What Financial Steps Might Tech Professionals Take in November?

Happy Halloween!

Are you ready for trick or treaters?

Ready or not, here they come! 🎃

Potential Steps for Tech Professionals

Financial steps tech employees might take in November include:

Schedule a vacation

Harvest a tax loss or gain

Give to charity

Buy holiday gifts

Rebalance investments

This assumes open enrollment is complete. If not, do that first!

1. Schedule a Vacation🌴

You’ve already booked your vacation for 2025, right? 😆 Good - because it’s time to consider spring.

Remember those cold and dreary days in February? It could be a good time to plan a vacation before prices rise!

The biggest benefit of scheduling Paid Time Off now is to call dibs! Many teams have limited coverage so get yours approved early.

2. Harvest a Tax Loss or Gain

Income generally falls into three buckets for taxes:

Earned

Investment

Passive

Earned

Earned income is what someone receives from working. That could be working for a company, self-employment, or both!

Investment

Investment income is money earned from investments like stocks, bonds, mutual funds, etc. The U.S. government encourages capital funding by taxing investments at a lower rate than wages.

Passive

Passive income is for investments like rental real estate, limited partnerships, and equipment leases.

If someone actively participates in the business, the income may be taxed as earned. Material participation can complicated.

Rarely Mix

The important thing is that these buckets are rarely allowed to mix.

Passive investments were once abused by higher earners who used them as tax shelters. Now, they’re tracked separately.

Passive Activity Losses generally don’t reduce earned income. They’re not your PAL. 😉

The same is typically true for investments. Losses normally don’t lower earned income and, therefore, taxes.

Tax Loss Harvesting

However, there’s an exception!

Up to $3,000 in net investment losses can offset earned income and lower taxes.

If someone sold investments with $7,000 of gains, that person would need to sell other investments with $10,000 in losses for a net $3,000 loss.

Investment losses may lower someone’s tax bill… especially if they’re in a higher tax bracket.

Tax Gain Harvesting

Another opportunity is tax gain harvesting. This occurs when someone has lower income than they normally would.

Because of deductions and lower tax brackets, it may make sense to sell investments before year end. Gains might be taxed less now than later!

