How Does an ESPP Work?

How does an Employee Stock Purchase Plan work?

What to Do with RSUs?

What to do with Restricted Stock Units? There are at least fifteen (15) things to do besides hold onto the shares.

Frequent Restricted Stock Unit Vests May Be Win-Win-Win

Why frequent RSU vests - like quarterly or semi-annual - can benefit employees, companies, and shareholders alike.

Are Employee Stock Purchase Plans Underrated?

Why Employee Stock Purchase Plans can be a hidden gem - offering discounted stock and smart lookbacks.

Is It Worth Holding Employer Stock?

There are risks of holding your employer’s stock - lack of diversification, it might not be as unique as it seems, and potential impacts to your other assets.

How Are Restricted Stock Units Taxed?

Know how RSUs are taxed - why vesting counts as income, how your share basis works, and short- vs. long-term capital gains.

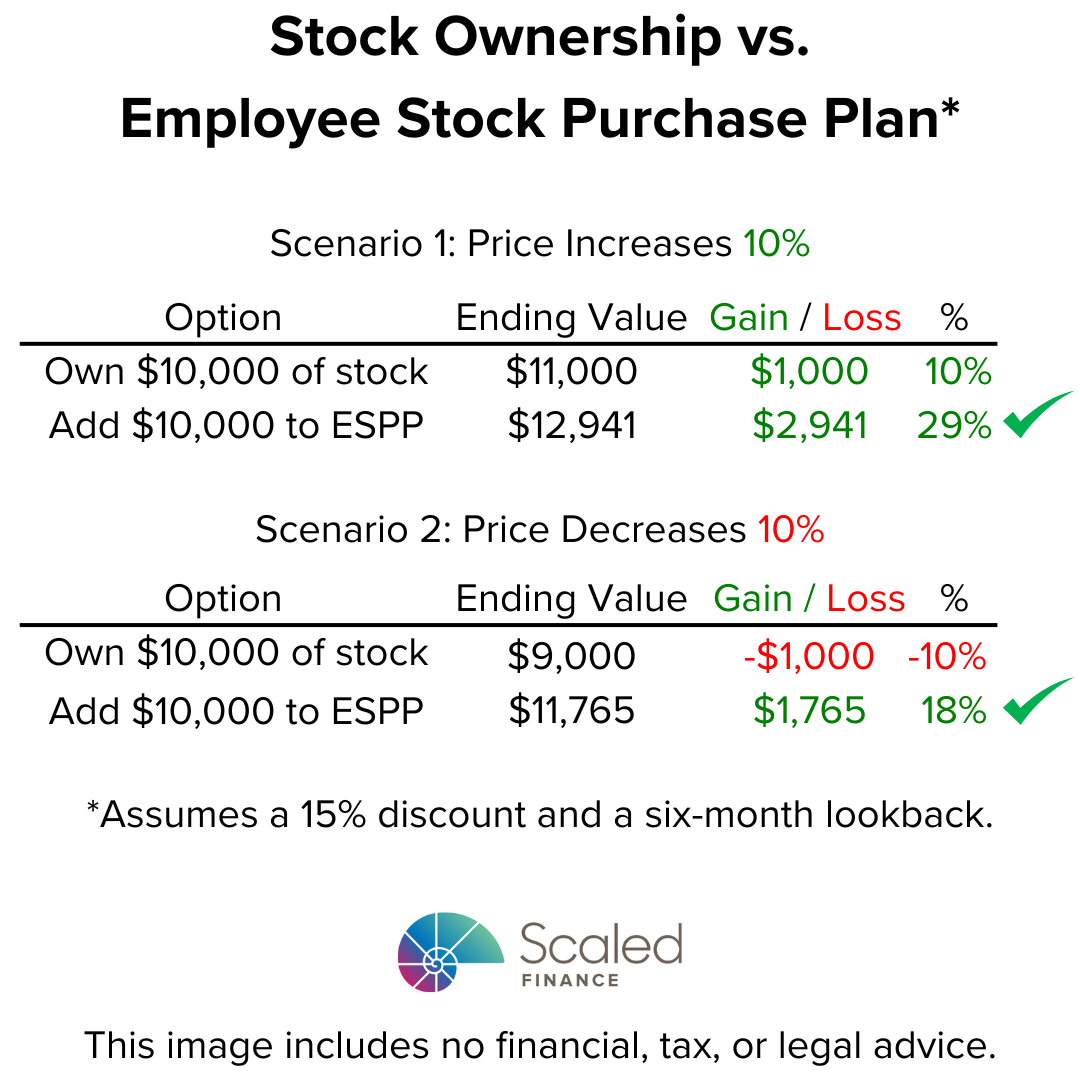

Own Stock or Contribute to ESPP?

Is it better to own stock or contribute to an Employee Stock Purchase Plan better?

Contributing to an Employee Stock Purchase Plan may be preferable.

Let’s compare a couple scenarios either:

owning $10,000 of stock or

contributing $10,000 to an Employee Stock Purchase Plan with a 15% discount and six month lookback

Scenario 1: a price increase of 10% could result in:

Ending value of $12,941 with the ESPP versus $11,000 if holding stock

Gain of $2,941 with the ESPP versus $1,000 if holding the stock

Return of +29% with the ESPP versus +10% if holding stock

Scenario 2: a price decrease of 10% could result in:

Ending value of $11,765 with the ESPP versus $9,000 if holding the stock

Gain of $1.765 with the ESPP versus loss of $1,000 if holding stock

Return of +18% with the ESPP versus -10% if holding stock