17 Investment Signs You Need a Financial Plan

Explore 17 clear signs - like confusing advisor fees or neglecting ESPPs - that you may need a financial plan.

Is All Debt Bad?

How debt can be a tool - highlighting credit benefits like flexibility and rewards as well as risks like fees and lost future options.

12 Emotional Signs You Need a Financial Plan

Explore 12 emotional signs you're ready for a financial plan - like sleepless nights, money fears, or wanting more from life.

XYPN Live 2024

XYPN Live 2024 was good! The event marked the 10th anniversary of the XY Planning Network. It brought together many fee-only advisors and vendors from across the industry. In this article, I share some of my insights on the conference.

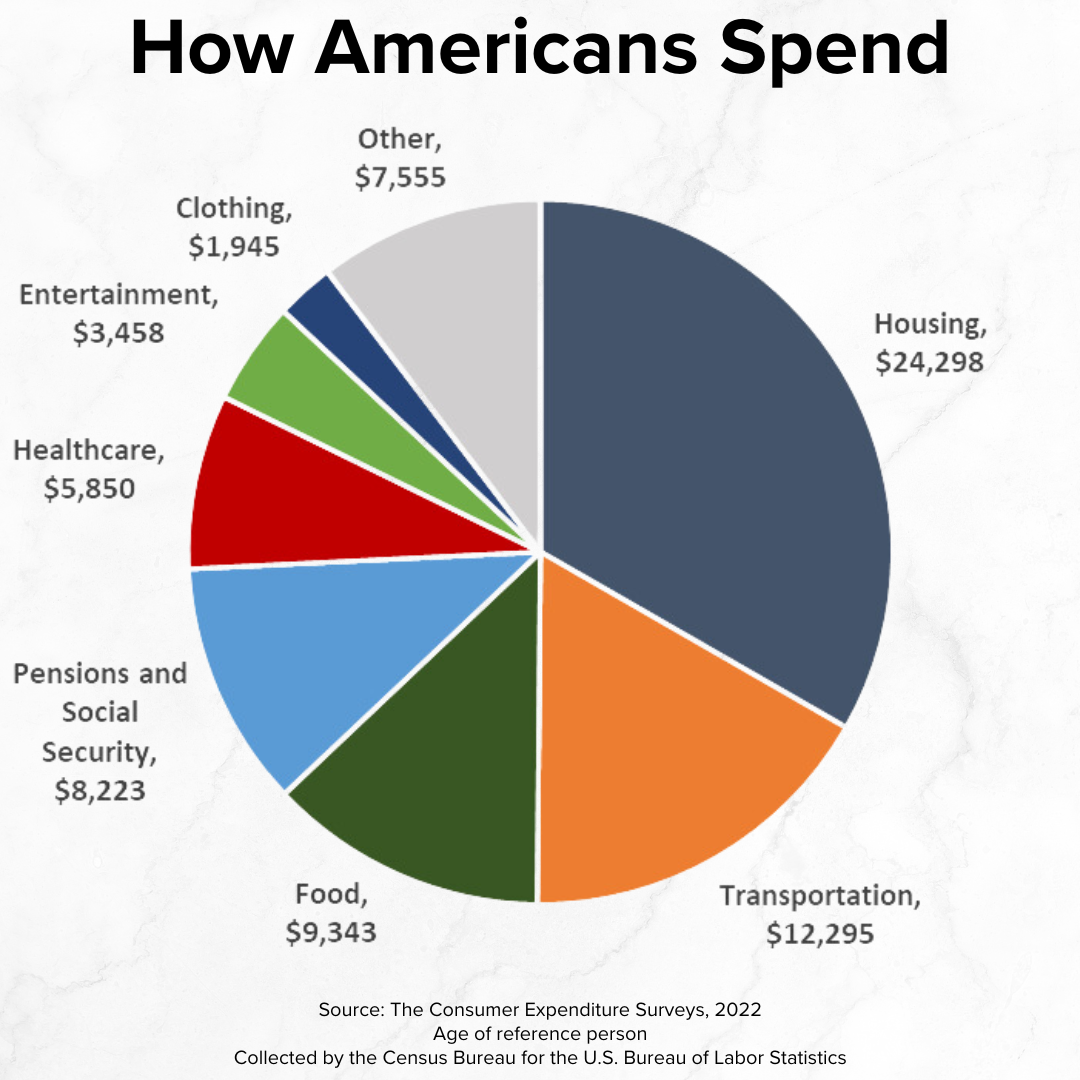

How Americans Spend

Knowing how Americans spend - from housing and transport to entertainment - can help you focus your spending where it matters most.

Benefit from Stop, Start, Continue!

Benefit from Start, Start, Continue! This technique applies to many areas of life - including personal finance.

Rich Is Flashy

Rich is flashy. However, few things can destroy someone’s wealth faster than trying to look rich.

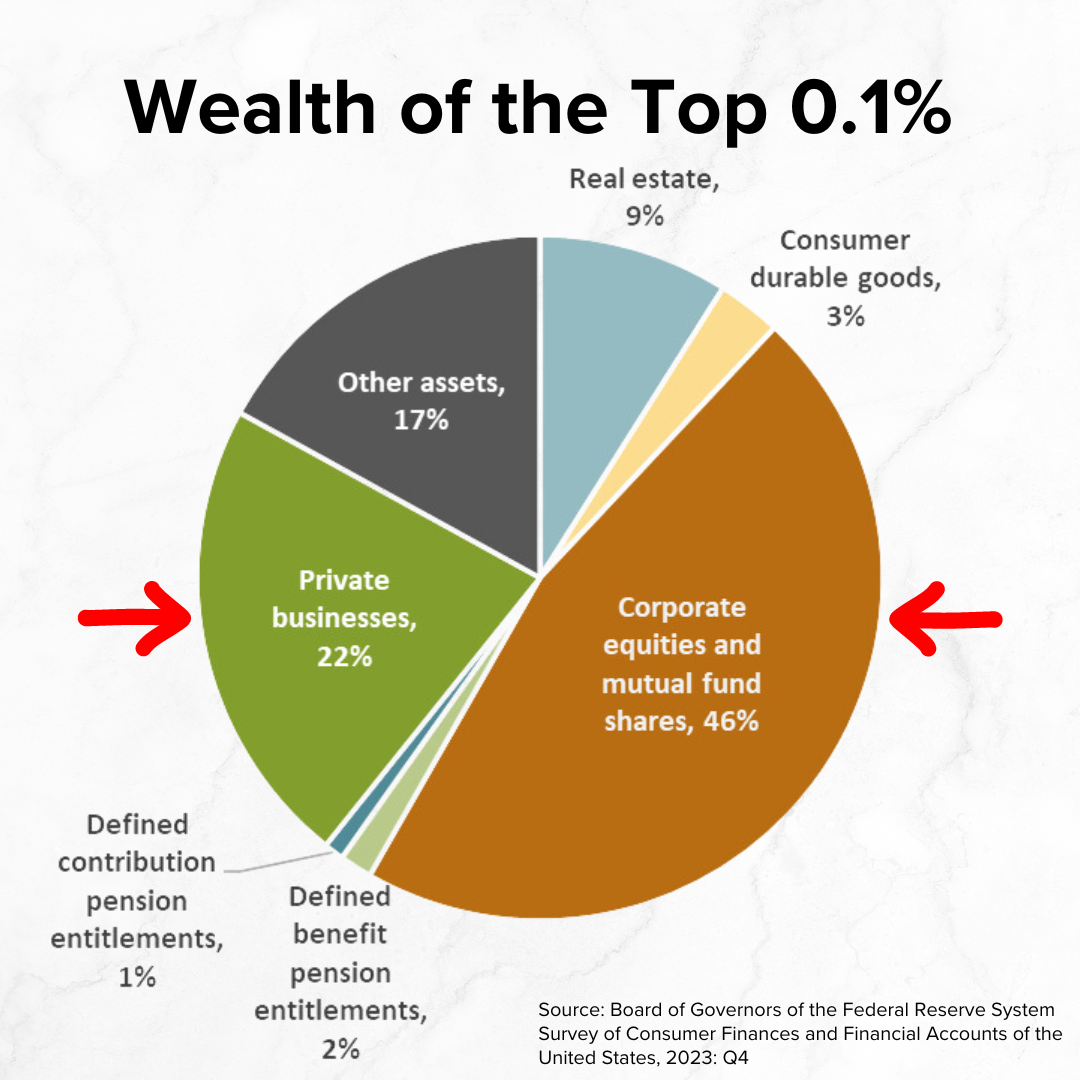

Own Like a Billionaire?

A lot of the focus has been on how much those with significant wealth own. However, what they own might be even more interesting! This article leverages data from the Federal Reserve to compare what households own at varying levels of wealth.

Love Future You

A friendly reminder why your future self deserves love - how your raise and bonus today can supercharge savings and help future you thrive.

Do You Even Need a Budget?

How replacing strict budgeting with mindful spending can help you spot hidden costs, evaluate expenses, and align spending with what matters most.

Is Your Cash Starving?

Running low on cash can trigger stress, fees, and a downward spiral - building a buffer breaks the cycle and can unlock opportunities.

5 Great Questions to Ask Yourself

What are five great questions to ask yourself? 1) What do I want my money to accomplish? 2) How do I minimize lifetime taxes? 3) What if I’m injured? 4) How can education costs be reasonable? 5) Are my assets in the right location?

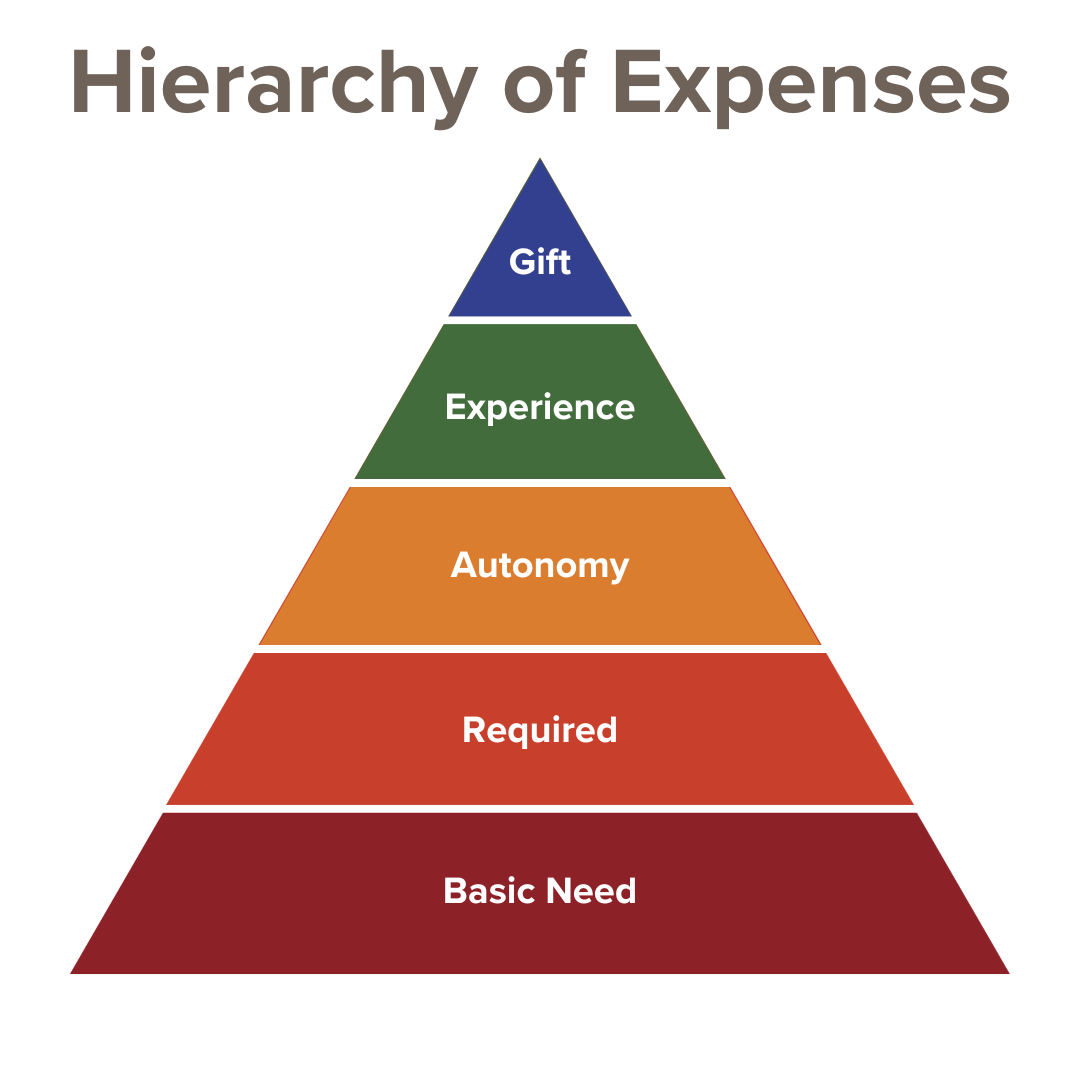

Hierarchy of Expenses

What are the hierarchy of expenses? Basic needs, required, autonomy, experience, and gift.

This article explores each in turn.

