$1 Million in Bank Account

Hello, I’m Kevin - a financial planner who helps tech professionals and their families live great lives.

Make yourself at home. We’ll get to the million dollars in a moment.

But first - here are some links you may want to save for later.

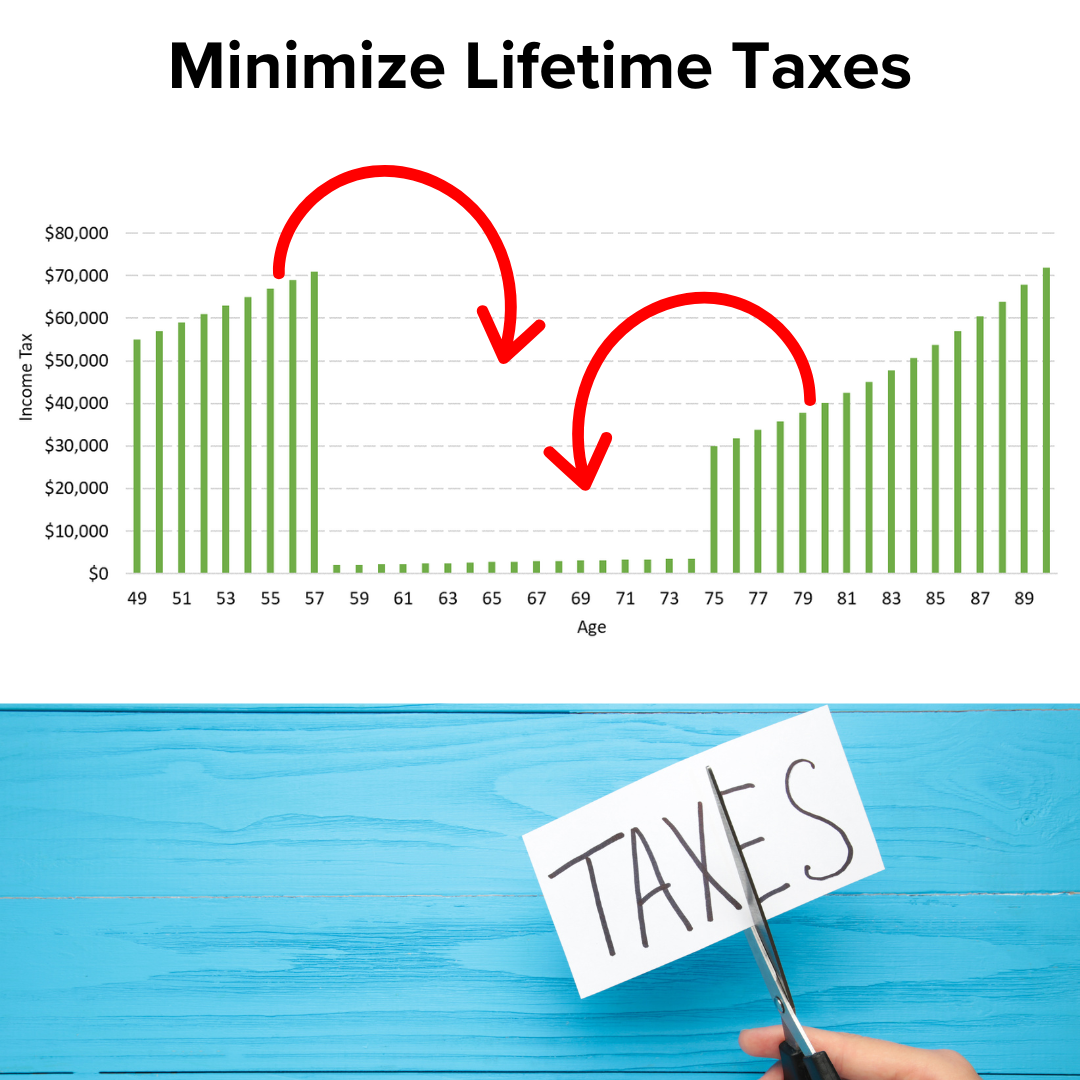

How to Minimize Lifetime Taxes

Contribute to Pre-Tax or After-Tax?

Now, let's get on to the blog!

Better Options

A bank account may not be the best place to park $1 million.

However, it depends on the situation.

This article has seven parts:

possible scam,

drawbacks of checking and savings,

appropriate cash reserve,

extra compensation,

current tax savings,

future tax savings, and

investment considerations.

1. Possible Scam

Hopefully, it’s not a scam.

A fraudster may claim you’re set to receive $1 million for a:

prize,

settlement,

inheritance…

All you need to do is provide your bank account and routing number!

Their goal is to empty your account. 😯

However, let’s assume that isn’t the case.

You have $1 million in your checking or savings account from:

an inheritance or settlement,

the sale of a business or home,

a great income, or

some other valid reason.

2. Drawbacks of Checking and Savings

A checking or savings account may:

lack full FDIC protection,

earn a low interest rate, and

be a fraud target.

FDIC Protection

The Federal Deposit Insurance Corporation (FDIC) provides protection for many banks and savings associations. It steps in to pay account holders in the remote chance that a member institution fails.

For one account, only $250,000 is covered by FDIC insurance.

As a result, it rarely makes sense to keep $1 million in a single checking or savings account for long.

