Update Your Accomplishments

Updating your list of accomplishments may have a big impact on your finances. A review can help you shape your future, set your direction, and expand your options.

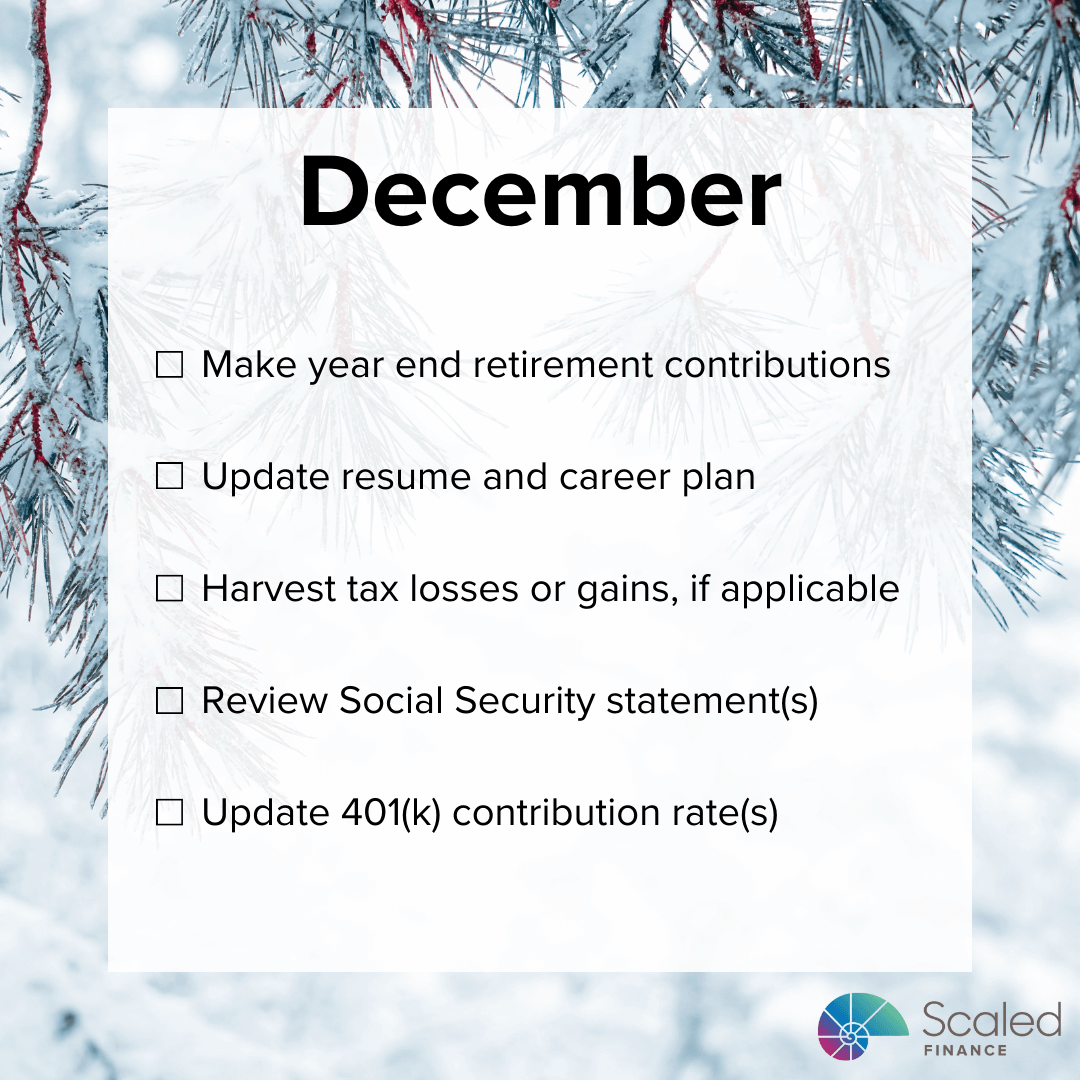

What Financial Steps Might Tech Professionals Take in December?

What financial steps might tech professionals take in December? Options might include: make year end retirement contributions, update resume and career plan, harvest tax losses or gains, review Social Security statement(s), and update 401(k) contribution rate.

Happy Thanksgiving!

Happy Thanksgiving, all!

I have even more than usual to be thankful for this year - including family, health, time, clients, support, and democracy.

What Financial Steps Might Tech Professionals Take in November?

What financial steps might tech professionals take in November? Schedule a vacation, harvest a tax loss or gain, give to charity, buy holiday gifts, and rebalance investments.

What Financial Steps Might Tech Professionals Take in October?

What financial steps might tech professionals take in October? Perhaps: evaluate stock purchased with the Employee Stock Purchase Plan (ESPP), book holiday plans, complete open enrollment, update beneficiaries and estate plan, and plan year end health expenses.

