One More Year

The math on financial independence seems fantastic… as in unbelievable. However, it’s technically possible! Nonetheless, inertia is tough to overcome. This article explores the pros and cons of waiting one more year to retire.

Get a HELOC Before Retirement?

This article explores why setting up a HELOC before retirement can give you flexibility, protect your portfolio, and act as a safety net if markets dip.

What Supersavers Miss

Supersavers often overlook opportunities. Some of those include: merit aid, Social Security funding, benefit claiming strategies, single stock exposure, target allocation, asset location, Mega Roth, home gain exclusion, personal liability, rental cash flow, lifetime tax minimization, penalties and interest, withholdingg, bunching donations, Donor-Advised Fund (DAF), giving income away, coverage limits, deductibles, prepaid discounts, umbrella, disability impact, federal estate tax, state estate and inheritance taxes, and step-up in basis.

Are You Ignoring $900,000?

Why ignoring Social Security could miss nearly $900,000 in retirement income - and how timing your benefits wisely matters.

My Goal? Help People Reach Financial Independence!

My goal? Helping you reach financial independence so you choose to work - not because you have to.

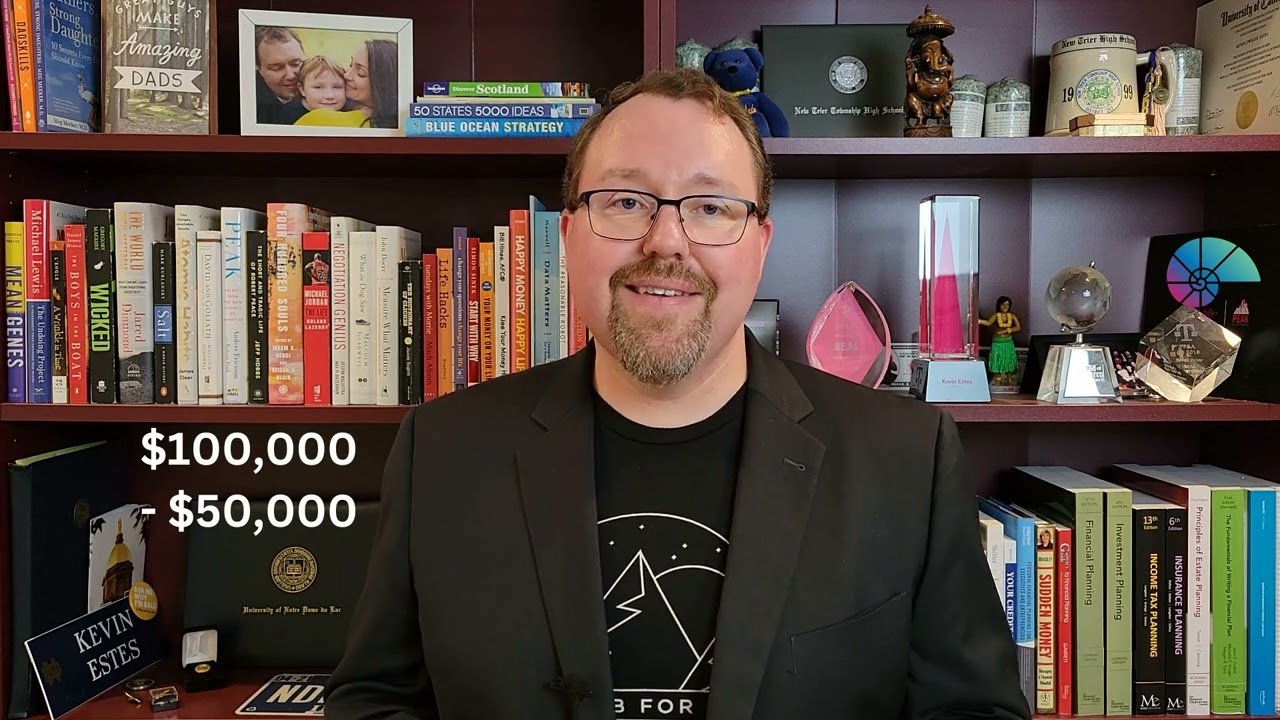

How Does a Couple Reach Financial Independence?

Know how couples may achieve financial independence: estimate expenses, subtract expected income, then multiply the shortfall by 25.

What Is Financial Independence?

What is financial independence?

That’s the beauty of it. Everyone’s definition is different.

At its core, it's the ability to do what you like, when you like, and with whom you like.