Low Interest Rate

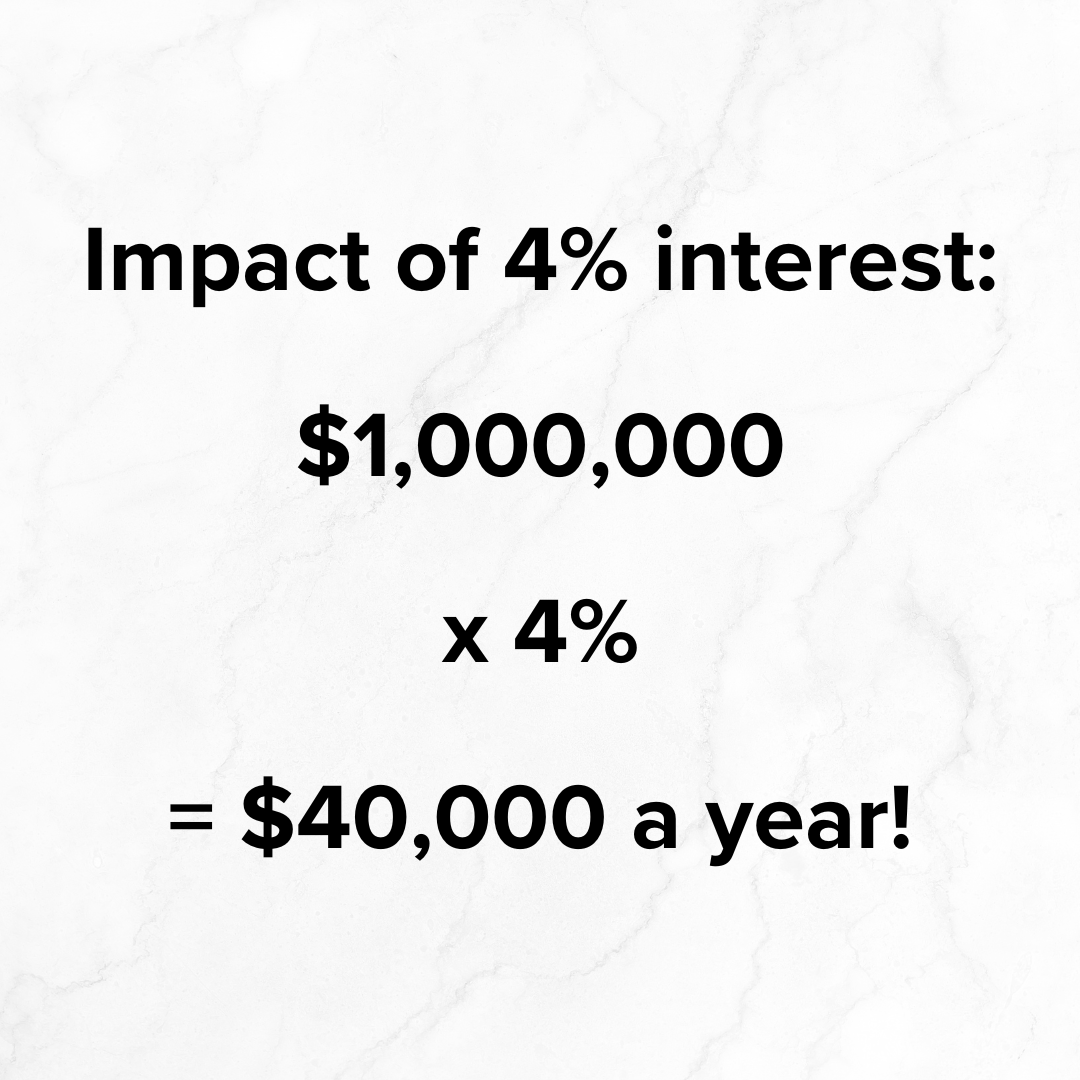

Many accounts pay an annual interest rate that rounds to 0%. Meanwhile, some high-yield savings accounts and money market mutual funds pay over 4% interest a year.

An extra 4% on $1 million is $40,000 a year!

Fraud Target

Keeping that much cash in one account can make it a target.

It’s also a bit tougher to reverse fraud:

If there’s a bad charge on a credit card, the financial institution’s money was taken.

If there’s a bad charge on a debit card, your money’s gone!

3. Appropriate Cash Reserve

It’s important to have a cash reserve. Even the wealthy can lapse into a scarcity mindset without ready access to funds.

Three to Six Months

I generally suggest someone keep at least three (3) to six (6) months’ of living expenses in cash reserves.

These funds could be used for either:

emergencies or

opportunities.

For someone who spends $2 million a year on business and personal expenses, $1 million could be just right!

However, it depends on the situation.

Upcoming Expenses

Major planned expenses add to the required cash reserve.

Big expenses on the horizon could include:

buying a home, car, or business,

paying for education or medical expenses, or

caring for a loved one.

These expenses would be on top of the regular cash reserve.

Special Circumstances

Some situations can push the cash reserve to six months and beyond!

It may make sense to keep more cash if someone:

has variable income,

owns a business or real estate, or

is retired.

4. Extra Compensation

An employee might earn additional income offered by their employer.

