One More Year

Hello, I’m Kevin - a financial planner who helps tech professionals and their families live great lives.

Make yourself at home. We’ll get to whether or not it makes sense to work another year in a moment.

But first - here are some links you may want to save for later.

Your Last Career Will Be Investor

My Goal? Help People Reach Financial Independence!

Get a HELOC Before Retirement?

Now, let's get on to the blog!

Early Retirement

The math on financial independence seems fantastic… as in unbelievable. However, it’s technically possible!

Nonetheless, inertia is tough to overcome.

Silly Math

Let’s say someone:

started working at age 22 and

wants to retire by age 40.

They might only work 18 years!

The average life expectancy is 78 years. Someone who retires at 40 may live another 38 years.

Their retirement may last more than twice as long as they worked!

4% “Rule”

However, it may be possible.

Bill Bengen studied historical inflation as well as the returns on on stocks and bonds. In his paper published by the FPA Journal in October 1994, he concluded:

“Assuming a minimum requirement of 30 years of portfolio longevity, a first-year withdrawal of 4 percent, followed by inflation-adjusted withdrawals in subsequent years, should be safe.”

Someone with a $1 million portfolio may be able to withdraw $40,000 the first year. Withdrawals would then adjust with inflation each year.

A team of three researchers from Trinity University researched the topic in 1999 and came to a similar conclusion.

Assumptions

However, there’s no guarantee.

More Years

The authors focused on up to a 30-year retirement. Early retirees may have a much longer time horizon. What if they live past 100?

The studies also generally ignored:

income taxes,

other income like pensions and Social Security,

planned inheritance (receiving or giving)...

Variable Spending

The authors assumed current spending plus inflation each year. However, inflation-adjusted spending tends to fall in later years - despite higher healthcare costs.

It’s also lumpy because of major purchases like a new appliance, roof, or vehicle.

It Depends

Each household’s financial situation is different:

A couple’s pension and Social Security benefits may be enough to cover their living expenses.

Travel could increase spending.

Major medical costs can derail a plan.

An inheritance could fund expenses for decades.

Raising children or grandchildren late in life could extend costs.

The research was most concerned with especially bad years.

It really isn’t difficult to model someone’s financial situation correctly. Consider hiring a professional to review your situation.

Inertia

Newton’s First Last of Motion:

An object at rest remains at rest… unless acted on by an unbalanced force.

Many people have more than enough to retire yet keep working.

Some says to themselves - and maybe others:

“I’m just going to work one more year.”

However, one year can turn into two, three… or even decades!

Change often requires a catalyst. Something may need to happen.

The pain of staying must exceed the pain of changing.

Pros

There can be real benefits to working another year.

Some of them could include:

income,

Social Security,

network,

structure,

time,

identity, and

severance.

