Buying a Property You Are Currently Renting

How to buy a place you’re renting - take steps to align what you and your landlord want, and move forward.

Is a Home an Investment?

Is a home an investment? The majority of voters in a recent LinkedIn poll think so! However, it’s worth a deeper dive.

Raise Rent on Parents?

Does it make sense to raise the parents’ rent?

Investing in or Betting on Real Estate?

When real estate is a true investment vs speculation - focusing on profit, lifestyle use, leverage, and how properties can become income generators

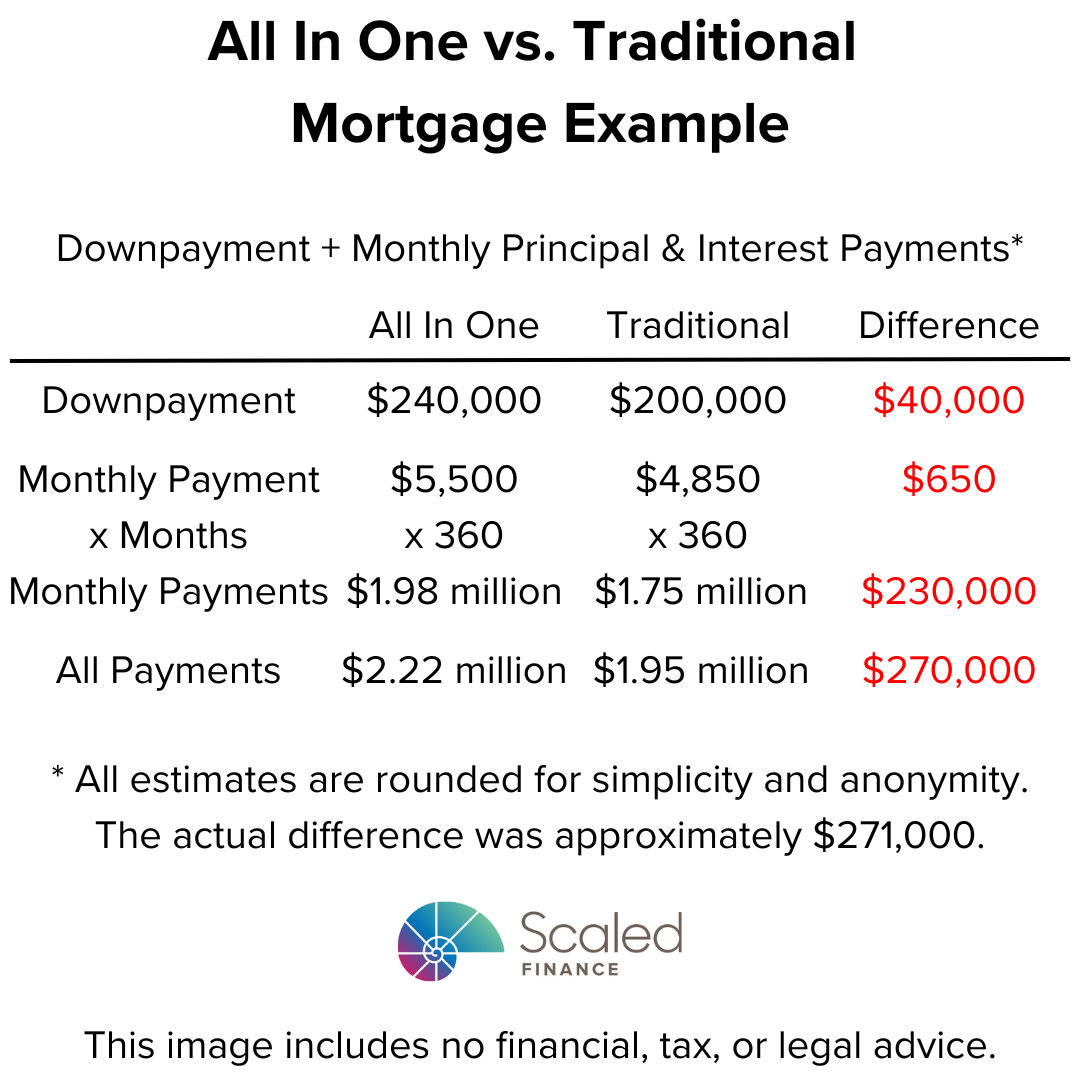

Could an All In One Mortgage Cost an Extra $270,000?

How an ‘all in one’ mortgage could cost $270,000 more over time - and why a traditional mortgage might be smarter.

Charge Market Rent!

Why charging market rent can boost your cash flow, lift property value, and avoid income loss over years.