The Rise of Agentic AI

Agentic AI is a fascinating new frontier. To date, AI has largely been used as a knowledge accelerator, a content editor, and even a thinking partner. However, there’s a new use: assistant.

What Financial Steps Might Tech Professionals Take in September?

What financial steps might tech professionals take in September?

Select employee stock purchase plan contribution percentage

Book Thanksgiving plans

Start benefits and insurance review

Replenish emergency fund

Schedule remaining Paid Time Off (PTO)

What Is a Mega Backdoor Roth?

A Mega Backdoor Roth is an opportunity to save more for retirement, requires specific employer plan options, and impacts cash flow as well as taxes.

What Financial Steps Might Tech Professionals Take in August?

Smart August steps for tech pros - shop school supplies, take a break, review investments, submit care expenses, and check your Financial Independence plan.

Case Study: Thrived Through a Layoff

This case study explores how a client has been able to thrive despite a layoff! She’s taken many steps to improve her: investments, cash flow, taxes, real estate, protection, estate plan, and life.

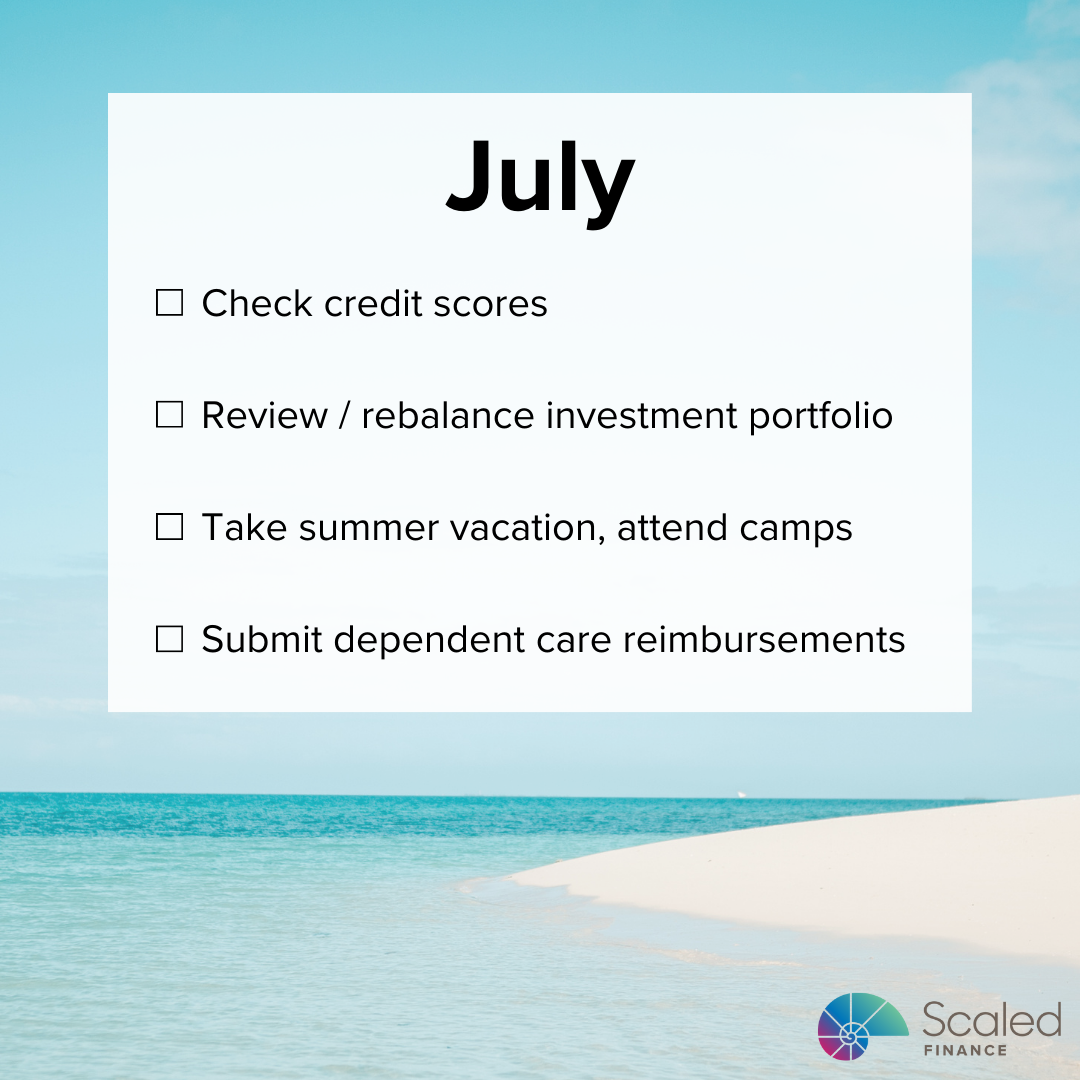

Potential Financial Steps for Tech Professionals in July

Smart July financial steps for tech professionals could include: check credit reports, rebalance investments, take summer breaks, and submit dependent-care reimbursements.