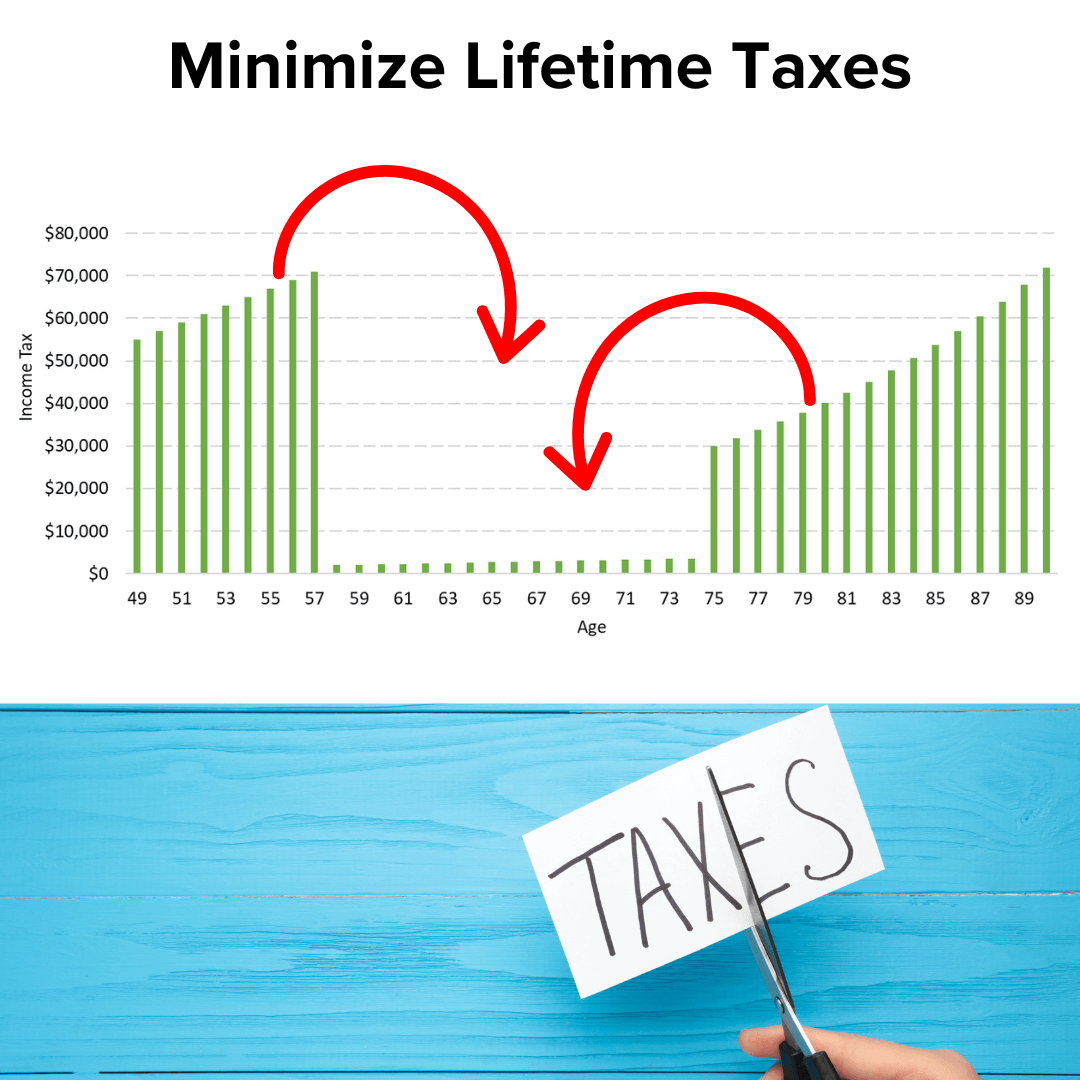

Minimize Lifetime Taxes

Two ways to potentially minimize lifetime taxes are:

lower income in high-income years and

raise income in low-income years.

3. Give to Charity

Among other things, the Tax Cuts and Jobs Act of 2017:

Capped the state and local tax (SALT) deduction at $10,000,

Lowered the deductible mortgage balance from $1,000,000 to $750,000 (existing mortgages were grandfathered), and

Nearly doubled the standard deduction.

The One Big Beautiful Bill Act increased the state and local tax (SALT) deduction to $40,000 for married couples who file jointly in 2025.

Standard Deduction

More people now use the standard deduction.

Good news! That simplified taxes for millions of Americans.

Bad news! That caused fewer people to itemize deductions and reduced their tax benefit of charitable giving.

Itemized Deduction

Nonetheless, millions of Americans still itemize. It may pay to be strategic with charitable giving.

Some techniques to save more tax with donations include to:

bunch - give more one year instead of less in multiple years,

contribute to a Donor-Advised Fund (DAF) - give now and then advise on how the funds will be distributed later, and

donate an appreciated asset - give an investment which has risen in value to charity.

It generally doesn’t make sense to sell an investment, pay tax on the gain, and then donate what’s left to charity. Charities don’t pay income taxes! Donating an appreciated investment can save taxes, enable a bigger contribution, or both.

Tech employees may also have access to special Giving Tuesday employer matching the Tuesday after Thanksgiving, 12/2/2025.

4. Buy Holiday Gifts 🎁

It’s nearly the most wonderful time of the year!

Buying gifts early can ensure they’re:

still available and

arrive in time.

There will be big sale days in a few weeks:

Black Friday, 11/28/2025

Small Business Saturday, 11/29/2025

Cyber Monday, 12/1/2025

The discounts don’t just have to be for gifts! There are some business items I hope to buy on sale. 🤞

5. Rebalance Investments

Now may be a good time to check your portfolio.

The stock market’s done well this year! Investments may have drifted from their target allocation.

ESPP

Tech employees may have recently stocked up - literally - through the Employee Stock Purchase Plan. Do they still want to hold it?

For more, check out:

RSU

Restricted Stock Units (RSUs) often vest throughout the year. It’s worth considering how much, if any, company stock to hold.

For more, check out:

Cash Reserve

As part of the review, it’s important to consider whether you have enough of a cash reserve.

Cash can help with:

emergencies and

opportunities.

Even the wealthy can slip into a scarcity mindset if they don’t have ready access to funds.

Retirement Account Investment Changes

It often works best to adjust retirement account investments.

Doing so could avoid realizing taxable gains. Those gains could require someone pay taxes either:

with an estimated payment,

through additional withholding, or

alongside their tax return.

Fortunately, transactions in retirement accounts aren’t usually taxed.

Asset Location

Where assets are held is often overlooked.

Asset location may be as important as asset allocation. Are your assets in the right location?

It could make sense to hold:

more aggressive investments in after-tax accounts and

more conservative investments in pre-tax or taxable accounts.

Hey, thanks for reading my post on potential steps tech professionals might take in November!

Just a reminder, I share a lot of resources that can help you.

Sign up to get the white paper:

Personal Finance for Tech Professionals

Disclaimer

In addition to the usual disclaimers, neither this post nor these images include any financial, tax, or legal advice.