What Is a Mega Backdoor Roth?

Hello, I’m Kevin - a financial planner who helps tech professionals and their families live great lives.

Make yourself at home. We’ll get to the Mega Roth in a moment.

But first - here are some links you may want to save for later.

Contribute to Pre-Tax or After-Tax?

Now, let's get on to the article!

Key Takeaways

A Mega Backdoor Roth:

is an opportunity to save more for retirement,

requires specific employer plan options, and

impacts cash flow as well as taxes.

What Is a Mega Backdoor Roth?

The Mega Roth is a way to save more than the usual limit, convert funds to a Roth account, and hopefully benefit from tax-free growth.

This strategy is especially helpful for someone who can’t contribute to a Roth IRA because they earn too much.

The income limits to contribute directly to a Roth IRA in 2025 are:

$165,000 single and

$246,000 married, filing jointly.

How Does a Mega Roth Work?

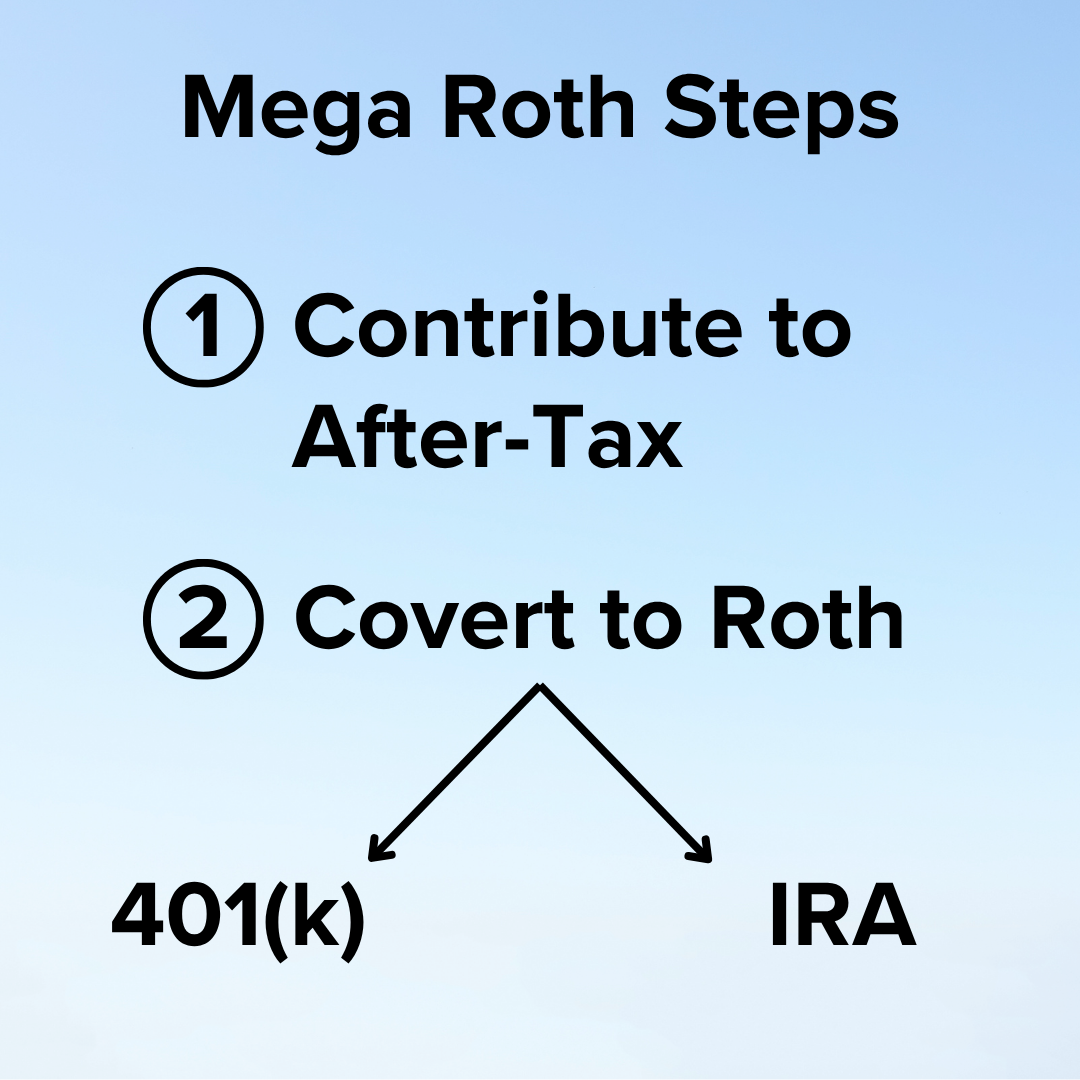

The Mega Backdoor Roth takes two steps:

Contribute to an After-Tax 401(k).

Convert the funds to a Roth 401(k) or Roth IRA.

This process is also known as the Mega Two-Step Roth, or simply the Mega Roth.

Types of 401(k) Contributions

Common 401(k) account types include:

Pre-Tax,

Roth, and

After-Tax.

Contributing may be as easy as choosing the percentage of income to save to each account.