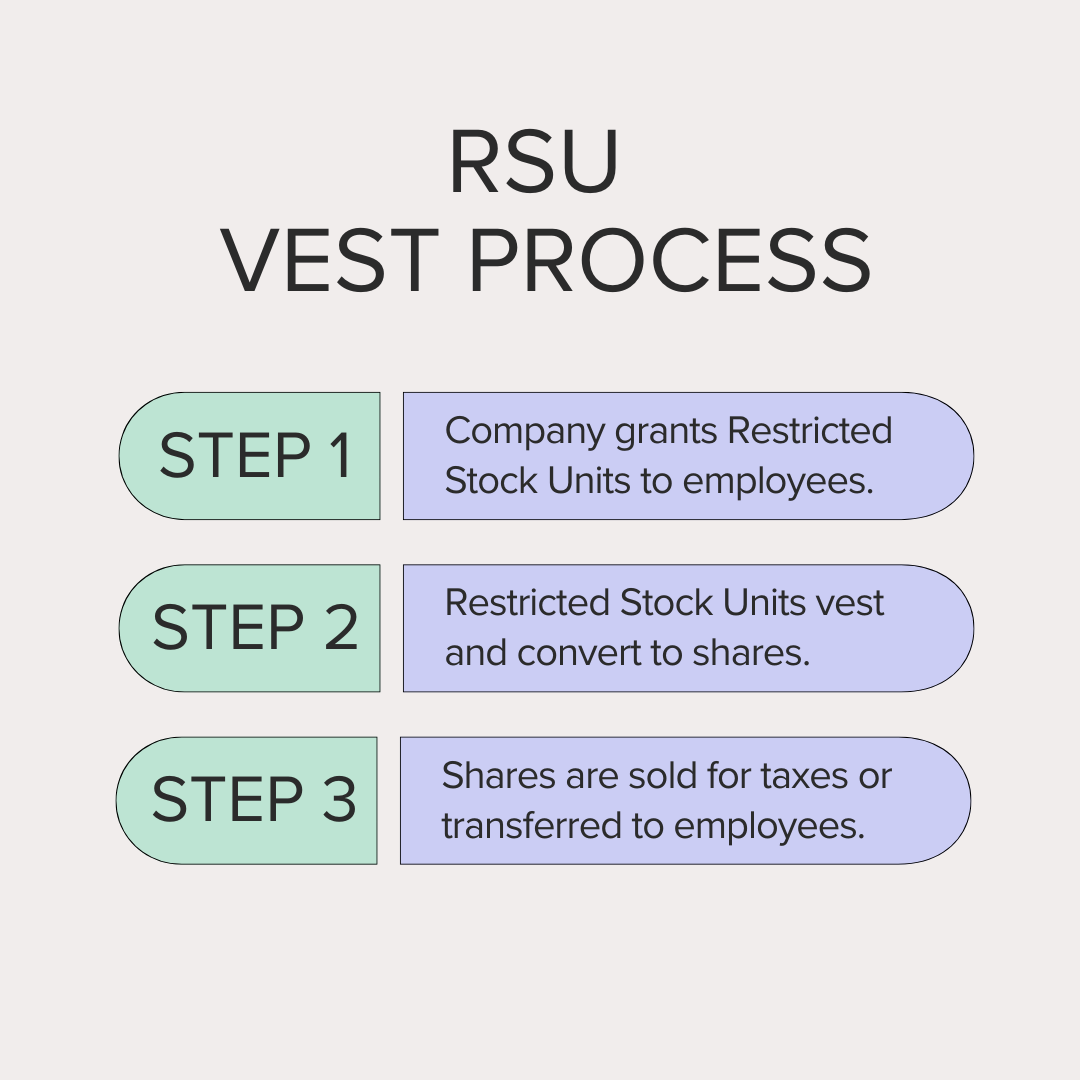

Restricted Stock Units

It generally makes sense to accept Restricted Stock Unit (RSU) grants.

Grant

The units granted usually tie to employer shares.

If someone stays employed with the company, those grants could grow to be worth a lot of money.

Vest

When Restricted Stock Units vest, they’re treated as income.

Some shares are sold and withheld for taxes. The remaining shares are deposited into the employee’s account.

Tax

The shares deposited into the employee’s account are treated as if the employee purchased them the day they vested. Selling at that price creates no more taxes!

Holding RSU shares is like taking money from a checking account to buy company stock. Is that the plan?

Not enough shares may be sold to cover the tax on Restricted Stock Unit vests. That’s especially likely for higher earners.

Tip: Employees may need additional funds to pay income tax on Restricted Stock Unit vests.

Stock Options

It also usually makes sense to accept stock option grants.

Grant

Stock options allow someone to purchase shares of their employer at a set price in the future. That’s called exercising the option.

The exercise price is often the company stock price when the options are granted.

Exercise

Options can provide significant leverage if the stock price rises. However, the options could be worthless if the stock price falls.

Funds may be needed to:

exercise the options and

buy shares below the market price.

Tip: Significant cash may be needed to exercise options.

However, the employer may offer a cashless exercise. It might sell shares at the market price and distribute the gain to the employee.

That income would be taxed.

Tax

Stock option taxes depend on both the option type and the recipient’s tax situation.

Options are usually taxed when:

exercised and

sold.

A qualified Incentive Stock Option (ISO) may avoid income tax when exercised. However, the difference between the fair market value and exercise price may increase taxes through the Alternative Minimum Tax (AMT) system.

401(k) Match

Many companies only contribute to a 401(k) if the employee firsts contributes. That’s called a company match.

Example

Assume an:

employee earns $100,000 a year and

their employer matches 4% of the first 5%.

A 5% employee contribution would be $5,000. The employer match would be $4,000.

How much the company matches grows with employee income. A 4% match on $400,000 is $16,000!

Vest

Some companies vest 100% of their contributions immediately.

Others have vesting schedules. For instance, an employee may need to work for the company for three to five years to fully vest. If not, some or all of the company matches could be clawed back.

Tip: Contributing to a 401(k) can be a higher priority if company matches vest immediately.

Tax

Traditional contributions can lower taxable income.

What an employee adds to a pre-tax 401(k) is a bit like deferred compensation since it:

isn’t earned income yet,

avoids tax initially, and

will be taxed later.

However, the distribution may be taken when it’s convenient for the employee. That income might be taxed at a lower rate.

