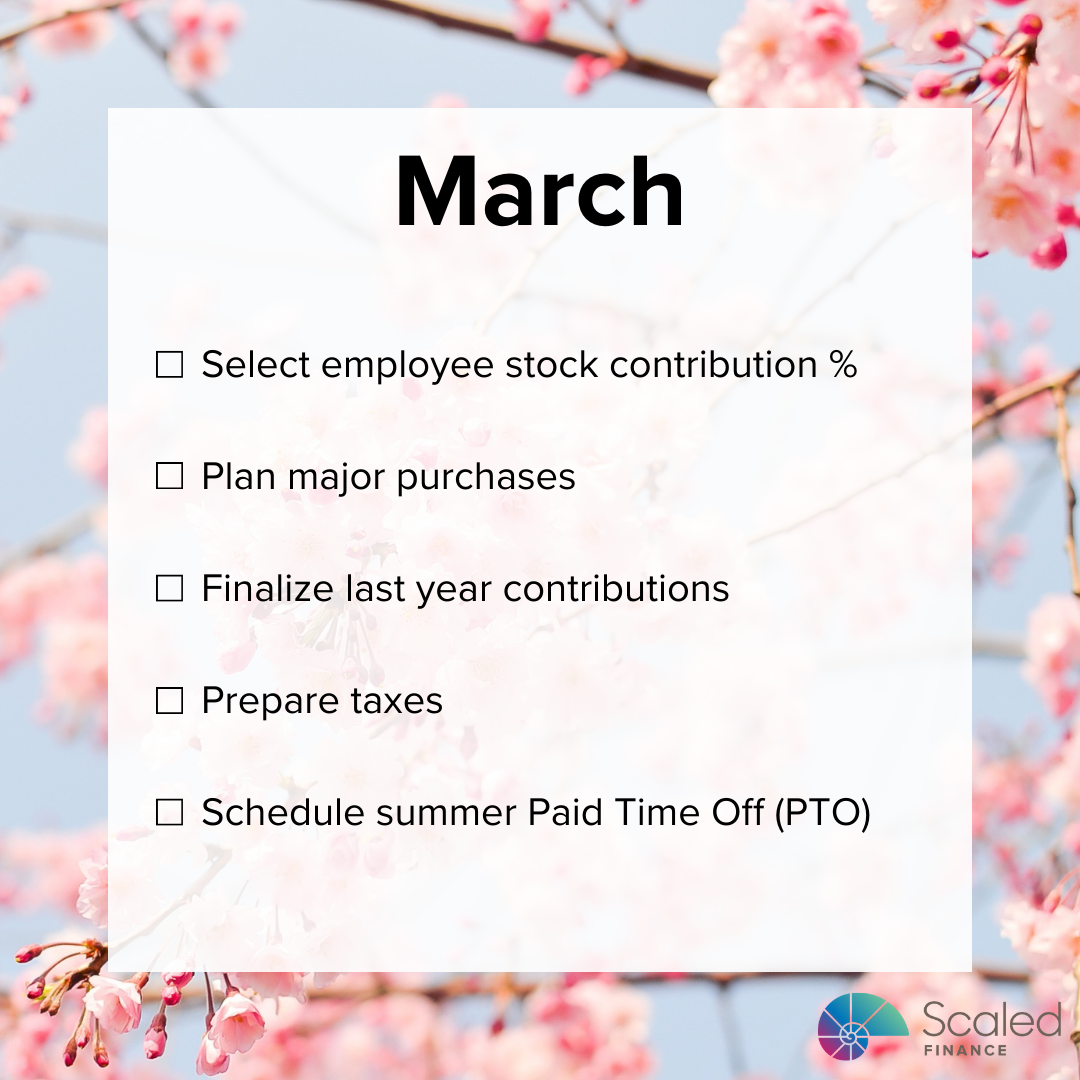

Potential Financial Steps for Tech Professionals in March

Smart March financial steps for tech professionals could include - choosing ESPP contribution, plan major purchases, finalize last-year contributions, prep taxes, and book summer PTO.

What to do with $100k

What should I do with $100k? It depends. Five good options include: 1. protect yourself, 2. cut expenses, 3. invest in yourself, 4. make a major purchase, and 5. invest wisely. This article explores ideas for each option.

Potential Financial Steps for Tech Professionals in February 2025

Key February moves for tech pros - like prepping taxes, saving bonus or raise, accepting your RSU grant, and rebalancing your investments.

Get a HELOC Before Retirement?

This article explores why setting up a HELOC before retirement can give you flexibility, protect your portfolio, and act as a safety net if markets dip.

What Supersavers Miss

Supersavers often overlook opportunities. Some of those include: merit aid, Social Security funding, benefit claiming strategies, single stock exposure, target allocation, asset location, Mega Roth, home gain exclusion, personal liability, rental cash flow, lifetime tax minimization, penalties and interest, withholdingg, bunching donations, Donor-Advised Fund (DAF), giving income away, coverage limits, deductibles, prepaid discounts, umbrella, disability impact, federal estate tax, state estate and inheritance taxes, and step-up in basis.

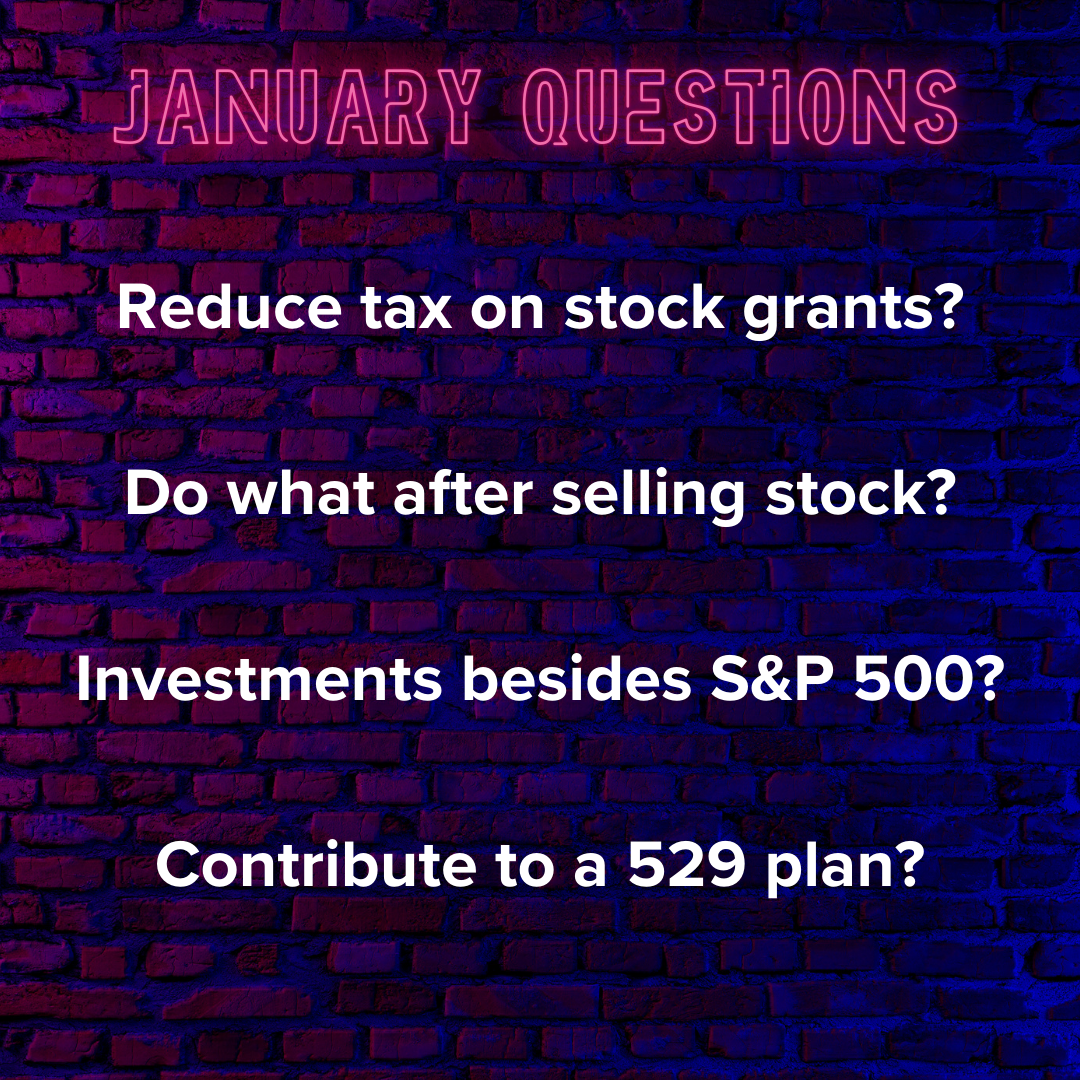

January 2025 Questions

Get answers to top January questions on RSU tax strategies, diversifying from a single-stock, investment alternatives beyond the S&P 500, and 529 plan moves.

Potential Financial Steps for T-Mobile Employees in January

What financial steps might T-Mobile employees take in January? Options might include: submit dependent care reimbursements, update net worth estimate, refresh long-term projections, evaluate Mega Roth, begin gathering tax forms, and plan summer vacations and camps.

December 2024 Questions

Answering top December questions - from managing RSUs and 401(k) planning to HSAs, Medicare, investing apps, crypto, and more.

17 Investment Signs You Need a Financial Plan

Explore 17 clear signs - like confusing advisor fees or neglecting ESPPs - that you may need a financial plan.