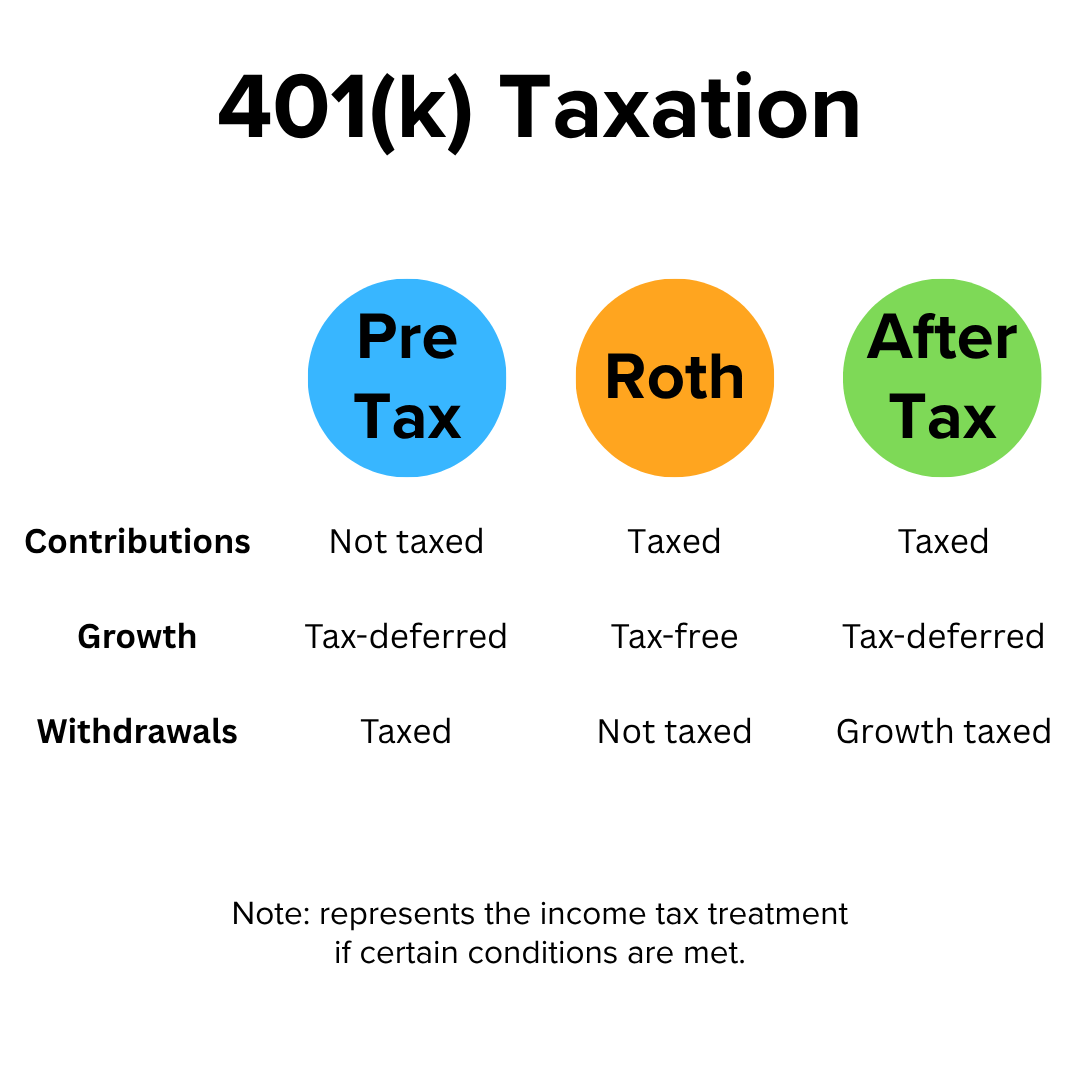

1. Pre-Tax

The Pre-Tax option is also known as Traditional or Tax-Deductible.

Contributions:

avoid income tax initially,

grow tax-deferred, and

are taxed as income when withdrawn.

2. Roth

A Roth 401(k) works the opposite way. Contributions:

are taxed as income initially,

grow tax-free, and

avoid income tax when withdrawn if some conditions are met.

Think of it like an orchard:

Pre-Tax - the seed isn’t taxed, and the harvest is.

Roth - the seed is taxed, and the harvest isn’t.

3. After-Tax

An After-Tax account works differently:

Contributions are taxed initially and can be withdrawn tax-free.

Investments grow tax-deferred.

The growth is taxed as income when withdrawn.