One More Year

The math on financial independence seems fantastic… as in unbelievable. However, it’s technically possible! Nonetheless, inertia is tough to overcome. This article explores the pros and cons of waiting one more year to retire.

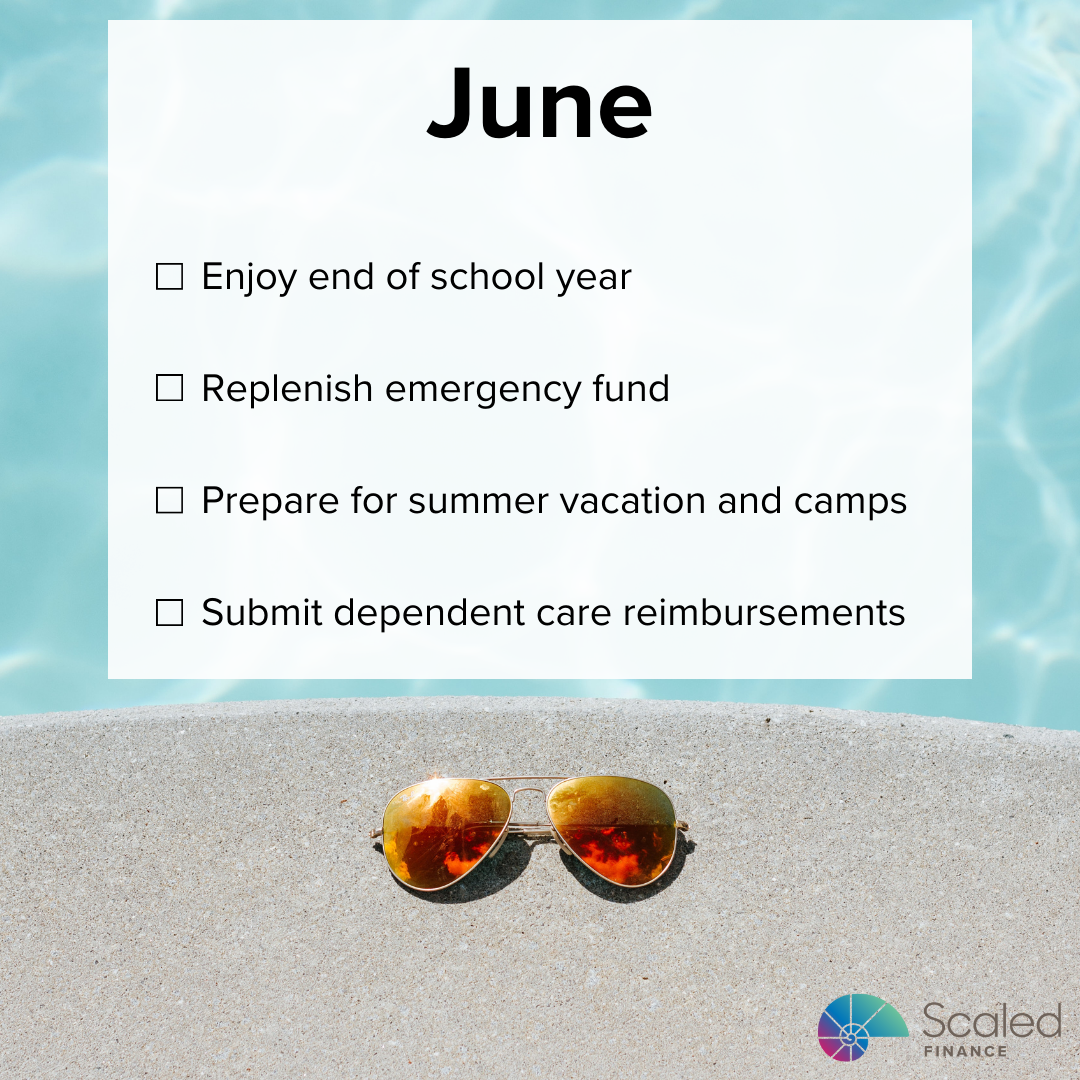

Potential Financial Steps for Tech Professionals in June

A guide for tech pros through June money moves - enjoy end-of-school celebrations, replenish your emergency fund, plan summer trips, and submit dependent-care reimbursements.

$1 Million in Bank Account

Wondering if keeping $1M in the bank is ideal? We explain the risks and share smart ways to protect and grow your money.

Buying a Property You Are Currently Renting

How to buy a place you’re renting - take steps to align what you and your landlord want, and move forward.