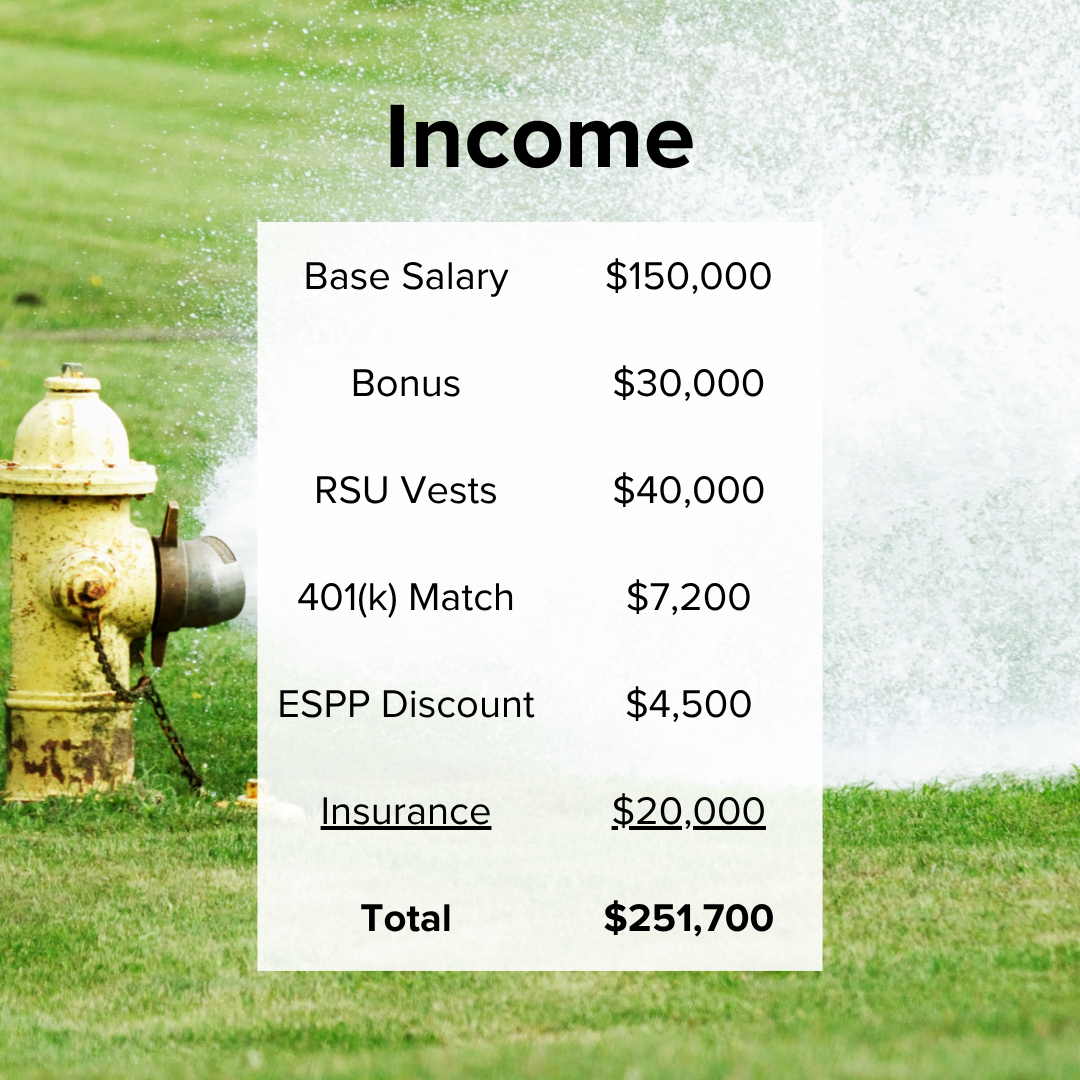

Income

A tech professional may be stepping away from a firehose of money.

Let’s assume they:

earn a $150,000 base salary,

receive a 20% bonus,

vest $40,000 in Restricted Stock Units,

get a 4% match on their 401(k) contributions,

earn 18% on $25,000 of discounted employee stock purchases, and

receive a $20,000 break on their healthcare premiums.

That may be over $250,000 of income for the year!

Social Security

Working another year can also grow Social Security benefits.

Calculation

The Social Security formula essentially uses the highest 35 years of earned income. That income must have been subject to Social Security.

It’s indexed to the national average Social Security wage for each year, which basically accounts for inflation.

Missing Years

Someone without 35 years of Social Security income will have some years counted as $0. If they worked 18 years, they would have 17 zeros.

Anyone who’s ever failed to turn in an assignment knows that a zero really drags down the average!

Replacement

Even someone who has 35 years of Social Security earnings may benefit from working longer.

Higher income years can replace leaner years when:

a student,

getting started in a career,

temporarily unemployed, or

working part-time.

Network

Some people have spent decades building relationships with coworkers. Not seeing them every day would be a big change.

Your retirement party may be the last time some people ever see you. Without enough humor and enthusiasm, it can feel like a funeral!

We’re social beings. It’s critical to consider your future community:

Will they stimulate you?

Will they help you grow and develop?

Will you enjoy spending time with them more than your coworkers?

How will you support each other?

Structure

We all look forward to not having to wake up to an early alarm. However, the lack of structure in retirement is often overlooked.

Create a New Routine

It’s important to choose what to do with your time. A routine can help.

What will you do?

When will you do it?

Who’ll join you?

Task Expansion

Parkinson’s Law: work expands to fill the time allotted for its completion.

Without a deadline, everyday tasks can consume your day:

laundry,

groceries,

yardwork,

cleaning,

errands…

That’s especially true if you cut services to save money in retirement, and take on the work yourself. Be careful.

Time

Working another year buys time, which can help someone:

reduce risk and

find passions.

Risk

Working longer reduces risk several ways.

Expenses

Each year someone works likely pays for another year of their expenses. They may also pay another year of their mortgage.

At the extreme, working until death can eliminate longevity risk!

Down Market

There will almost certainly be down markets if someone continues to work for several years:

It’s nice to be saving aggressively when investments go on sale.

Continuing to work reduces the number of downturns in retirement.

Someone’s D’s

A close friend or relative may need your help.

That’s especially true if they’re dealing with:

disease,

disability,

debt,

drug dependency,

divorce, or

death.

A former coworker retired early… until an extended family member fell ill and needed financial support. It forced her back to work!

For drug addition and debt, take steps to avoid enabling the behavior.

Also, it’s possible to regret working to pay for someone’s misfortunes, poor decisions, or lack or planning.

Everyone has a limit. Know yours.