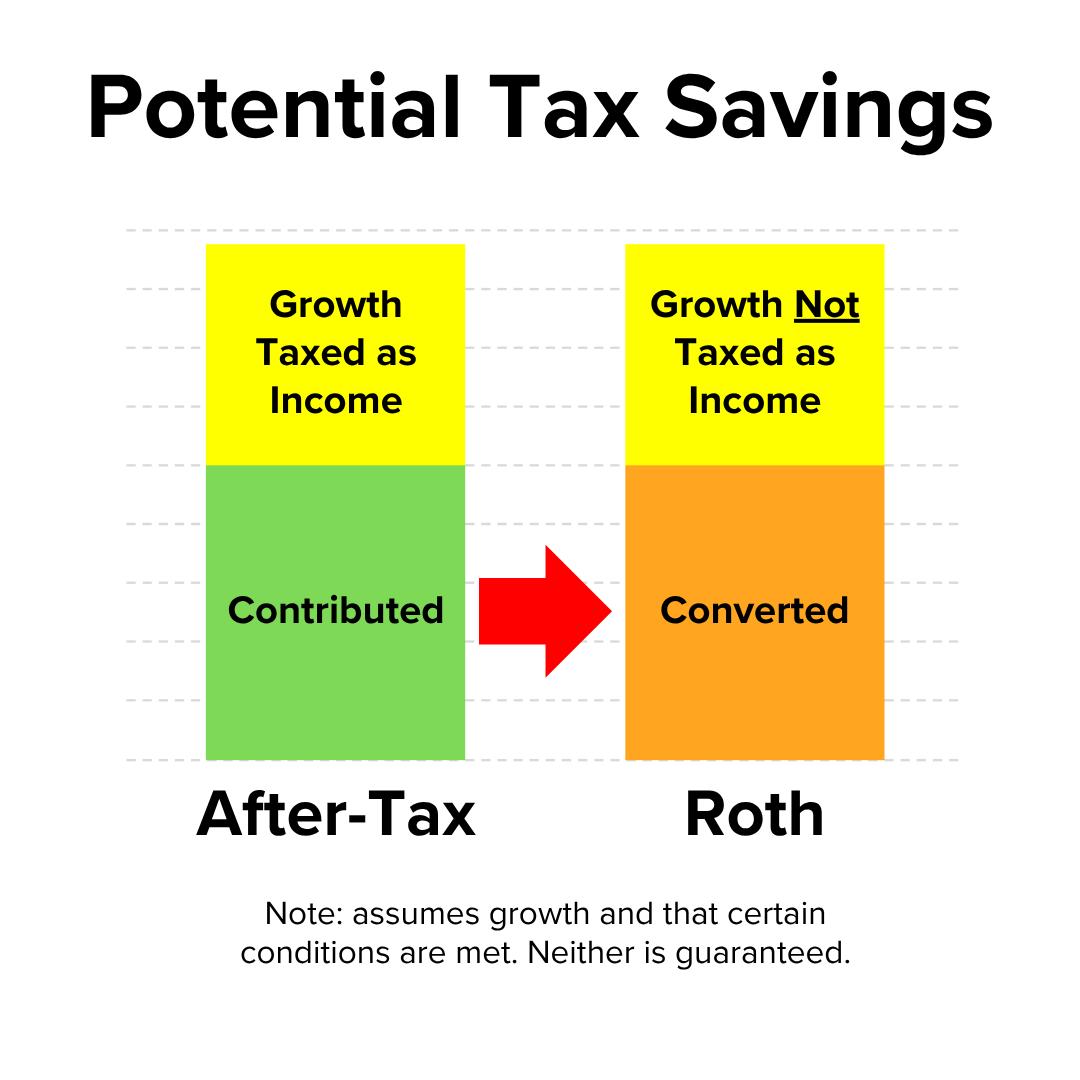

After-Tax to Roth Conversion

It may be possible to:

convert funds from After-Tax to Roth and

avoid tax on investment growth.

However, it’s important to convert funds quickly. Growth in an After-Tax account may be taxed when the balance is converted or withdrawn.

Benefits of Less Taxable Income

Reducing income can have many benefits.

Federal Taxes

Income taxes are progressive:

Some income avoids tax with the standard or itemized deduction.

Income above the deduction is taxed at 10%, up to a limit.

Income above that is taxed at 12%, up to another limit.

Income above that is taxed at 22%…

and so on until reaching the maximum 37% tax bracket.

Also, some credits and deductions aren’t allowed for higher earners.

State Taxes

Less taxable income may also lower state income taxes.

There’s even a State And Local Tax (SALT) deduction cap. Less taxable income may allow more of the state taxes to be deducted on the federal return.

Other Impacts

Government benefits often depend on income, including:

Affordable Care Act (ACA) subsidies,

Medicare premiums for Part B and D,

Social Security payments before full retirement age, and

various social welfare programs.

Higher income can also limit financial aid for education.

