What Financial Steps Might Tech Professionals Take in December?

The Holidays!

The nights are long. The shops are full. Mariah Carey, Brenda Lee, Bobby Helms, Burl Ives, and Wham! are playing everywhere.

I hope you had a wonderful Thanksgiving and are ready for December. Ready or not, it’s heeere! 🎁

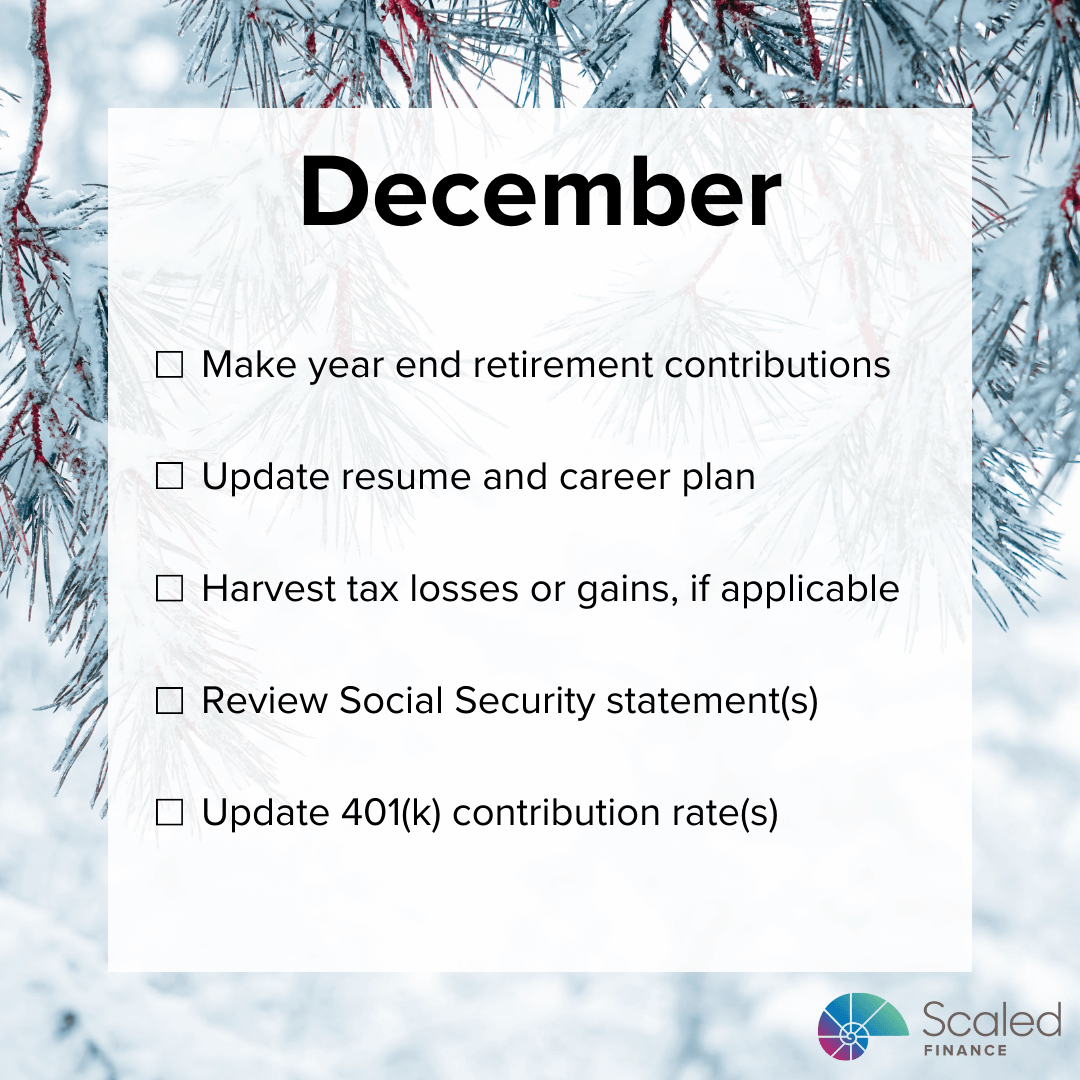

Potential Steps This Month

Financial steps tech professionals might take in December include:

Make year end contributions

Update resume

Harvest tax losses or gains

Review Social Security

Update 401(k) contribution

1. Make Year End Contributions

401(k)

If the goal is to max out the employee 401(k) contribution, make sure that’s on track.

The 2025 employee contribution limits are:

$23,500, up $500 from 2024, plus a

$7,500 catch-up contribution for those aged 50-59 and 64+ or

$11,250 for those 60-63.

Now may be a good time for heavy contributions:

we’re only a few months away from the tax benefit,

many employees have reached the Social Security taxable maximum income, and

annual bonus payouts as well as Restricted Stock Unit (RSU) vesting are expected in mid-February.

Someone in the 24% federal and 8% state tax brackets might get $0.32 of every dollar contributed back in a few months with their tax return.

IRA

Contributing to an IRA might be especially helpful for a spouse. That could reduce the income tax for a married couple who files jointly.

The IRA deduction income limits are higher for someone without an employer retirement plan. That’s especially common in single income families. The spouse with earned income would need to earn enough to cover both of their contributions.