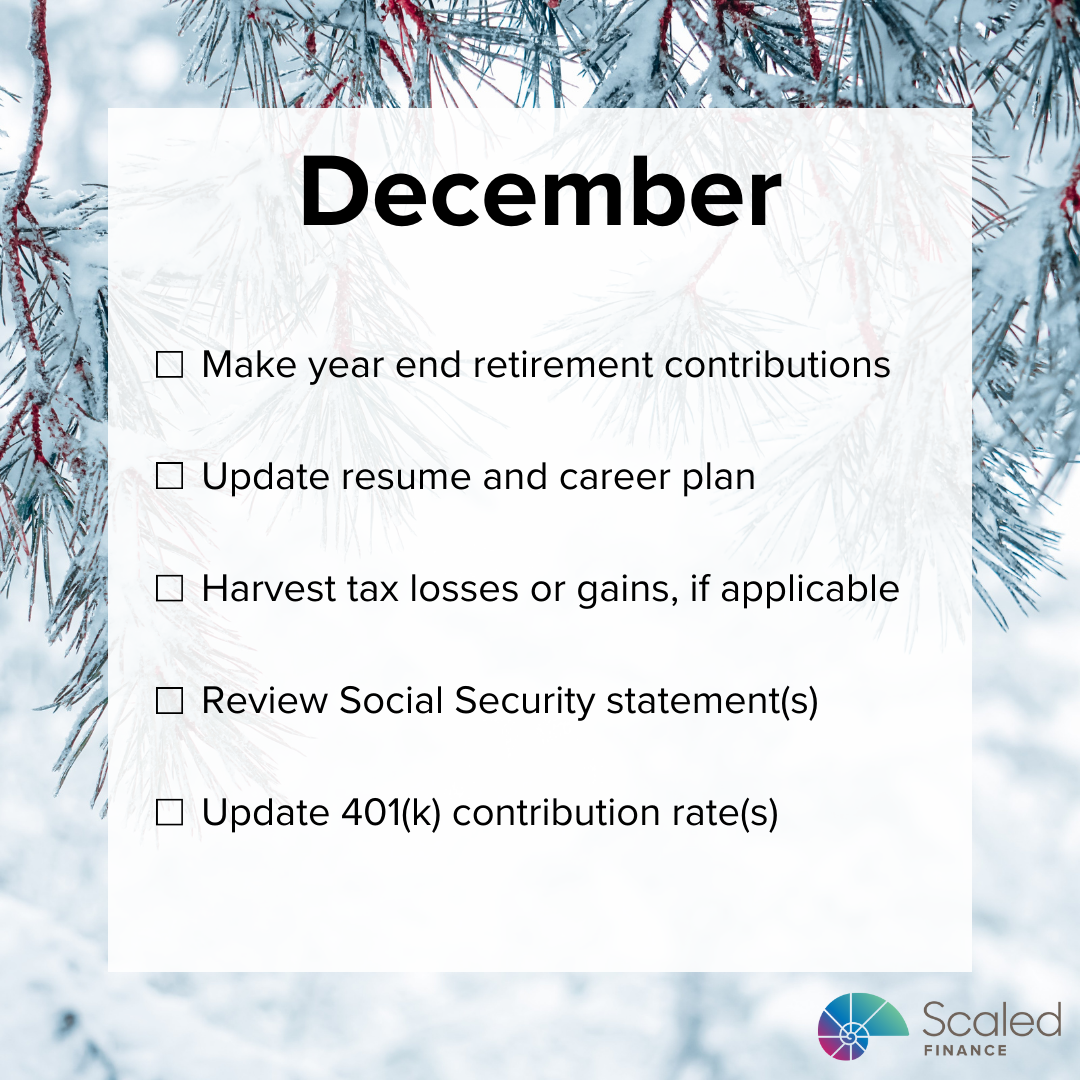

Potential Financial Steps for T-Mobile Employees in December

What financial steps might T-Mobile employees take in December? Options might include: make year end retirement contributions, update resume and career plan, harvest tax losses or gains, review Social Security statement(s), and update 401(k) contribution rate.

Happy Thanksgiving!

Happy Thanksgiving, all!

I have even more than usual to be thankful for this year - including family, health, time, clients, support, and generator.

Is All Debt Bad?

How debt can be a tool - highlighting credit benefits like flexibility and rewards as well as risks like fees and lost future options.

12 Emotional Signs You Need a Financial Plan

Explore 12 emotional signs you're ready for a financial plan - like sleepless nights, money fears, or wanting more from life.

Potential Financial Steps for T-Mobile Employees in November

What financial steps might T-Mobile employees take in November? Schedule spring Paid Time Off (PTO), plan tax loss or gain harvesting, finalize year end charitable giving, purchase holiday gifts and review / rebalance investment portfolio.