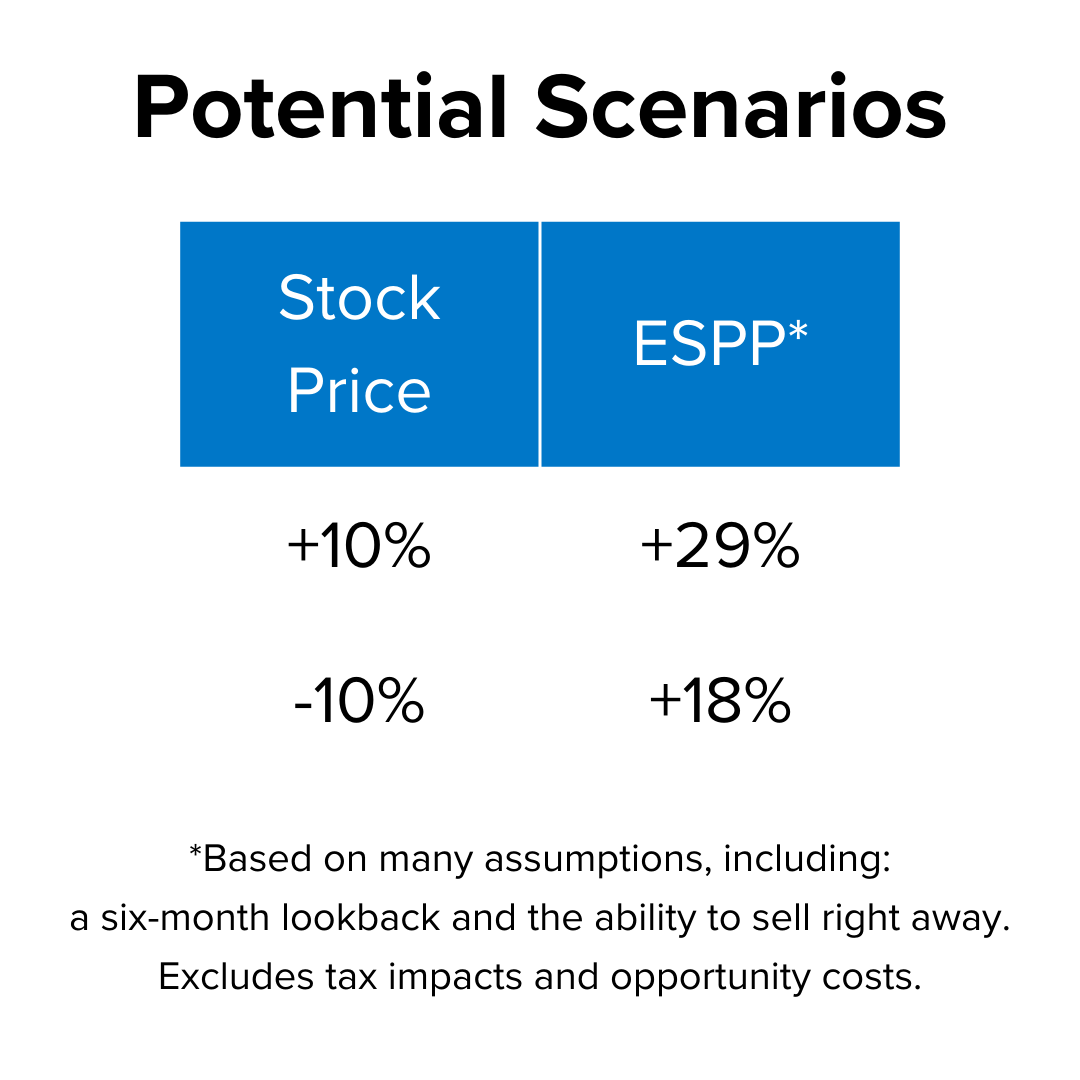

ESPP

Employee Stock Purchase Plans can be attractive.

Plan

The best plans offer a:

steep discount and

lookback.

The highest qualifying discount is 15%. However, it could be higher with a lookback that takes the lower of the price at the start and end of each offer period.

An employee participating in the plan would contribute a certain amount each paycheck. These contributions are after-tax. They reduce what goes into the employee’s checking account dollar for dollar.

At the end of the offer period, the employee buys shares at a discount. If they leave the company before then, the employee will receive the cash they contributed.

Example

Assume a company offers an ESPP with a:

15% discount,

lookback provision, and

six-month offer period.

Also, the stock was $100 and rose to $110 over the six months.

The purchase price is 15% off the lower of $100 and $110. That’s $85. However, the stock’s worth $110.

That’s over a 29% gain:

$25 divided by the

$85 purchase price!

Tax

The employee may be able to sell the stock right away. If so, the gain would be taxed as ordinary income.

Maximum

The most that can be contributed to a qualified Employee Stock Purchase Plan is:

15% of an employee’s income,

up to $25,000 for the year.

5. Current Tax Savings

There may also be opportunities to use funds to minimize lifetime taxes.

Health Savings Account

A Health Savings Account (HSA) is different from spending and reimbursement accounts.

Portable

HSA funds are not “use it or lose it.” They don’t need to be spent each year and can instead continue to grow.

When an employee leaves the employer, they can take the balance with them.

Investment

HSA funds can be invested for long-term growth.

A certain amount - often $2,000 - may need to be held in “cash” to pay for healthcare expenses.

An employer may also contribute to an employee’s Health Savings Account. That’s a bit like extra compensation.

Tax

Health Savings Account contributions can:

lower taxable income the year made,

grow tax-free, and

be used tax-free for qualified medical expenses.

Limits

To be eligible to contribute to a Health Savings Account, someone needs to be on a qualified High Deductible Health Plan (HDHP).