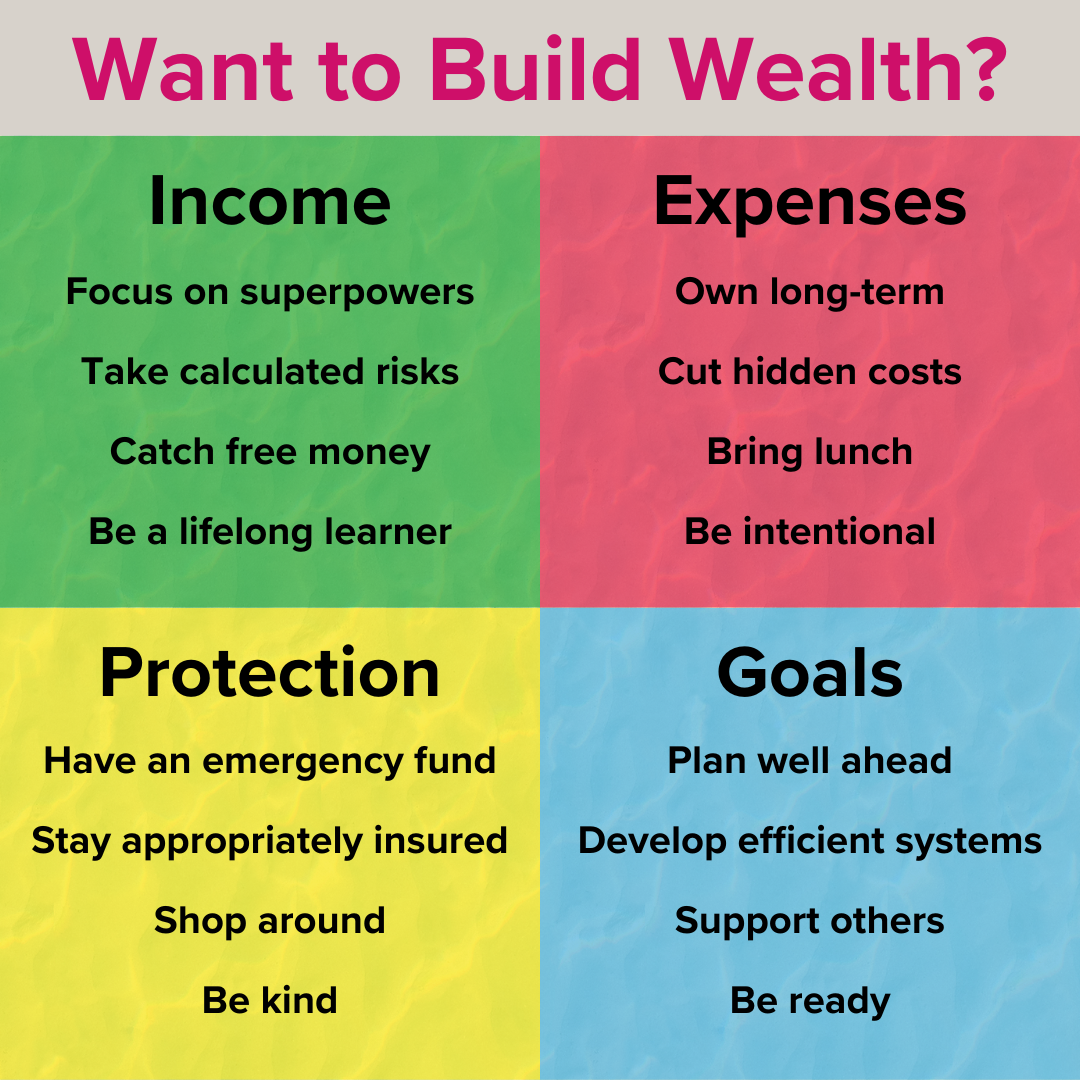

16 Ways to Build Wealth

Explore 16 simple, smart ways to build wealth - from boosting income and cutting costs to protecting assets and planning ahead.

Benefit from Inertia

This is how inertia can work in your favor over decades with minimal effort - including automated savings and compound growth.

Big Takeaways from XYPN Live 2023!

I had the great fortune to attend the XYPN Live last week.

Michael Kitces asked me about my big takeaways.

They were all about mindset:

Stephanie Bogan’s challenge to think bigger

Michael Kitces’ closing keynote on scaling

Adam Cmejla’s perspectives on growth and automation

Do You Have the 3 T’s to Manage Finances Well?

Do you have the 3 T’s to manage finances well?

Those are:

Time

Training

Temperament

Are You Less Behind Than You Think?

How compound growth - using the rule of 72 - reveals that you may be further ahead than you feel in your financial journey.

Could Waiting a Year Cost $140,000?

How delaying financial moves by a year could cost you nearly $140,000 over 40 years - due to compound growth.

Buying a Car

Five smart car-buying steps - from knowing your alternatives and negotiating financing to staying energized and walking away if needed.