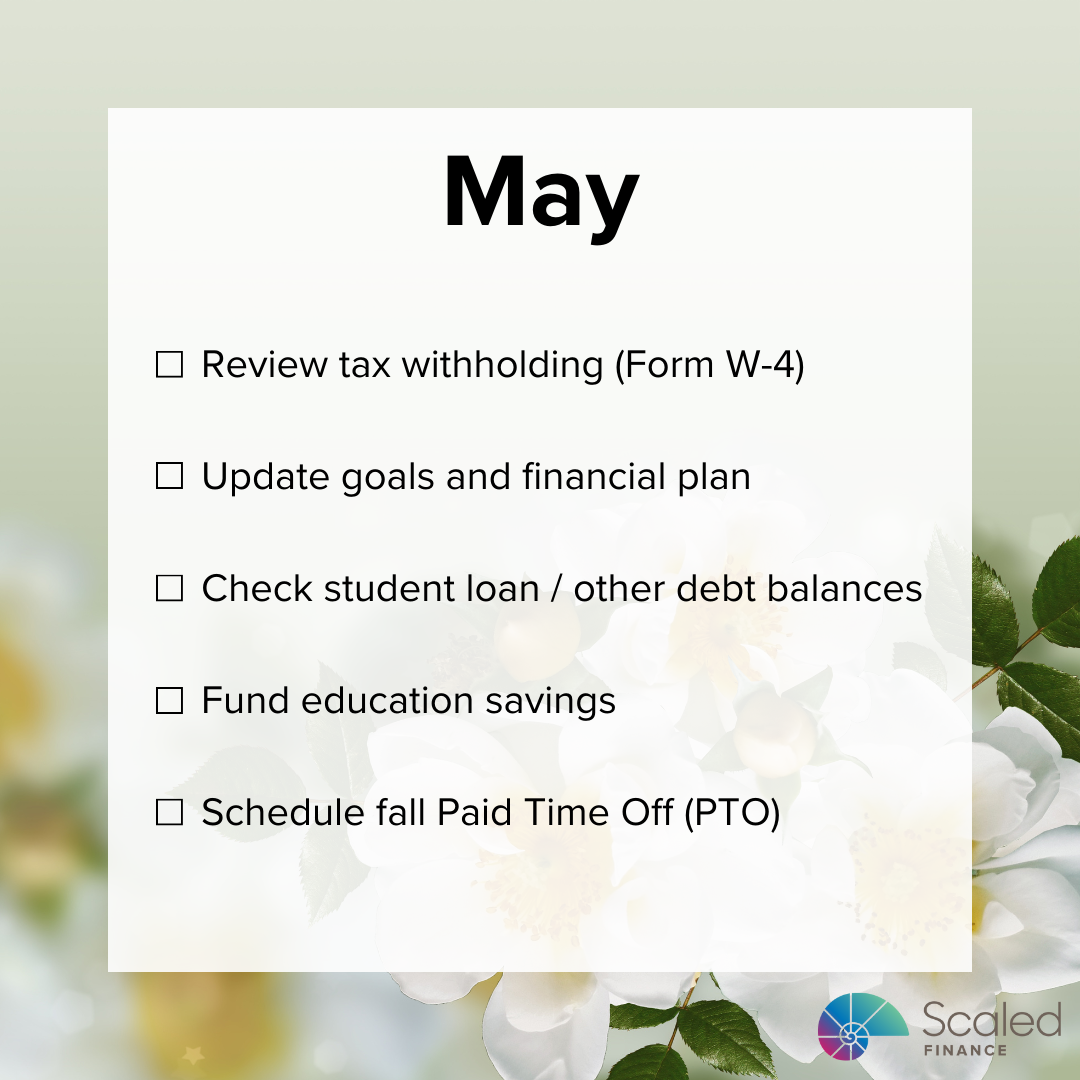

Potential Financial Steps for Tech Professionals in May

Smart May financial steps for tech pros can include - review tax withholding, revisit your goals, check debt balances, boost education savings, and book fall PTO.

Who Should Be My Beneficiary?

It can be tough to choose a beneficiary for an account! There are many considerations. This article has three parts which may help you select your beneficiaries: 1. Importance of naming a beneficiary, 2. Primary and contingent beneficiaries, and 3. Account type considerations.

What to Do When Stocks Drops

It can be scary when stock markets fall. However, things may not be as bad as they seem. There are steps you can take. This article explores: 1. Not as bad as the headlines, 2. Back to basics, and 3. Current opportunities.

Potential Financial Steps for Tech Professionals in April

Smart April financials steps for tech professionals could include tax prep, rebalancing investments, evaluating stock purchases, topping off emergency fund, and planning refunds.

How Salary Is Calculated

This article explores: 1. How salary is calculated, 2. How salary is determined, and 3. How to get a raise.