A high deductible could force the employee to pay more out of pocket for healthcare. That may not be right for a family with:

expensive prescriptions,

ongoing health expenses, or

certain medical conditions.

It’s important not to let the tax tail wag the healthcare dog. The right health insurance takes priority!

Unlike with other account types, someone doesn’t need earned income to contribute to a Health Savings Account.

However, they cannot contribute to an HSA once they go on Medicare.

Maximum

The maximum contribution to a Health Savings Account in 2025 is often:

$4,300 single and

$8,550 married, filing jointly.

There’s also a catch-up contribution of $1,000 for those 55 and wiser.

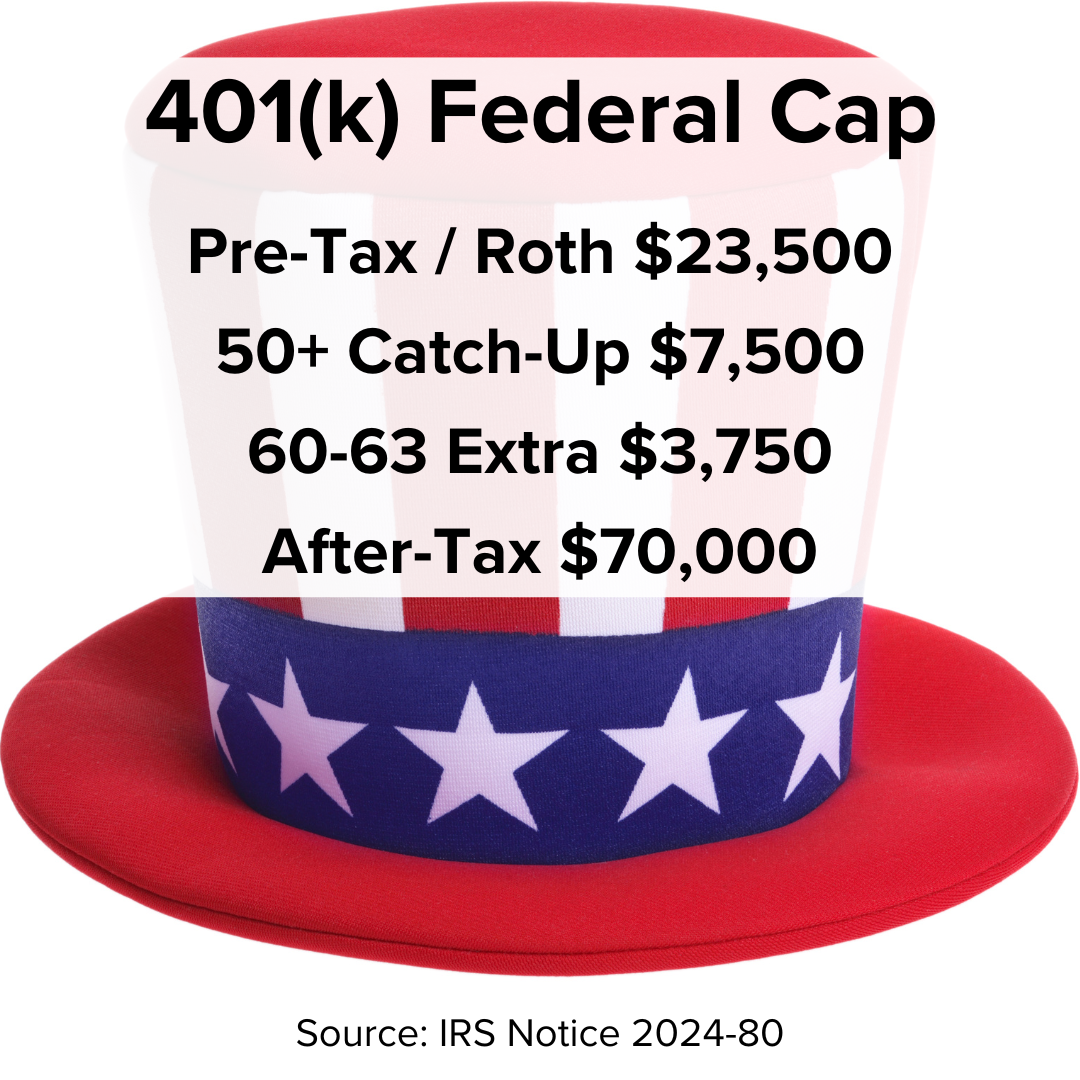

Pre-Tax 401(k)

Contributing to a 401(k) plan can be a way to save automatically. Retirement plans also benefit from creditor protection.

However, the primary benefit of contributing to a pre-tax 401(k) beyond the employer match is to lower taxable income for the year.

Tax

Pre-tax contributions can be especially helpful for someone who earns more now than they will later.

They may be able to pay a lower tax rate by shifting income from higher to lower income years.

Limits

The most an employee can contribute to a 401(k) is their earned income for the year.

Many employer plans have additional restrictions to ensure employees:

withhold taxes and

still receive some regular income.

Those limits might be something like 50% or 75%.

Maximum

For 2025, the regular 401(k) contribution maximum is $23,500.

There are also catch-up contributions of:

$7,500 for those aged 50-59 and 64+ as well as

$11,250 for those aged 60, 61, 62, and 63.

Spousal IRA

Contributing to a spouse’s IRA may also help lower taxable income. That can be especially helpful for a stay-at-home parent.

Limits

The couple needs to be married and file a joint tax return.

They also need to earn enough income to cover all of their retirement plan contributions.