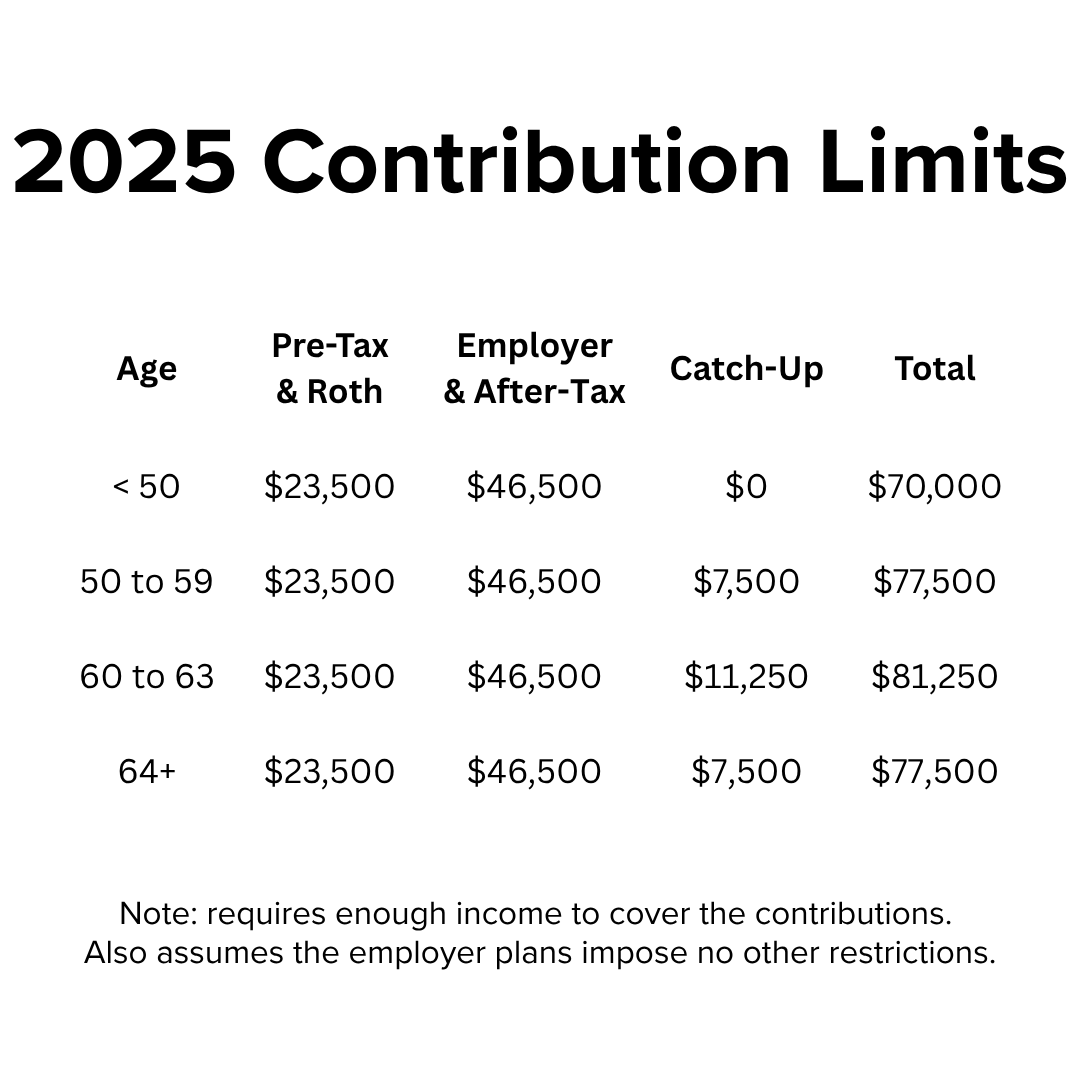

Mega Backdoor Roth Limit for 2025

A benefit of the Mega Backdoor Roth is saving more than the regular 401(k) limit.

For 2025, the employee limit is $23,500. That includes both Pre-Tax and Roth contributions.

The After-Tax contribution limit is $70,000 less what the:

employee contributes to Pre-Tax and Roth plus what their

employer adds to their retirement accounts.

Example

Assume a 45 year-old employee earns $250,000 a year,

contributes the maximum $23,500 to their Pre-Tax 401(k),

their employer matches 4% ($10,000) to their Pre-Tax 401(k), and

their plan offers the After-Tax 401(k).

The employee could contribute $36,500 to their After-Tax 401(k),

on top of their $23,500 Pre-Tax contribution and

$10,000 employer match.

Catch-Up Contributions

Employees over the age of 50 can contribute more.

For 2025, the maximum catch-up contributions are:

$7,500 for those 50 to 59 or 64+, and

$11,250 for those 60 to 63.

These catch-up contributions are on top of the $70,000 combined limit.

Employees who earn more than $145,000 a year are required to make any catch-up contributions to a Roth account.

Contribution Tradeoffs

The $23,500 employee contribution limit is for both Pre-Tax and Roth. Contributing to one lowers how much can be saved to the other.

Catch-up contributions, employer matching, and funds converted from After-Tax to Roth do not count toward the $23,500 limit.

If the employee contributes the maximum $23,500 to their Pre-Tax and Roth 401(k) accounts, that leaves $46,500 for either:

employer or

employee After-Tax contributions.

Total Contributions

The maximum 401(k) contributions for 2025 are:

$70,000 for those under age 50,

$77,500 for those 50 to 59 or 64+, and

$81,250 for those 60 to 63.

