Potential Financial Steps for Tech Professionals in June

Hello, I’m Kevin - a financial planner who helps tech professionals and their families live great lives.

Make yourself at home - we'll get to potential steps for June in a moment.

But first - here are some links you may want to save for later.

Now, let's get on to the blog! 😀

Is It Summer Yet?

The days are getting longer and warmer.

Technically, summer is a few weeks away. However, some schools are already out for the year!

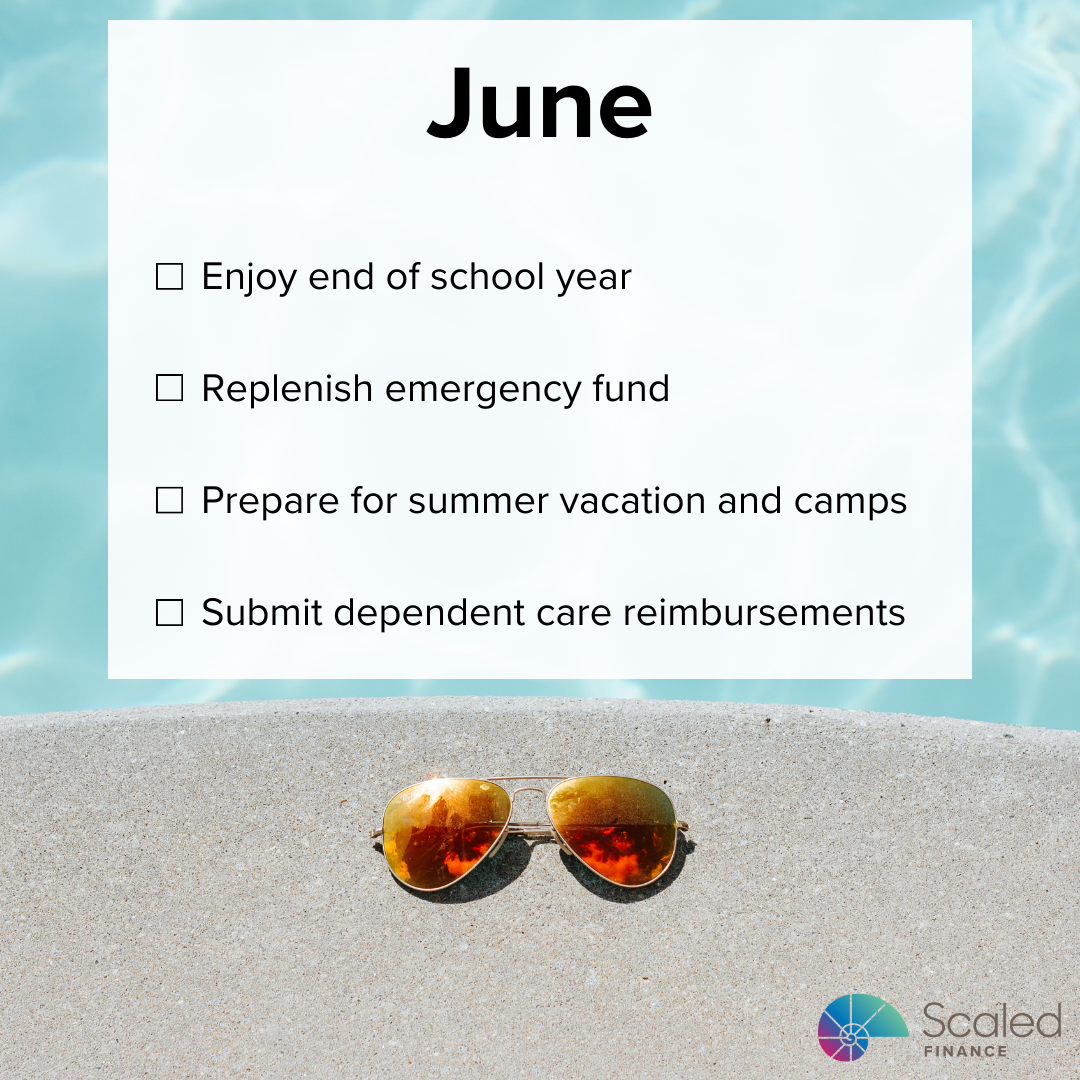

Potential Steps for Tech Professionals This Month

Financial steps tech employees might take in June include:

Enjoy end of school year

Replenish emergency fund

Prepare for summer vacation and camps

Submit dependent care reimbursements

1. Enjoy End of School Year

Final exams, papers, and projects are either complete or nearly there.

Remember that last day of school feeling?

It’s also “moving up” season. Treat the graduates you know!

Next year’s schedules are being finalized. Now is a good time to schedule late summer physicals for student athletes.

2. Replenish Emergency Fund

Millions of Americans take advantage of the long summer days.

Spending rises for:

Gear - camping, bicycle tune-ups, sprinklers;

Water fun - swimming, fishing, boating; and

Hosting - barbecues, drinks, fireworks.

The time and money spent landscaping rises. Nice weather allows for home improvement projects.

Now’s a good time to check cash reserves. Having three to six months’ of expenses can help fund emergencies and lasting memories!

For more, check out: Is Your Cash Starving?

Wealth is what you don’t see. Rich is Flashy.

3. Prepare for Summer Vacation and Camps

It’s nearly peak vacation season.

Summer Vacations

Trips often require:

Travel - flights and/or road trips;

Lodging - hotels, Airbnb, VRBO; and

Meals - dining away from home.

If you haven’t scheduled your summer vacation(s) yet, considering doing so ASAP.

An “adventure” is better than no vacation!

Summer Camps

It’s also time to get ready for camp! There are:

forms to complete,

medicines to replace,

transportation details to iron out…

Many camps let parents fund small accounts for their children. Campers allowed to spend a set amount learn math, forecasting, and prioritization skills!

It’s nice for parents to reconnect when children are away at camp. Hooray for date nights!

4. Submit Dependent Care Reimbursements

Dependent care expenses can by heavy in the summer.

Submitting receipts quickly may:

improve cash flow,

help with Back to School, and

ensure funds are received by year end.

If there’s a problem, knowing early gives more time to resolve it!

A dependent care Flexible Spending Account (FSA) generally cannot be used for a overnight camps. The program is intended to help people work regular hours.

Hey, thanks for reading my post on potential financial steps for tech professionals in June.

Just a reminder, I share a lot of resources that can help you.

Disclaimer

In addition to the usual disclaimers, neither this post nor these images include any financial, tax, or legal advice.