Unlock the Mega Backdoor!

Kevin Estes is a CERTIFIED FINANCIAL PLANNER® who helps tech professionals and their families live great lives. He works on an hourly basis so you only pay for what you need.

Secure your future.

Financial Planning

Equity Compensation

Retirement Planning

Strategic Tax Planning

Investment Optimization

Estate Planning

Let’s connect.

As seen in:

Supercharge wealth.

Are you a high-earning tech employee looking to maximize savings and minimize taxes?

If your employer offers an after-tax 401(k), you might do more with tens of thousands each year.

What’s a Mega Roth?

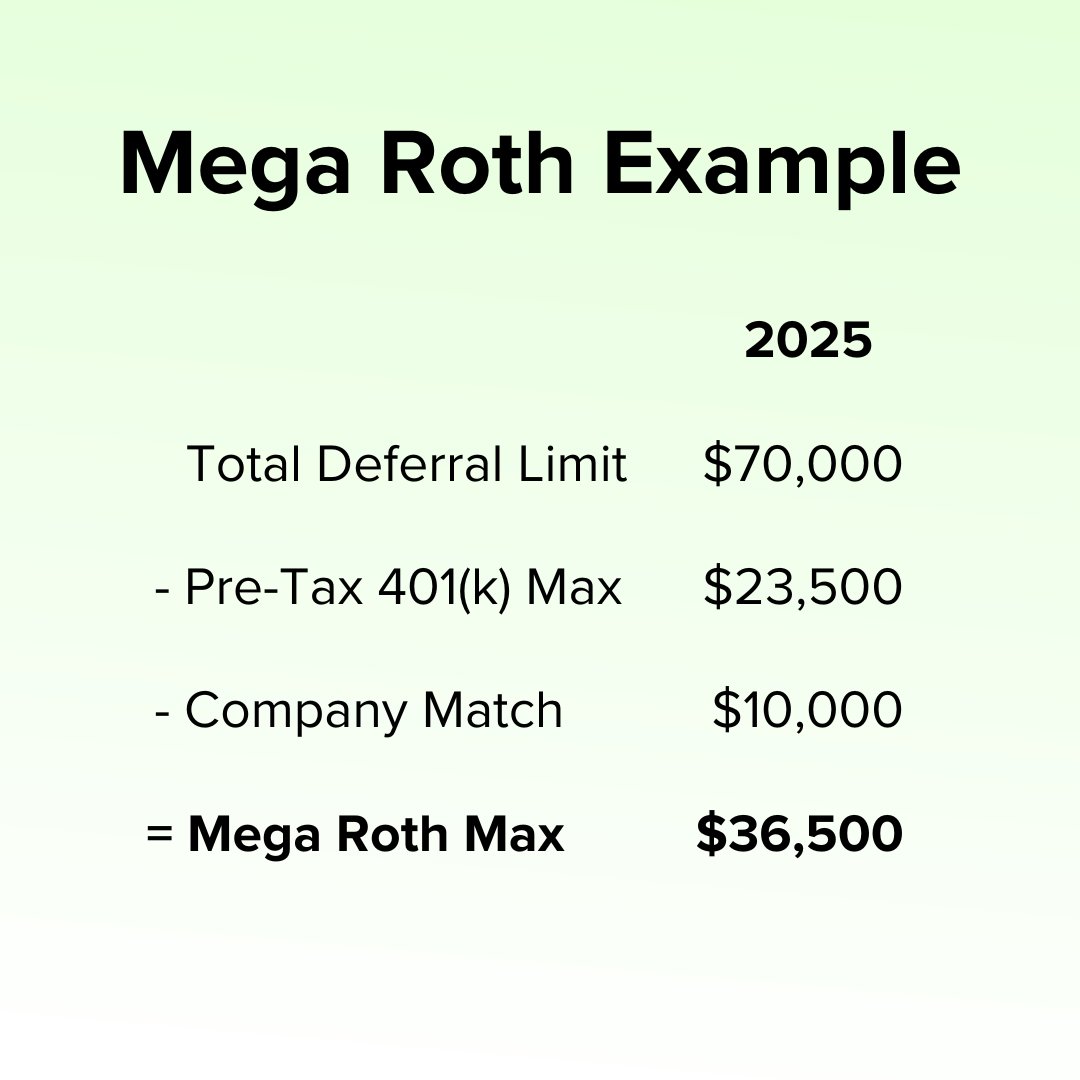

Most employees think 401(k) contributions are capped at $23,500.

How about nearly triple that?

You may be able to contribute up to $70,000!

That limit includes:

other employee contributions,

employer matching, and

after-tax 401(k) contributions.

What’s the benefit?

Converting funds from after-tax to Roth can avoid tax on the growth.

This strategy is especially powerful for high earners looking to:

save more,

minimize lifetime taxes, and

maximize company benefits.

However, the rules are complex - which is where I come in.

Maximize benefits.

With a deep understanding of tech benefits, I help you:

Determine if your 401(k) plan allows a Mega Roth. Not every company does. I’ll quickly assess your options.

Calculate your optimal contribution. Ensure you maximize the strategy without over-doing it.

Integrate into your broader financial plan. A Mega Roth is just one piece of your long-term strategy.

Take action now.

Some companies are removing or restricting the Mega Roth option.

If your employer still allows it, now may be the time to lock in years of tax-free growth.

Trusted by employees at: