What Is a Mega Backdoor Roth?

A Mega Backdoor Roth is an opportunity to save more for retirement, requires specific employer plan options, and impacts cash flow as well as taxes.

$1 Million in Bank Account

Wondering if keeping $1M in the bank is ideal? We explain the risks and share smart ways to protect and grow your money.

What to Do When Stocks Drops

It can be scary when stock markets fall. However, things may not be as bad as they seem. There are steps you can take. This article explores: 1. Not as bad as the headlines, 2. Back to basics, and 3. Current opportunities.

What to do with $100k

What should I do with $100k? It depends. Five good options include: 1. protect yourself, 2. cut expenses, 3. invest in yourself, 4. make a major purchase, and 5. invest wisely. This article explores ideas for each option.

I Changed Jobs. Should I Roll Over My 401(k)?

I changed jobs. Should I roll over my 401(k)? It depends. There are potential benefits and cost of either rolling an old 401(k) into an IRA, rolling thee 401(k) into another 401(k), or keeping the 401(k).

Risk Capacity Matters More Than Risk Tolerance

Risk capacity matters more than risk tolerance. Someone’s ability to take risk depends on their financial circumstance. That’s their risk capacity. Risk tolerance depends on many factors and is more fluid.

Transactions in Retirement Accounts Aren’t Taxed… Yet

When something keeps coming up in conversations, I prioritize it for content! Some very intelligent, educated, and succesful people haven't been sure how investment changes within retirement accounts are taxed. Fortunately, investment changes don't usually have an immediate tax impact! Adjusting these accounts may be the best way to rebalance a portfolio.

Turn $200,000 into $13 Million?

Most people want to get rich NOW. That's now (usually) how wealth is built. Want to know the secret? Time.

What Are Large, Mid, and Small-Cap?

What are large, mid, and small cap? There’s a clear definition… in theory. Reality is messier.

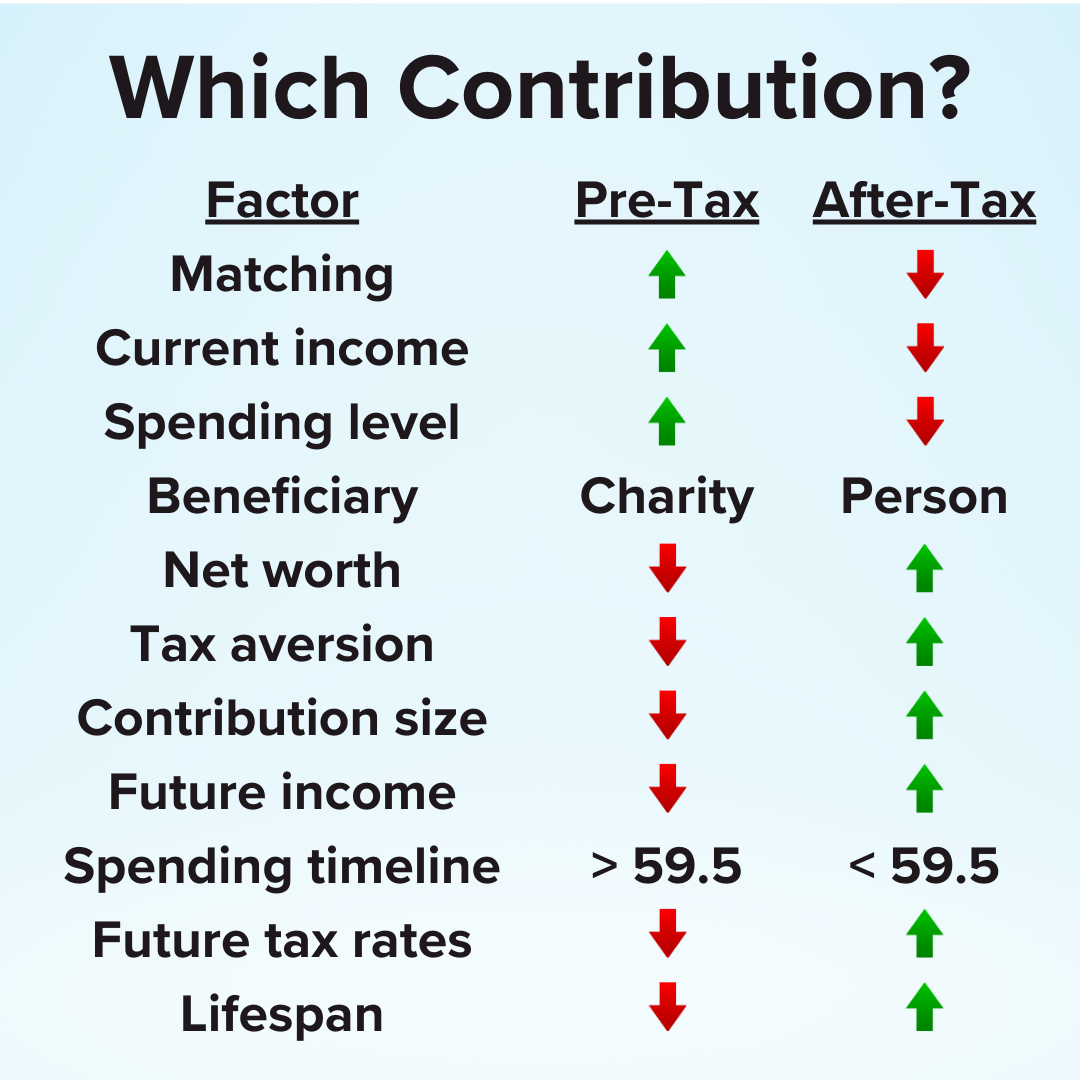

Contribute to Pre-Tax or After-Tax?

Many people struggle to decide whether to contribute to a pre-tax account, after-tax account, or both. Both options may exist for plans like a 401(k), 403(b), 457(b), and Individual Retirement Arrangement (IRA). The after-tax version is often a Roth plan.

Ignoring the Spousal IRA?

One of the most often overlooked opportunities is the spousal IRA. A spousal IRA is a traditional retirement account a spouse can contribute to despite earning little or no income. Contributing to a spousal IRA may help a couple lower their taxable income, reduce their taxes, and save for retirement.

Your Last Career Will Be Investor

Why your final career might be investor - because nobody cares for your money as much as you, and learning to invest gives you control.

Are My Assets in the Right Location?

Place your money wisely - align your emergency fund, retirement, investments, and HSAs in the right account types to work smarter.