policy Statement with helpful information.

Based on our conversations and a questionnaire, we identified that she has a high risk tolerance. A Growth portfolio was appropriate.

We created a target allocation. That target determines what percent of her portfolio to hold in assets like stocks, bonds, and cash.

Her primary changes were to:

sell some international stocks,

buy more mid-cap and small-cap stocks, and

buy more bonds.

While updating her portfolio, she also improved her asset location.

2. Cash Flow

Her initial cash position was low.

She set a goal to increase her cash reserve about $45,000.

High-Yield Savings Account

She deposited the proceeds from selling individual stocks to her high-yield savings account.

At 4% interest, $45,000 could earn about $1,800 a year.

Motorcycle

A motorcycle she owned was sitting unused in her garage.

She decided to sell it and increase her cash position by about $5,000.

Credit Card

We realized she often ordered through Amazon. However, she wasn’t earning much from her purchases.

She started using an Amazon Prime credit card that earns 5-6% cash back. That’s a few percent more than she had been earning.

Based on her spending, the change is expected to earn about $500 more cash back a year.

3. Taxes

She completes her own tax returns with the help of software. However, we identified many steps to hopefully lower her lifetime taxes.

Pre-Tax 401(k)

Her pre-tax 401(k) contributions were trending below the maximum.

She increased her contribution rate to ensure she met the employee limit for the year.

After-Tax 401(k)

We explored her employer’s after-tax 401(k).

Contributing lets her save more than the regular limit. Also, the funds may never be taxed again if done right.

She decided to contribute the maximum 10% to her employer’s plan.

Health Savings Account

Since her healthcare expenses were low, she was only contributing $200 a year to her Health Savings Account.

We discussed how HSA contributions may have a triple tax advantage:

lower taxable income the year contributed,

grow tax-free, and

be withdrawn tax-free for qualified medical expenses.

She chose to:

make a one-time HSA contribution up to the annual limit and

increase her ongoing contributions with open enrollment.

4. Real Estate

“Marie” owns a single-family home.

As is often the case, it needs some upgrades. I generally assume repair and maintenance expenses of 1% of the home’s value each year.

If costs are lower, great! Save it for next year.

Past Improvements

She’d made updates since buying the home.

Upgrades

For instance, she upgraded the electrical and HVAC systems:

using the electrical upgrade to install a sauna and

taking the opportunity to install a heat pump.

Receipts

However, she hadn’t been saving the receipts.

Her home had appreciated significantly. We considered how her gain may exceed the $250,000 home exclusion limit for a single taxpayer. The receipts may increase her cost basis.

She started saving her physical receipts and backing them up digitally. Doing so may save her taxes if she ever sells the home.

Roof Replacement

Her roof was old and needed to be replaced.

She considered financing it with a Home Equity Line of Credit. However, she was able to use her larger cash reserve to fund the replacement.

Future Remodels

Next on her home improvement list are new:

pipes,

floors,

doors, and

a driveway.

She applied for and will likely use a Home Equity Line of Credit (HELOC).

Doing so could help her maintain a healthy cash reserve. The interest expense may even be deductible.

5. Protection

Unfortunately, she was in the common position of:

being underinsured

despite paying high premiums.

Property and Casualty

Coverage Limits

We discussed how higher limits were important, especially given her relatively high income.

“Marie” increased her insurance coverage limits. For instance, she raised her bodily coverage:

from $100,000 each person / $300,000 each accident

to $250,000 each person / $500,000 each accident.

Deductible

Her deductibles were also low. Now that she has a higher cash reserve, she can pay smaller expenses out of pocket.

She increased her collision and comprehensive deductible:

from $250

to $500.

Competitive

Since she hadn’t shopped her insurance in years, I suggested she check prices at a few reputable insurers.

For her home and auto insurance, she was able to:

increase her coverage limits,

increase her deductibles, and

lower her premiums.

Umbrella

Although she was approaching millionaire status, she didn’t have umbrella insurance. That insurance rests on top of other coverage (home, auto, etc.) in case there’s a claim that exceeds those limits.

She researched her options and was able to secure a $1 million umbrella insurance policy for less than $200 a year.

6. Estate Plan

She didn’t yet have key parts of her estate in place.

Documents

We discussed that it’s especially important for her to have her estate plan buttoned up since she’s single.

The following may be particularly important:

powers of attorney,

living will,

account titling,

last will and testament.

She signed up for the legal assistance plan through work to prepare her estate documents.

Estate Tax

The state she lives in - Washington - has a low estate tax exclusion of $2.193 million. That threshold hasn’t changed since 2018.

Her net worth forecast suggests she may exceed the limit.

7. Life

Her life was going well!

Fortunately, she didn’t get lulled into complacency. She sensed there was more she could do and hired help.

Leadership Change

Things were great at work!

Then, her entire leadership team left.

Interim Director

She stepped into an interim Director role and performed admirably, earning a:

top performance review,

raise, and

bonus.

Application

The open Director role was posted. She applied to make her interim position permanent.

Unfortunately, she didn’t get it.

A Shock

Her manager considered her a threat and took steps to remove her.

The move came as a shock because she’d performed well as both an individual contributor and in the interim leadership role. She said:

I guess I was naive. I didn’t think it’d happen to me.

Reframe

My question to her was:

How could this be the best thing that ever happened to you?

She made the most of the situation.

Leave of Absence

”Marie” wanted to spend more time with family during the transition.

Her grandfather was very ill, and she was needed on the other side of the country. She took a leave of absence from work.

Grandfather’s Death

The leave pay funded her expenses and cross-country trips.

It helped her spend time with her grandfather on many of his final days. She supported her family through a trying time.

After he passed, she helped her aunt handle the estate. That included locating his accounts.

Pro Tip: Keep at least one physical account statement as a breadcrumb in case something happens.

His passing also helped her reflect on life:

It sucks to work all the time. I’d like to start living today.

Layoff

After she returned from the leave of absence, “Marie” was laid off.

Severance

She received a severance package and eventually unemployment benefits. Those funds covered her living expenses.

Because the market continued to perform well, she even grew her net worth while unemployed!

COBRA

Since the company’s COBRA wasn’t too expensive, she maintained healthcare coverage through her previous employer.

As she had both the time and coverage, she took the opportunity to get a checkup, bloodwork, etc.

COBRA carried her all the way until she started a position with another tech company.

Pivot

She stayed active in a professional group for her specialization.

New Position

One of her fellow members worked at tech company that was hiring. “Marie” received and accepted an offer for a good position.

Since starting, she’s having a lot of fun and doing well. She loves her manager, teammates, work, and company!

Travel

She traveled for family during the transition.

Now, she travels with friends.

Activities

A previous injury had kept her from doing some of the things she loved. Surgery was successful, and she fully recovered.

She’s able to:

go on bicycle rides with her neighbor,

enjoy social outings, and

participate in team events.

Hey, thanks for reading this case study about a client who thrived through a layoff!

Just a reminder, I share a lot of resources that can help you.

Disclaimer

In addition to the usual disclaimers, neither this post nor these images include any financial, tax, or legal advice.