Tax

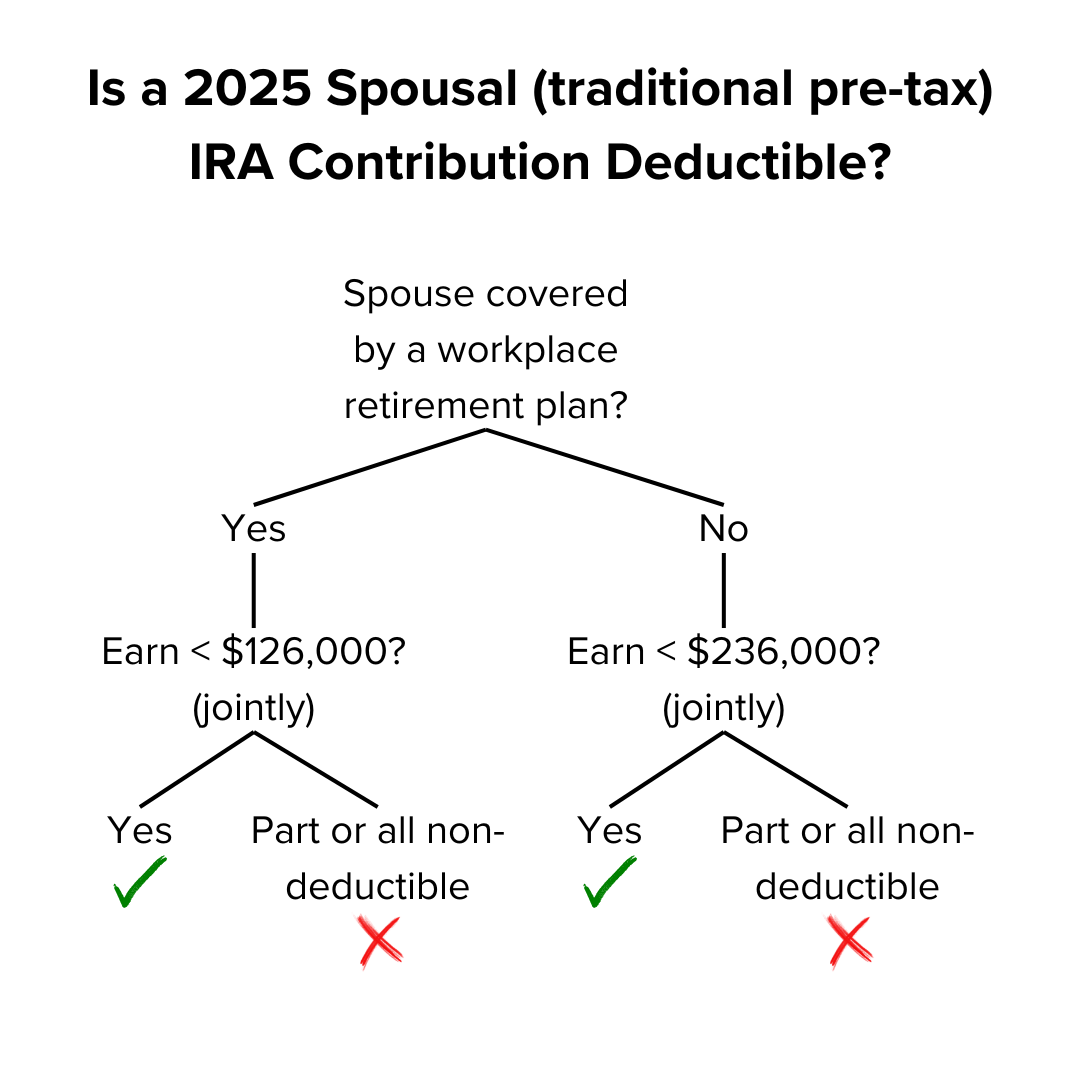

Whether a pre-tax contribution is deductible in 2025 depends on:

whether the spouse is covered by a workplace retirement plan and

the couple’s combined income.

Maximum

The regular maximum IRA contribution for 2025 is $7,000.

There’s also a $1,000 catch-up for those aged 50 and over.

6. Future Tax Savings

Let’s assume someone has already:

optimized their cash reserves,

maximized their additional compensation, and

minimized their taxes for the year.

It may also be possible to lower future taxes.

After-Tax 401(k)

Someone may be able to save even more with an after-tax account.

Not Roth

After-tax is different from Roth.

Roth and pre-tax 401(k) contributions count toward the employee limit. Together, they must generally stay below the $23,500 cap.

After-tax contributions have a higher limit, which can be especially helpful for higher earners.

Tax

While after-tax contributions generally aren’t taxed when withdrawn, the investment income and gains are. That’s why it’s ideal to move after-tax 401(k) balances to a Roth account.

With a Mega Roth, a participant:

contributes to an after-tax account and

rolls the funds into a Roth account.

It may be easiest to transfer funds from the employer’s after-tax 401(k) to its Roth 401(k).

There are income limits to contributing directly to a Roth IRA. However, those restrictions don’t apply to a Roth or after-tax 401(k).

Limits

Not all companies offer after-tax contributions. Even fewer allow in-service distributions to move funds from an after-tax to a Roth 401(k).

Many tech companies offer both. The combination is the Mega Roth.

Maximum

For 2025, the maximum after-tax contribution is $70,000 less the other:

employee and

employer contributions.

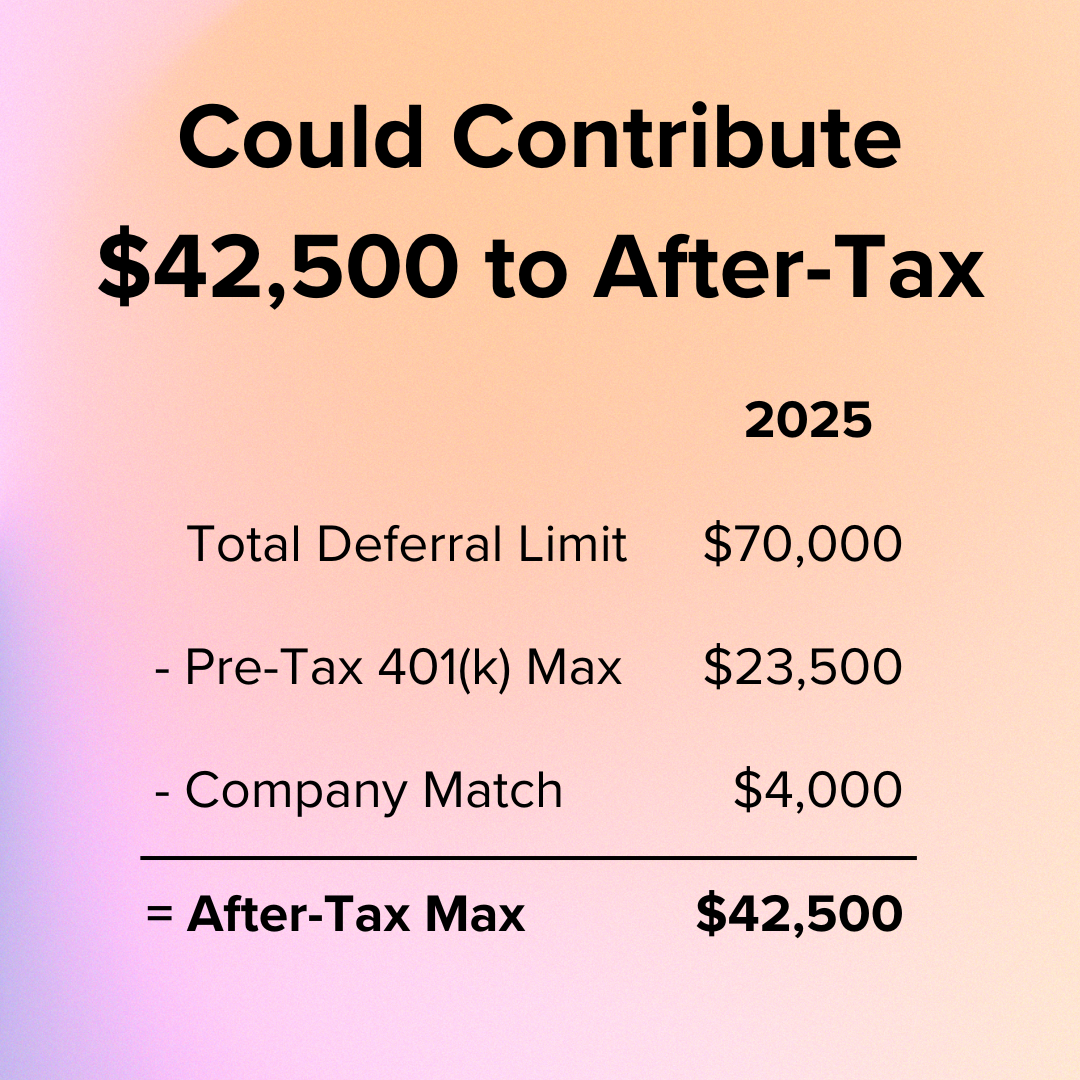

Example

Let’s assume that in 2025 someone:

earns $100,000,

maxes their pre-tax 401(k) contributions at $23,500,

receives a 4% match of $4,000, and

has access to an after-tax 401(k).

Their maximum after-tax contribution is likely $42,500 for the year.

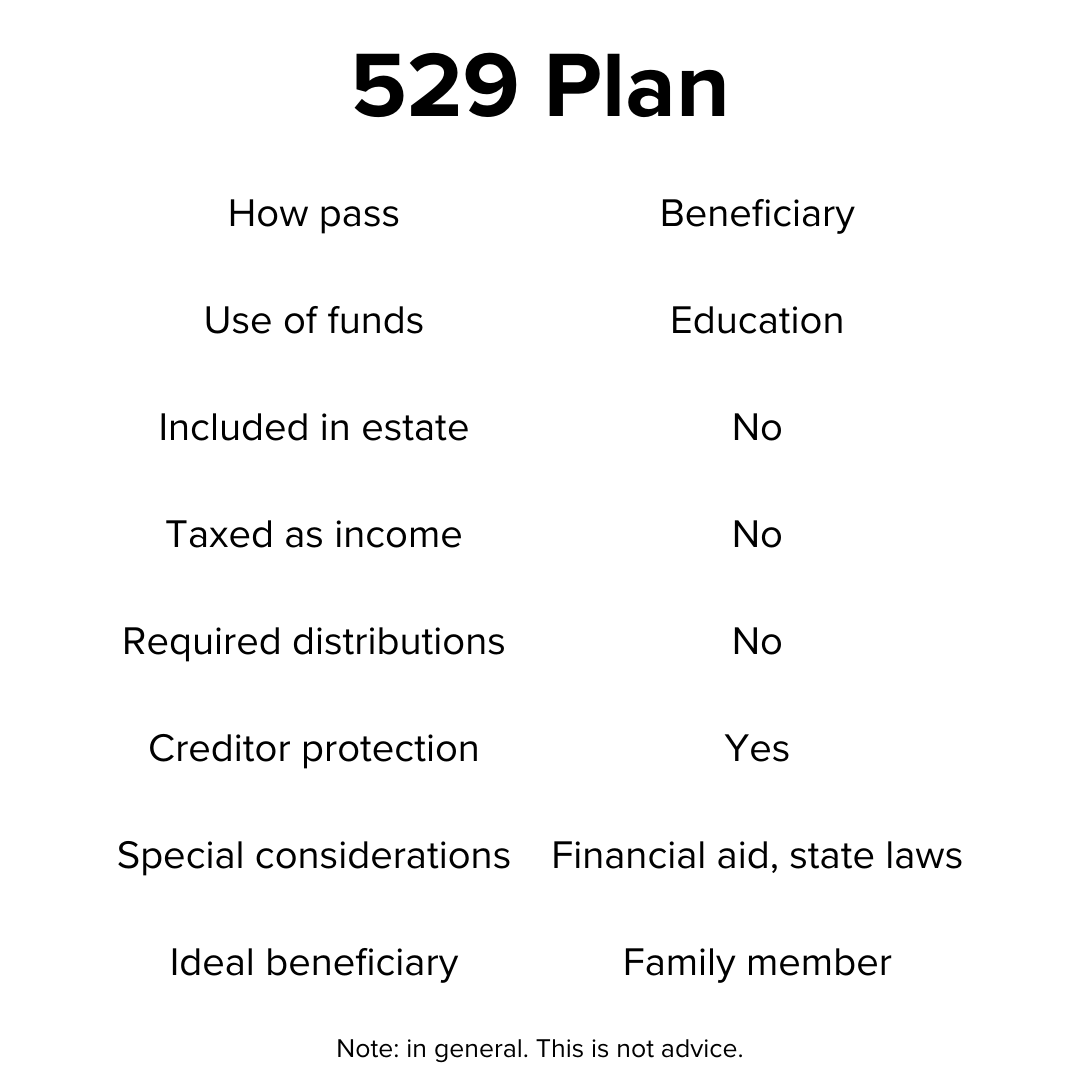

529 Plan

A qualified tuition program can help someone save for education and lower future taxes. It’s also called a 529 plan.

Use

529 plans have expanded over time to include:

K-12 private school tuition,

trade schools and apprenticeships,

associate and bachelor’s programs,

graduate and professional school, etc.

Funds can even be used at many international colleges and universities.

Flexible

529 plans have a lot of flexibility.

Funds can be transferred to a family member. That includes parents!

It’s also possible to withdraw funds from a 529 plan if a student receives a scholarship or appointment to a U.S. military academy.

Those distributions generally avoid the 10% penalty for not using funds for qualified education expenses. However, they could still incur state and federal income taxes.

A new rule that took effect in 2024 could allow unused funds to be rolled over to a Roth IRA.

The 529 plan account would need to have been:

open at least 15 years and

have received the contributions at least five years prior.

Also, the rollovers are capped at the annual Roth IRA contribution limits and subject to a $35,000 lifetime maximum.

Tax

Contributing to a 529 plan could lower state income taxes.

However, many states cap the benefit. Contributions aren’t deductible for federal taxes.

Funds can be invested and grow tax-free. Many 529 plans offer low-cost, diversified investment options.

Better yet, funds can be used tax-free for qualified education expenses. Unfortunately, the state and federal definitions of “qualified” may differ.

Maximum

In many ways, the IRS treats a 529 plan contribution like a gift.

The standard contribution limit is based on the annual gift tax exclusion. That’s $19,000 for 2025.

However, there’s an opportunity to “superfund” a 529 plan. Someone could add up to five years of contributions in one year.

For 2025, they could contribute $95,000:

$19,000 annual exclusion

times five (5) years.

A married couple who files a joint tax return could double that contribution. However, they’d need to

complete a gift tax return (Form 709) and

reduce their combined gift and estate tax exemption for any gifts made to the individual over the next five years.

Investment

It makes sense to invest a 529 plan based on when the money will be needed. Using a target enrollment date fund often makes sense.

Target date funds grow more conservative over time. You wouldn’t want the balance to plummet just before it’s needed!

However, a target date fund may not make sense if needed for:

K-12 private school,

graduate school, or

another family member.

A target enrollment fund also might not make sense once the student starts their education. Even a conversative investment may lose value!

7. Investment Considerations

Assume someone has:

set aside a cash reserve,

taken advantage of their benefits, and

funded tax-advantaged accounts.

Remaining funds might be moved to a taxable brokerage account.

How to invest depends on many factors, including:

timing,

taxes, and

tolerance.

Timing

Money needed later can generally be invested more aggressively than money needed now.

For instance:

Roth IRA funds that won’t be needed for decades might be invested more aggressively than

college savings needed in a couple years.

Traditional brokerage account funds are often used first in retirement. That’s because retirement account distributions have an extra 10% penalty if used before age 59.5 unless an exception applies.

Taxes

Someone in their peak earning years may want to lower their taxable income. In that case, a stock mutual fund or Exchange-Traded Fund (ETF) might be a more natural fit for a taxable brokerage account.

Bonds may work better in a traditional (pre-tax) retirement account. Investment income could be deferred until earned income falls.

Roth accounts may hold slightly more aggressive investments like:

mid-cap, and

international funds.

Tolerance

Someone’s allocation can also depend on their risk tolerance.

If an investor would panic sell when markets fall, they may benefit from less aggressive investments.

However, investors typically need growth to achieve their goals. Even retirees often need to take risk to fund 30+ years of retirement!

Hey, thanks for reading my post about a $1 million bank account.

Just a reminder, I share a lot of resources that can help you.

Disclaimer

In addition to the usual disclaimers, neither this post nor these images include any financial, tax, or legal advice.