401(k) loan repayments are separate. The IRS doesn’t consider them contributions.

Mega Backdoor Roth Eligibility

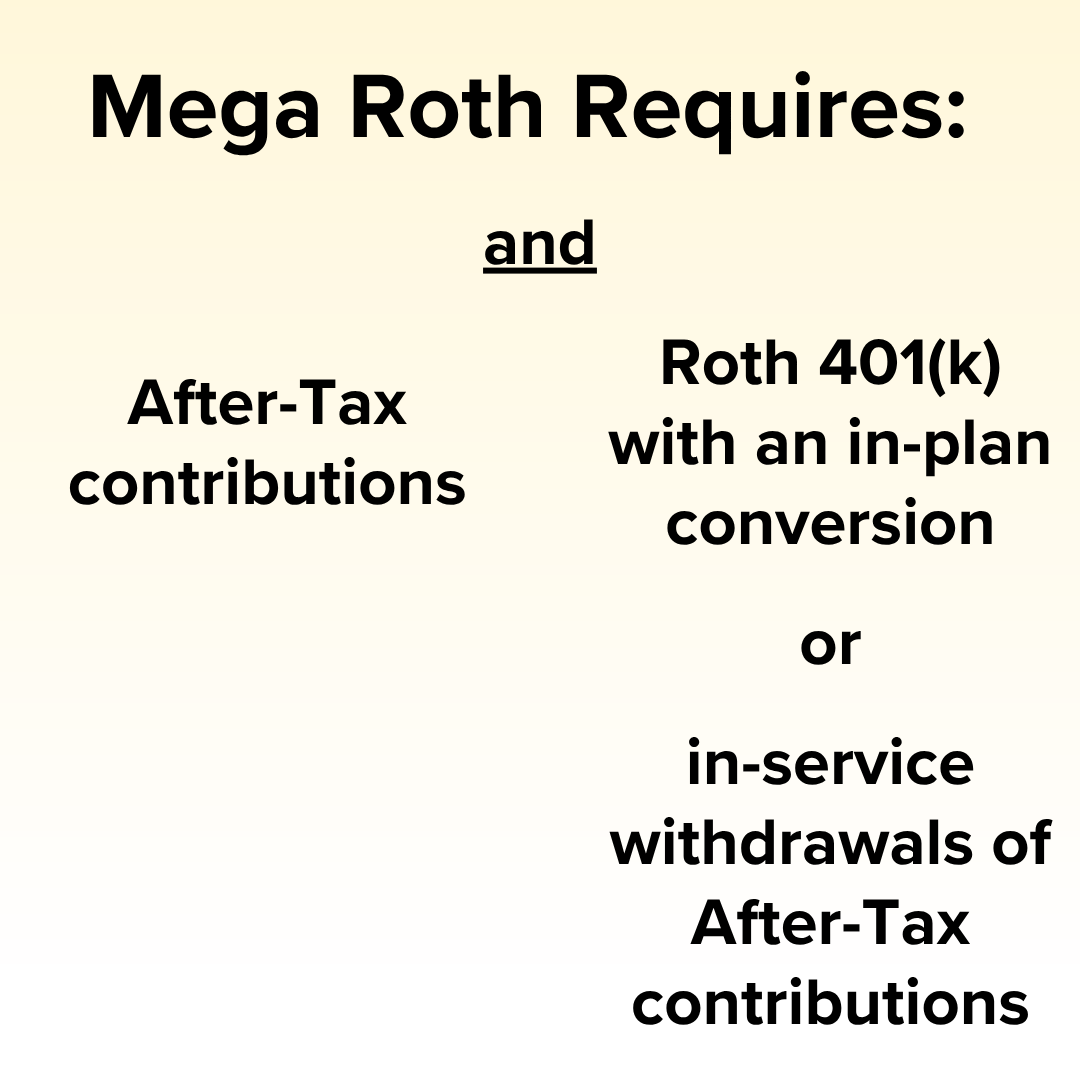

To unlock the Mega Roth, the employer plan must allow:

After-Tax contributions and either

a Roth 401(k) with in-plan conversions or

in-service withdrawals of After-Tax contributions.