Passions

Some people have few passions outside of work.

On the Rails

They’ve lived an efficient life:

graduated high school,

graduated college,

got a job,

got married,

saved for a house,

bought a house,

had kids,

raised kids,

saved for retirement…

They’ve done what they were expected to do. Now what?

It’s like the line in the movie The Shawshank Redemption about prison:

Red: These walls are funny. First you hate ‘em, then you get used to ‘em. Enough time passes, you get so you depend on them. That’s institutionalized.

Plan

The key is to prioritize the life you want to live:

What passions will you pursue?

How will you connect with your community?

How will you stay in shape?

What’s your purpose?

The Usual

Some yearn to travel. How long will that last?

Others want to support family. How much help will they need?

It may also be volunteering, mentoring, reading, part-time work, gardening, golfing, writing a book, playing cards…

What will you do because you love it, not because it’s something to do?

Exploration

If you lack a clear vision for retirement, working longer can give you time to explore.

Consider reducing your work hours to spark and fan your passions.

Identity

Retirement ends an identity.

Intro Test

How do you describe yourself when you meet people?

Your default might be like mine:

“Hi, I’m Kevin. I’m a [profession] who…”

If so, your transition may be tougher.

Careers

A sense of identify can be especially strong for professions that:

require a lot of training,

command respect,

have few options to return after retirement, and

take a long time to master.

Examples

Some well paid positions come to mind like senior military officials, commercial pilots, and doctors.

Despite my focus on early retirement, I’m connected to many people on the other end of the spectrum!

One friend’s the most senior pilot at a major airline.

Another’s mother is a 94-year-old physician in New York City!

Of Counsel

The legal profession has a nifty setup for retiring lawyers: “of counsel.”

A firm may hire a retired attorney part-time for specific legal advice.

It can be a way for the retiree to:

stay connected,

leverage their expertise, and

earn a good hourly rate.

Consult

Another hack is to consult for former employers or coworkers.

This can be especially helpful for positions that depend on knowledge or connections.

Severance

Retiring early can leave money on the table.

Layoff

Someone who’s laid off may receive:

weeks of salary,

a prorated bonus,

Restricted Stock Unit vests,

subsidized insurance, etc.

How

If someone wanted to get laid off, they might slowly transition their responsibilities to other team members and avoid new projects.

They’d earn the same pay for less work - and raise their hourly wage!

They may also:

shed work they don’t like and

keep only what they truly enjoy.

When the next round of layoffs come, their leadership will need to make some tough decisions. However, their position may not be one of them!

They’ll likely be let go.

Drawbacks

Some downsides of this approach include:

damaged relationships with coworkers who notice,

the layoff could take years to occur, and

it rarely feels good to be let go - even when orchestrated.

Continued Benefits

Some companies encourage older employees to retire.

Pilot

For instance, the Federal Aviation Administration (FAA) caps the age of commercial pilots at age 65.

55 and 15

Microsoft has a program for employees:

who retire at age 55 or older

with at least 15 years of service.

They can continued to vest existing Restricted Stock Units after they leave the company. It’s a bit of an incentive to enjoy their golden years.

Cons

“The secret of change is to focus all your energy not on fighting the old, but on building the new.”

- Dan Millman

Some of the many drawbacks of continuing to work include:

poor conditions,

health,

no guarantees,

family,

health insurance,

Social Security,

cost,

working for zeros, and

confidence.

Poor Conditions

One more year may not be worth it if you hate the job.

It could feel like another year of playing Simon Says - or worse.

Unhappiness at work spills over to the rest of your life. It’s nearly impossible to be happy if you’re miserable half your waking hours!

Health

Jobs can negatively effect health.

It’s not just risky ones like law enforcement, coal mining, and professional football. It’s also sedentary white-collar positions - especially if they’re high stress.

They can:

not only shorten life

but also lower the quality of the remaining years.

No Guarantees

Each of us is a heartbeat from death.

Loved Ones

If you and a friend or family member have always wanted to take a trip, now may be the time! Do it while you’re both alive and able.

Every year spent working may be one less year with an older relative.

Ability

You and your traveling companion(s) may not be able to do some things later in life.

I saw a tragic photo of an older couple on a gondola ride in Venice. They were both passed out in broad daylight!

Their gondolier just shrugged.

Want to walk the Camino De Santiago, bicycle Tuscany, or explore each National Park? You may need to get on it!

Senses

Our senses tend to fade with age.

Rome literally may not look, smell, and taste the same to us in 20 years.

Locations

Destinations also change:

The Double Arch formation at Arches National Park collapsed.

The Great Barrier Reef is facing potential extinction.

My father had fond memories of Asbury Park, New Jersey. By the time we visited, it was a shell of its former self.