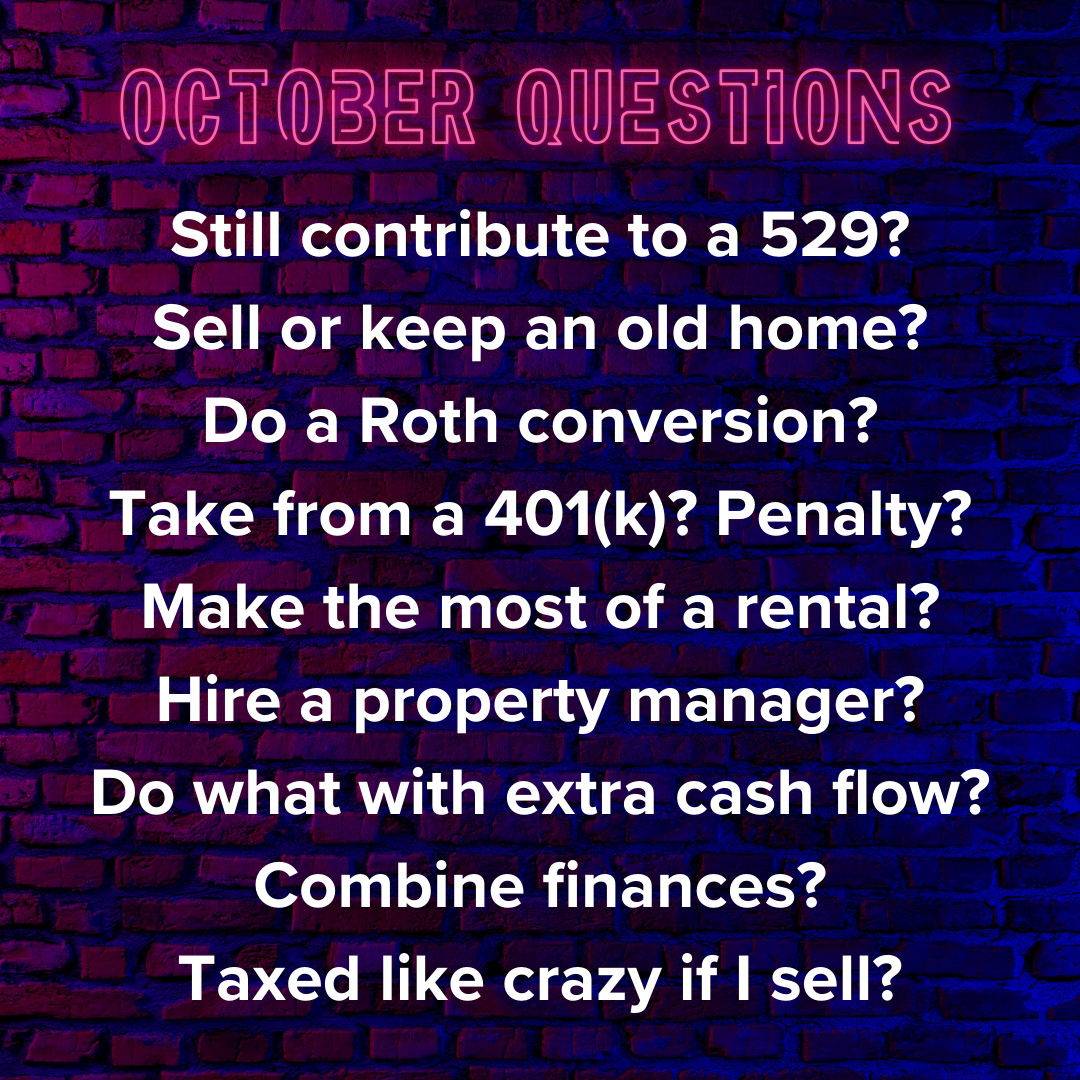

October 2024 Questions

There were many great questions asked in a recent Q&A session with T-Mobile employees! Does it make sense to contribute to a 529 now that my kid’s in high school? I moved for work. Should I sell my old home? Would a Roth conversion after retirement lower my taxes? Instead of keeping your 401(k) until you are 59 1/2, should you take some early? When you take 401(k) distributions before you reach retirement age, is there still a penalty? How do we make the most out of our rental property? What are best practices for us renting ir or using a property management company? Do you have best practices for how to treat the extra cash, $1,500 a month? We have been married for 10 years and have not joined our finances. Is that recommended? Would I be taxed like crazy if I sell my stock?

XYPN Live 2024

XYPN Live 2024 was good! The event marked the 10th anniversary of the XY Planning Network. It brought together many fee-only advisors and vendors from across the industry. In this article, I share some of my insights on the conference.

I Changed Jobs. Should I Roll Over My 401(k)?

I changed jobs. Should I roll over my 401(k)? It depends. There are potential benefits and cost of either rolling an old 401(k) into an IRA, rolling thee 401(k) into another 401(k), or keeping the 401(k).

Potential Financial Steps for T-Mobile Employees in October

What financial steps might T-Mobile employees take in October? Perhaps: evaluate stock purchased with the Employee Stock Purchase Plan (ESPP), book holiday plans, complete open enrollment, update beneficiaries and estate plan, and plan year end health expenses.

Risk Capacity Matters More Than Risk Tolerance

Risk capacity matters more than risk tolerance. Someone’s ability to take risk depends on their financial circumstance. That’s their risk capacity. Risk tolerance depends on many factors and is more fluid.

Save More Tax on Donations

Millions of people give to charity, which is wonderful! However, they often give cash each week, month, or year. That method can cost more! It’s often better to: donate appreciated assets, bunch donations, or contribute to a Donor Advised Fund.