In-plan Roth 401(k) conversions let an employee convert funds:

from After-Tax 401(k)

to Roth 401(k).

In-service After-Tax withdrawals let an employee roll funds:

from After-Tax 401(k)

to Roth IRA.

Convert to Roth 401(k) or IRA?

Employees rarely have the option to convert from After-Tax 401(k) to either:

Roth 401(k) or

Roth IRA.

If possible, the decision could depend on:

Simplicity - it may be easier to convert funds from one employer plan to another with the Roth 401(k).

Investment options - there can be more low-cost investment options with a Roth IRA than with a Roth 401(k).

Existing IRAs - an employee with another IRA account may have pro rata complications if converting to a Roth IRA.

Setting Up a Mega Backdoor Roth

Financial institutions like Fidelity, Vanguard, and Charles Schwab may automatically convert After-Tax 401(k) contributions to either Roth 401(k) or Roth IRA upon request.

The setup could require a call to the custodian. It will likely take time to clarify your intentions, options, and decisions.

Once set up, the After-Tax to Roth conversions should occur within a few days of each paycheck.

Is a Mega Roth Worth It?

It depends on someone’s situation and goals.

Limited Availability

Few plans meet the requirements for a Mega Backdoor Roth. It’s more common at large tech companies.

Even plans that offer it may impose restrictions. For instance, they might limit After-Tax contributions to 10% of an employee’s compensation.

Benefits

Contributing has many benefits, especially for those who earn too much to contribute directly to a Roth IRA.

Mega Backdoor Roth benefits include:

Automatic savings - payroll deductions let employees save for retirement before the funds reach their bank account.

Tax-free growth and withdrawals - investments can grow and be distributed tax-free if conditions are met.

No income limit - unlike with the Roth IRA, there’s virtually no income cap for Mega Roth contributions.

No RMDs - funds are not subject to Required Minimum Distributions (RMDs) like Pre-Tax retirement accounts are later in life.

No inherited tax bill - a Roth may avoid shifting income taxes to heirs, which can happen when someone inherits a Pre-Tax account.

Costs

The primary downside of the Mega Roth is less cash flow. Savers often run out of cash before they run out of opportunities.

Other options may take priority:

Cash reserve - keeping at least 3-6 months of living expenses provides flexibility.

Taxable brokerage - using other funds until age 59.5 can avoid the 10% early withdrawal penalty on retirement accounts.

Debt repayment - paying debt is a bit like earning a tax-free return at the interest rate.

401(k) match - earning the employer match is like getting a raise.

Employee Stock Purchase Plan - taking advantage of a stock discount and/or lookback feature may make a lot of sense.

Health Savings Account - contributing can have tax advantages.

Spousal IRA - saving to a spouse’s Pre-Tax retirement account may lower a household’s taxes.

Cost savings - prepaying expenses, increasing deductibles, or making energy efficient upgrades may be very beneficial.

Education - funding a 529 plan could have similar benefits plus a state income tax deduction.

Real estate - buying or renovating property may have a higher return on investment.

Career - buying a car, hiring a coach, or pursuing more education could expand career opportunities.

Insurance - preventing income loss may require both life and disability insurance.

Life Goals - buying a home, starting a family, travelling, and other lifestyle choices may be more fun.

Support - giving to family, friends, or charity may better support someone’s goals.

Conclusion

The Mega Backdoor Roth is a powerful tool for high earners. It’s worth a look if your employer offers it.

However, it isn’t right for everyone. Please consult a tax professional and/or financial planner about your situation.

Hey, thanks for reading my article about the Mega Backdoor Roth!

Just a reminder, I share a lot of resources that can help you.

Join the newsletter and get the white paper:

Personal Finance for Tech Professionals

Disclaimer

In addition to the usual disclaimers, neither this post nor these images include any financial, tax, or legal advice.