Family

It’s unfortunate that when we’re needed most at home is often when we’re needed most at work.

Children

Many families prioritize time with children before Kindergarten. That time is crucial for development!

However, we may underestimate the importance of the early teenage years. That time is packed with emotional development and activities.

Once children can drive themselves to activities, the workload drops.

I hope. 😉

Parents

I was amazed by how many people in the financial independence community needed to help a parent soon after leaving work.

Then, it happened to me.

Extended

Consider who in your extended family lives alone.

Who would take care of them if something happened?

How old are they?

How’s their mental and physical health?

Consider long-term care. It may even make sense to take out a policy on their behalf!

Health Insurance

Companies share how much they pay for an employee’s insurance:

They may report it in a “total compensation” report.

It’s also usually published as Code DD in Box 12 of the W-2.

(Congrats if you know that that means!)

Affordable Care Act

However, health insurance might be less expensive in retirement. The Affordable Care Act (ACA) plans may help.

Premiums for these plans are based on income, not wealth. A multi-millionaire with little income may receive subsidies!

Medicare

Americans typically become eligible for Medicare at age 65. They may be able to enroll earlier in some instances.

Medicare enrollment is handled by the Social Security Administration. However, participants are not required to start Social Security benefits when they go on Medicare. They’re two separate decisions!

As with the ACA healthcare exchanges, higher income can increase monthly premiums for some Medicare coverage.

Social Security

Progressive

The Social Security system is intended to serve as a safety net for those with limited means in retirement.

For 2025, Social Security payments are based on:

90% of the first $1,226 of average indexed monthly earnings plus

32% between $1,226 and $7,391 plus

15% above $7,371.

For a year, those translate to:

90% of the first $14,712 of average Social Security income,

32% between $14,712 and $88,692, and

15% above $88,692.

Less Incentive

The Social Security taxable maximum wage limit is $176,100 for 2025.

Assume:

a worker reaches the income cap each year and

the growth of average indexed monthly earnings matches that of the taxable maximum.

They would need to work about:

3 years to reach the first bend point and

18 years to reach the second.

Working another year may only increase the monthly benefit about $63:

$176,100 taxable maximum

divided by 35 years = $5,031

multiplied by 15% = $775 benefit a year

divided by 12 months = an extra $63 a month, plus inflation.

There’s less incentive for high earners to keep working.

Benefit

The annual Social Security benefit with the first two bend points is about $36,914 for 2025:

90% of $14,712 plus

32% of $88,692.

Also, a spouse or ex-spouse may be entitled to:

50% of the Social Security benefit while the worker’s alive and

100% of the benefit after the worker’s death.

For the example above, a married couple may earn:

$55,371 a year while the worker’s alive and

$36,914 a year after their death.

The benefits grow with inflation.

Cost

It’s worth considering the cost of working:

clothes,

makeup,

commuting,

parking,

meals,

convenience,

subscriptions,

memberships,

dues, etc.

It’s not just the hard cost but also the unpaid time dedicated to work!

Working for Zeros

A friend and her husband used to talk about not just “working for zeros.”

Meaning

They felt there was no need to keep adding digits to their net worth when they already had enough.

It can also means working for a boss you dislike!

Unfortunately, their story has even more significance. Her husband passed away far too young from cancer a few years after they retired.

Play It Out

I dislike the terms “success” and “failure” for financial planning.

Adjustment

We have the ability to adjust!

We might:

take fewer vacations,

replace vehicles less often, or

work a part-time job.

Worst Case

Let’s ride a crazy train of thought all the way to the end.

Assume the worst financial situation occurs late in life. We contract an expensive condition that still allows us to live a long time.

At some point, we might have to go on Medicaid.

My grandmother was wealthy. Many of her fellow hospice residents were on Medicaid.

My grandmother paid full price.

Other patients didn’t.

We’re cared for when we’re babies and when we’re old.

Is it worth working longer to pay for it?

Confidence

Some people fixate on the small chance of “failure” instead of focusing on the high likelihood their plan will work well.

Too Much

Consider the “success” scenarios as having saved too much!

Someone with:

less than a 5% chance of ever needing to adjust their plan

has 95%+ odds of over-saving!

Going from 94% to 100% confidence may take years of sacrifice.

Also, it’s important to get clear on the odds. They’re often just for the investment portfolio and may ignore real estate equity!

Run the Numbers

Consider running the Monte Carlo for a wide interval - like 5% to 95%.

How much will you likely end with in those cases?

Knowing you might “only” have $3 million to $70 million may give you the confidence to retire early.

Hey, thanks for reading my post about working one more year!

Just a reminder, I share a lot of resources that can help you.

Disclaimer

In addition to the usual disclaimers, neither this post nor these images include any financial, tax, or legal advice.