Although the deadline to contribute to an IRA is usually tax day, it may make sense to do so now. It’s easy to forget!

It might also take a while to open and fund the account. Setting them up now could avoid a fire drill later. 🚒

Whether to contribute pre-tax (traditional) or after-tax (Roth) depends on the situation.

2. Update Resume

Bonuses and raises often occur in mid-February for salaried employees.

Here’s a rough timeline:

Early January: Supervisors need to submit their raise and bonus decisions by mid-January. That means they’re making decisions in early January or even December!

Mid January: Senior leadership needs time to review / adjust / approve proposed raises and bonuses.

Late January: The Human Resources and Payroll teams need time to process the changes before the changes in mid-February.

Let’s consider a couple scenarios.

Review Is Positive or Excellent 😎

A manager might want to do everything they can for the employee!

It’s much easier to help an employee if you know where they want to go. The manager might be able to:

develop a stretch assignment,

prepare the employee for a promotion, or

help them find a great opportunity with another team.

Review Is Less Than Stellar 🤔

Sometimes, a role or team is a poor fit.

An employee might apply for a lateral change. In extreme cases, they may need to consider positions at other employers.

Either way, an updated resume could come in handy!

Time to Think

December is typically a quiet time around the office. It’s an excellent opportunity to reflect on recent accomplishments.

It’s also a good time to review uncompleted projects. Why weren’t they completed? Is there anything that could be done about it?

Any progress is better than a goose egg! 🥚

What Worked for Me

Here’s what I liked to do:

Go through my calendar month by month. What were my projects? What did I accomplish?

Review my sent emails. What were my key deliverables? What impact did they have?

Review my folders. What did I create? How did that help business partners, teammates, or customers?

I’d then consider the work I did and the people I worked with:

What did I really enjoy?

What didn’t I get a chance to do that I wished I could have?

Who did I like working with?

That review helped set my direction for the next year:

“It seems like there may be an opportunity with X. I’ve been thinking about it and I feel we might be able to do Y.”

“I really enjoyed working with Z on that project. I heard they’re leading a new opportunity. Could I explore that a little further?”

“W is making great progress. I feel they could be great at T. I have a fair bit of experience with that. Would there be an opportunity for me to mentor W on T?”

I then developed a one-page self-appraisal, which I normally printed and shared with my manager.

It’s a bit like discussing a letter of recommendation. They shouldn’t have to work to remember:

what I do well,

what my development opportunities are, and

what I’d like to do next.

I tried to make it easy for my manager to support me!

December is a good time to update resumes, CV’s, and career goals. They’re particularly helpful for performance review conversations.

3. Harvest Tax Losses or Gains

I wrote about tax loss and gain harvesting last year.

Here are some highlights:

Tax Loss Harvesting: Selling an investment at a loss can offset up to $3,000 of earned income. Than may help in a high-income year.

Tax Gain Harvesting: Selling an investment for a gain can increase taxable income in a low-income year.

Each of these tactics need to be completed by year end, making December an excellent time for an investment review! They can help minimize lifetime taxes.

4. Review Social Security

Social Security statements are updated once a year. December is a good time to check them!

Retirement Income

The latest statement can help dial in financial independence plans. Social Security benefits can exceed living expenses for some families!

However, Social Security statements assume someone will earn the same real income they did the previous year until at least age 62. That assumption may be fine for someone with over 35 years of earnings.

The Social Security Administration now includes a calculator to estimate benefits based on future income. I ask clients assume no future ($0) income to see how that impacts their expected benefits.

Fraud

Another good reason to review Social Security statements is to check for fraud. Some criminals report income with a stolen Social Security number. Any of us could be a victim!

Knowing as soon as possible may help catch the fraudster and minimize the financial impact. It’s not ideal to learn about from the IRS!

5. Update 401(k) Contribution

One final step a tech professional might take in December is to update their 401(k) contribution percentages.

Matching

Some employers match:

100% of the first 3% an employee contributes and

50% of the next 2% they contribute.

If someone contributes 5%, a company may match 4%.

Qualifying income includes:

regular salaries and wages,

commissions, and

bonuses - including the short-term incentive plan, monthly cash incentive plan, spot bonuses, etc.

Many people adjust their contribution rates toward the end of the year. However, it’s important to refresh contribution rates before the new year.

If someone’s planning to max out their 401(k) contributions, it might make sense to do so throughout the year. If someone reaches the maximum before the last paycheck of the year, the company may not make a true-up contribution until the following year, often in March.

2026 maximum

The 401(k) employee contribution limits for 2026 are a bit higher:

$24,500, up $1,000 from 2025,

$8,000 catch-up for those age 50-59 and 64+, and

$11,250 catch-up for those age 60-63.

To avoid impacting the 2025 contributions, it may make sense to wait until after the last paycheck of the year to make the changes in Fidelity.

Remember to consider both the regular and bonus 401(k) contributions!

Hey, thanks for reading my post on potential financial steps for tech professionals in December.

Just a reminder, I share a lot of resources that can help you.

Sign up to get the white paper:

Personal Finance for Tech Professionals

Disclaimer

In addition to the usual disclaimers, neither this post nor this image includes any financial, tax, or legal advice.